Home ›› 10 Jun 2022 ›› Back

For the upcoming fiscal year 2022–23, Finance Minister AHM Mustafa Kamal has proposed reducing corporate tax rates to help achieve the private investment to gross domestic product (GDP) ratio target.

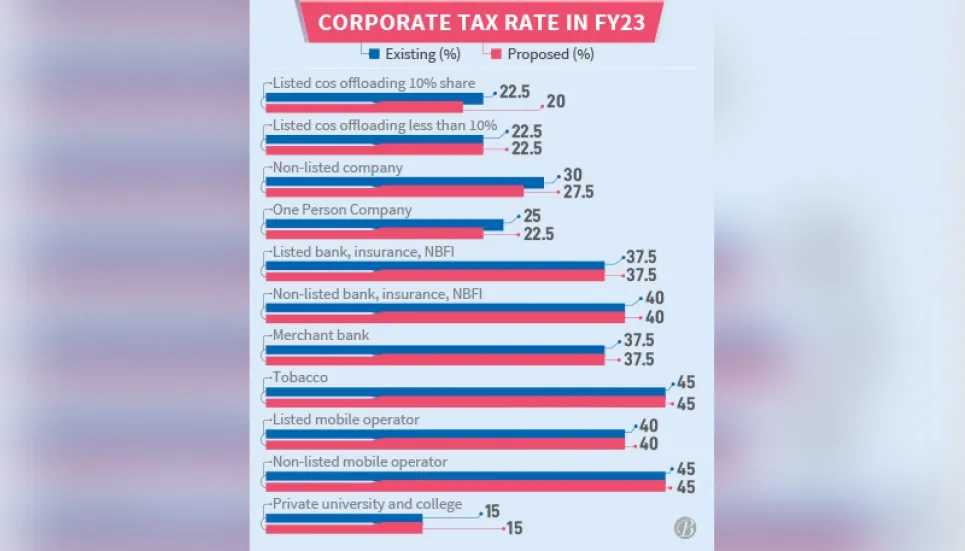

He has proposed cutting the tax rate to 20 per cent from the existing 22.5 per cent for listed companies that issue shares worth more than 10 per cent of their paid-up capital through an initial public offering (IPO).

While placing the budget proposal for the 2022-23 fiscal year before parliament on Thursday, he also proposed keeping the tax rate unchanged at 22.5 per cent for listed companies that issue shares worth 10 per cent or less of their paid-up capital through an initial public offering (IPO).

But for such companies, the tax rate would be 25 per cent if they fail to meet the conditions, he said.

In that case, all receipts and income must be transacted through bank transfers while all expenses and investments over Tk 12 lakh must be made through bank transfers as well, Kamal said.

He proposed reducing the corporate tax rate for non-listed companies from 30 per cent to 27.5 per cent.

Also, to facilitate the economy’s formalisation and incentivise the formation of one-person companies (OPCs), Kamal proposed lessening the tax rate for OPCs from 25 per cent to 22.5 per cent.

He said in his budget speech the present ratio of private investment to GDP in Bangladesh stood at 23 per cent.

The government had taken different initiatives to increase the ratio with a view to developing the country to the status of a developed one, he said.

The desired private investment to GDP ratio target could be achieved by reducing corporate tax rates, he said.

Earlier, stock market stakeholders urged to keep a 15 per cent gap in corporate taxes between listed and non-listed companies in the FY23 budget to attract healthier firms to the bourses.

The former governor of Bangladesh Bank, Salehuddin Ahmed welcomed the initiative. He said, “It is a good proposal.” It will also bring more investment in the private sector.

The South Asian Network on Economic Modeling (Sanem) said in the Quick Budget response, corporate tax rates are reduced for companies to make the economy business-friendly.

SANEM can notice a variety of tax exemptions and we do not know what will be the result of it. Reforms of tax structures should have been proposed.

The corporate tax rates in Bangladesh are higher than the Asian average of 21 per cent and the global average of 24 per cent, according to KPMG, a global network of professional firms providing audit, tax, and advisory services.

Bangladesh’s tax rates for companies are also higher than that in Vietnam, Thailand, Malaysia, China, Indonesia, Sri Lanka, and Pakistan. Vietnam and Thailand levy a 20 per cent tax on companies while the rate is 24 per cent in Malaysia and 25 per cent in Indonesia.

India’s basic corporate tax rate stands at 30 per cent, but the effective rate goes up to 35 per cent for domestic companies after adding surcharge and education fees.