Home ›› 28 Sep 2022 ›› Back

Income tax return submission across the country has drastically increased to around 3 lakh in the running fiscal year.

This fiscal year the income tax return submission is three times higher than the previous fiscal year.

Budgetary amnesties for TIN holders who have never filed their tax returns and mandatory return submission evidence to get some essential services have increased the submissions.

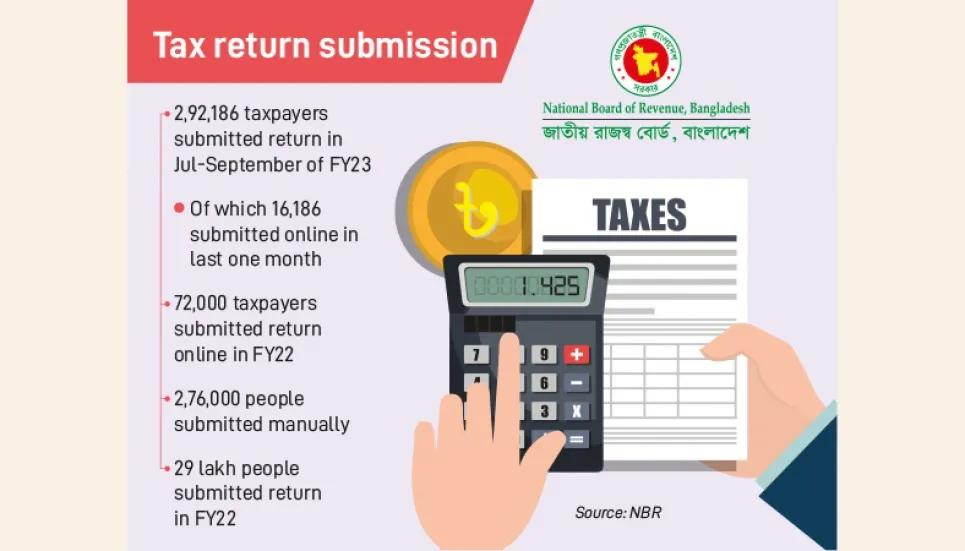

Till the first half of Tuesday, 2, 92,186 people had submitted their income tax returns both through online and offline while it was below 1 lakh during the first three months of the previous fiscal year.

Even the online submission rose to 16,186 in a single month after the service started on 25 August this fiscal year, according to the updated data of the National Board of Revenue.

During the period, 18,280 people prepared their returns through online and the submission has kept soaring every moment, source said.

The other 2,76,000 people have directly submitted income tax returns to tax offices from July to September 27 this year.

According to the national budget for the FY23, people who have tax identification numbers (TIN) but have not ever filed tax returns will be exempted from paying fines for the previous years if they file returns by this fiscal year.

The government this year has offered the amnesty to encourage TIN-holders to submit tax returns while earlier such TIN-holders had to pay a minimum of Tk5, 000 in fine for not submitting the return, NBR officials said.

Beside, tax return filing has been made mandatory for people to get about 37 services.

Mandatory return submission has caused a boost in the number of return submissions, the tax officials said and stressed that the decision would definitely play a pivotal role in enhancing revenue collection and reducing gap ratio between tax and GDP. At present, Bangladesh has the lowest tax-GDP ratio in the South Asia region.

The online submission has created an easy and accessible opportunity for the returnees and acted as stimuli to submit return online.

Commenting on the matter, a higher official concerned told the Business Post: “We are getting positive response from taxpayers.”

The online service started in October last year and around 72,000 taxpayers have submitted their returns online.

As the system is totally automated the officials can be updated about the return submission and monitor the zone and circle officials to enhance tax net, the official said.

Taxpayers can submit and prepare their returns online and they can pay tax and get other facilities. The returnees are also getting acknowledgment of the return submission from the online and registration is totally hassle-free.

According to a recent survey conducted by the Centre for Policy Dialogue (CPD), nearly 68 percent of people with taxable income did not pay tax to the government.

The Finance Minister AHM Mustafa Kamal echoed in his budget speech and said: “The number of population belonging to the middle class and above is about 40 million in our country but most of them are not paying income tax.”

He also added: “Necessary steps are being taken to prevent tax evasions and to bring all the people who have taxable incomes under the tax net.”

The budget speech said by April 2022, the number of TIN holders had increased to 75.10 lakh and the number of tax returns to 29 lakh by March 2022. The government is aiming to increase the TIN holders to 10 million.