Among a number of specified risk factors in the banking sector, credit risk appears to be dominant in terms of its impact.

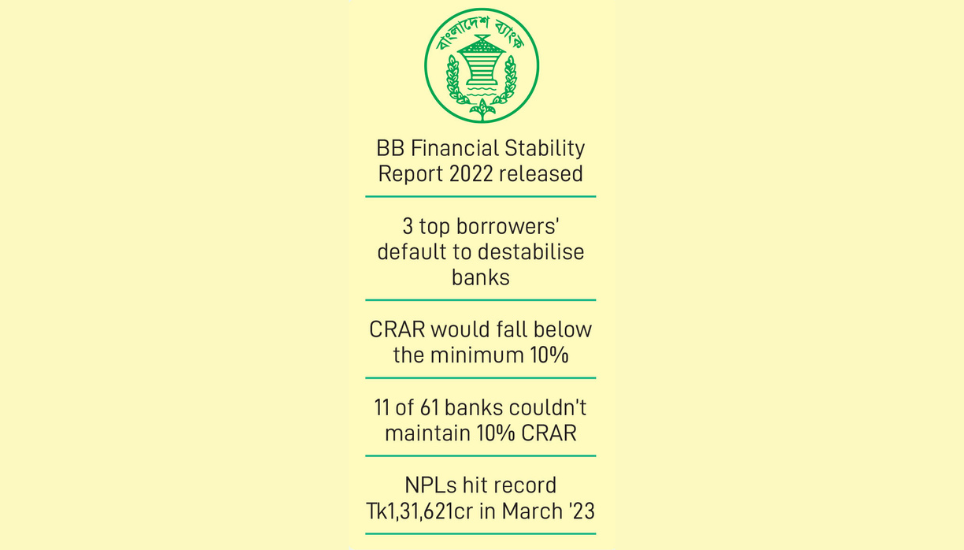

A 3 per cent increase in non-performing loans (NPLs) has the highest impact on the banking sector's resilience in terms of capital adequacy, followed by the default of top three borrowers, show a Bangladesh Bank stress test conducted in January-December of 2022.

The banking sector's Capital-to-Risk Weighted Assets Ratio (CRAR) would fall below the minimum requirement of 10 per cent in response to a 3 per cent increase in NPLs, read a recently published central bank report titled “Financial Stability Report, 2022.”

In contrast, the banking sector’s CRAR would remain above the minimum requirement for all of the market risk shock scenarios, except interest rate risks. In that case, the banking sector appeared to be slightly vulnerable.

A new record of defaulted loans has been set in the country’s banking sector. At the end of March this year, the amount of defaulted loans stood at Tk 1,31,621 crore. In the first three months of 2023, defaulted loans increased by Tk 10,965 crore.

Meanwhile, the figure increased by Tk 18,181 crore in March year-on-year.

According to the central bank report, in the event of a combined shock, excluding defaults by top large borrowers and an increase in NPLs in the highest outstanding sector, the banking system's CRAR would fall to 7.44 per cent, down from 11.83 per cent before the shock.

At the end of December 2022, in the pre-shock scenario, 11 scheduled banks out of 61 could not maintain the minimum required CRAR of 10 per cent.

Moreover, an additional five banks could not maintain the Capital Conservation Buffer (CCB) of 2.50 per cent with an existing CRAR of 10 per cent.

Stress test on banks is conducted through sensitivity analysis, incorporating impacts of minor shock scenarios for credit risk, market risk, and liquidity risk.

The after-shock CRAR under each shock scenario is compared with the minimum regulatory requirement of 10 per cent, with a CCB of 2.5 per cent, in line with Basel III.

Basel III is the third Basel Accord, a framework that sets international standards for bank capital adequacy, stress testing, and liquidity requirements.