Home ›› 19 Dec 2022 ›› Back

Sunflower Life Insurance Company Limited has failed to pay huge amount of insurance claims of policy holders due to numerous irregularities and mismanagements, according to the Insurance Development and Regulatory Authority of Bangladesh (IDRA).

The company has been also mismanaging and violating the insurance regulations in many cases including investing policyholders’ money in non-profit sectors, excessive management costs, earning from renewing premiums etc.

Amid such conditions, IDRA has directed the firm to clear all unpaid insurance claims by December 31 and sought investment details of life funds.

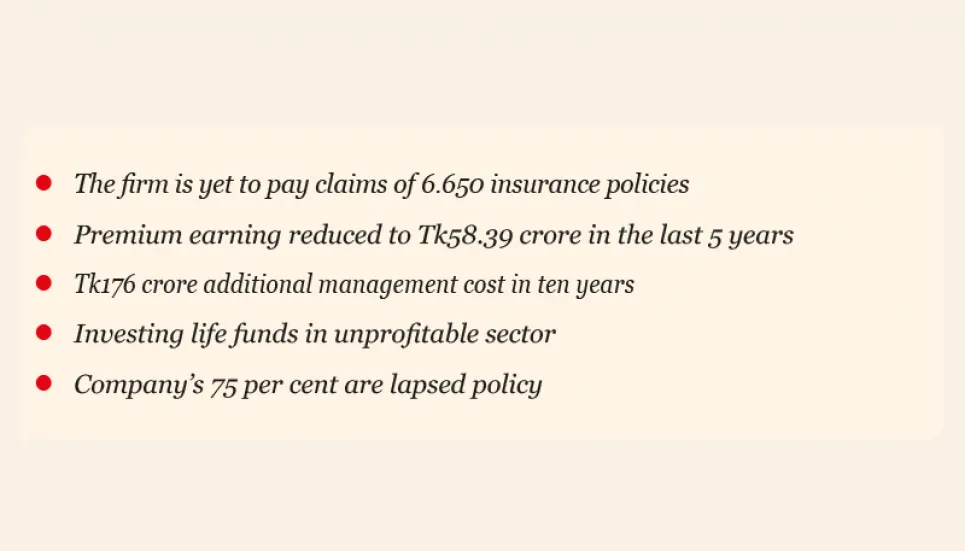

Sources of IDRA said Sunflower Life Insurance will have to pay claims of 6,650 insurance policies worth Tk3186 crore in 2022. The matter was unaccepted to the Authority as the company failed to pay policyholders despite having life funds.

On the other hand, Sunflower earned Tk116.86 from neat premium in 2017 which successively dropped down to Tk58.47 in 2021. Earning from premium witnessed Tk53.39 crore reduction in five years.

The company has total assets of Tk146.82 crore including Tk43.89 crore in advance deposit and sundry debtor sectors which is 29.89 per cent of the overall assets. Keeping such a large amount of money in advance deposit and sundry debtor sectors is inappropriate, according to the IDRA.

74 per cent are lapse policy

The company is struggling to get profits due to a high number of lapse policies. Companies normally can gain profit after policies sustain for five to six years. But lapse policies which means terminated policies due to non-payment of premium amount on the due date, simultaneously hamper interest of insurance company and the policy holders. The rate of lapse policies increased from 66.25 per cent to 75.73 per cent from 2017 to 2021.

Excessive management costs

Over the previous 10 years from 2012 to 2021, the company’s actual and approved management costs were Tk561.64 crore and Tk385.79 crore, respectively. The statistics displayed additional spending of Tk175.85 crore which is 19 per cent of the total premium earnings. This was one of the key reasons that reduced the company’s capacity to pay the insurance claims, IDRA said.

Inappropriate investments

The company has invested Tk49.18 crore against its total life fund of Tk125.21 crore in 2021. It also has a high opportunity cost as it failed to invest a large portion which means 5.31 per cent of the life fund.

The rate of investment return is also gradually declining in the Sanflower Life Insurance due to investing in non-profit sectors. In 2017, investment return rate was 4.72 that slipped to 3.61 per cent in 2021.

Classified Summary of the Assets or Form-AA of the audited accounts report of 2021, suggested that the company has Tk37.60 crore under the title of ‘Cash and collection in hand’ and ‘Current STD accounts in banks’. The cause of keeping 32.63 per cent money as liquid assets was not clear and the company is struggling to gain profits due to weak investment management, the IDRA stated.

The company invested Tk7 crore in zero coupon bond of Banglalion but currently Banglalion’s commercial operation has been shut. Sunflower Life Insurance audit report said Banglalion’s investment expired on June 30 in 2019 but the company failed to get any profit from the investment till December 31 of 2021, IDRA sources said.

Moreover, Sunflower Life Insurance invested Tk35 lakh in People’s Leasing and Financial Services Limited (PLFS) and Tk 11 crore in Bangladesh Industrial Finance Limited. IDRA also sought explanation regarding measures that have been taken to regain the invested money from these companies.

An official from IDRA, unwilling to be named, said Sunflower Life Insurance failed to ensure rational use of money or investment provided by the policyholders. The company is not paying the insurance claims of clients violating the insurance law that directed it to pay the policyholders within 90 days, he said.

The company is operating business against the insurance law, he said, adding that, company’s managing body has been directed to pay the policyholders within specific time after explaining all irregularities. At the same time, it will have to submit a complete plan over how to recover from the current condition to the IDRA within 21 working days.

According to the Insurance Act 2010, the company will have to pay all arrear insurance claims by December 31 of this year. Sunflower Life Insurance was also directed to submit documents of Tk37.60 crore that was shown in the cash and collection in hand and current STD accounts in banks and breakdown details of another Tk43.89 crore that was shown in advance deposit and sundry debtor sector with evidences within one week.

Sunflower Insurance managing body Chairman Major Abdul Mannan said currently they are keeping actual accounts of premium money which was earlier maintained through papers mainly.

Excessive management costs emerged due to extreme rates of commission and too much use of cars, Mannan said.

Talking about Banglalion’s zero coupon bond, he said that “The matter is under trial but we are hopeful to regain the money. And another investment of Tk11 crore in BFIC will be recovered.”

Necessary steps will be taken to increase premium earning, reduce rates of commission and coordinate between commission and premium, he added.