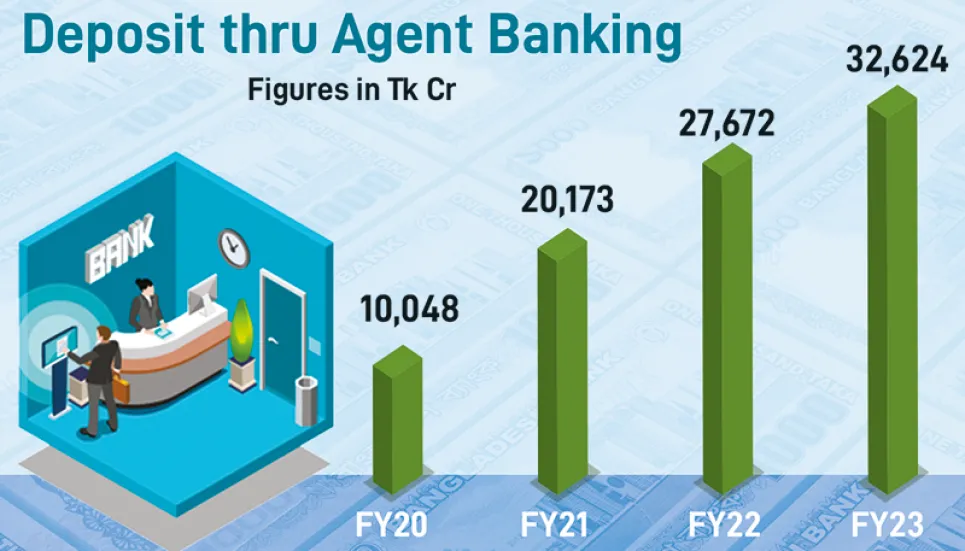

Though the banking sector is facing a shortage of deposit collection due to high inflation in the country, agent banking deposit collection rose by 17.90 per cent to Tk 32,624 crore in fiscal year 2022-23 as compared to the same period of the previous fiscal year.

According to the latest data available from the Bangladesh Bank, agent banking deposits stood at Tk 27,672 crore in FY22.

Agent banking deposit growth was slow in last one year as compared to previous three years. Deposit collection through agent banking rose by 100 per cent to Tk 20,173 crore in FY21, up from Tk 10,048 crore in FY20.

Agent banking deposits collected from the country’s rural areas amounted to Tk 25,841 crore in FY23 while the figure was Tk 6,782 crore from urban areas.

On the other hand, loan disbursement through agent banking increased by 27.28 per cent to Tk 854 crore in FY2023. Loan disbursement by agent banking was Tk 456 crore and Tk 447 crore in FY21 and FY20 respectively.

The Bangladesh Bank data showed that loan disbursement thru agent banking doubled in rural areas than urban areas. In FY23, agent banks disbursed Tk 573 crore loans in rural areas while Tk 281 crore in urban areas.

Md Arfan Ali, former managing director of Bank Asia, and one of the pioneers of agent banking, told The Business Post that actually, banks did not have experience of disbursing this kind of loans through agent banking.

“Due to some unknown factors, banks were apprehensive of lending in rural areas. Now with the experience gained, we are having a positive image,” he added.

Besides, he said, with the easing of coronavirus situation, the demand for loans is increasing in rural areas.

The vast rural economy is reshaping as access to electricity by almost all village households is helping boost the rural economy thanks to remittance and diversified agriculture crops, the renowned banker observed.

“Both consumption and demand are on the rise from the country’s people, making ways for both formal and informal financial organisations to invest in rural business establishments.”