Home ›› Economy ›› Budget FY24

In the proposed budget for 2023-24 fiscal year, Finance Minister AHM Mustafa Kamal on Thursday proposed increasing the tax-free income threshold for individual taxpayers from Tk 3 lakh to 3.5 lakh for male, Tk 3.5 lakh to Tk 4 lakh for female considering the ongoing high inflation.

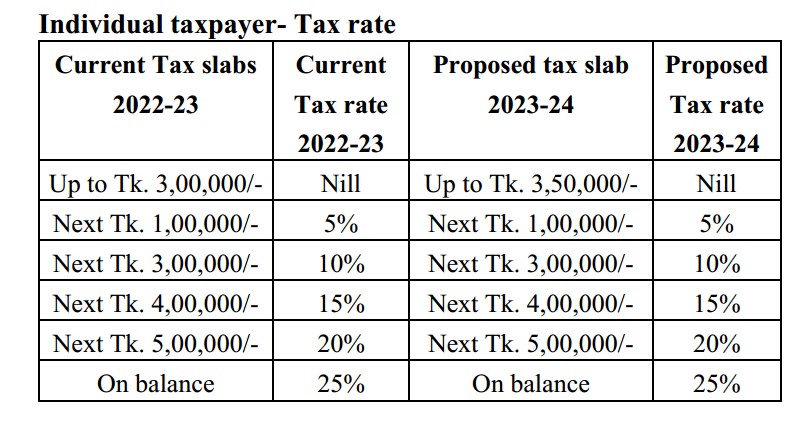

The minister said that the tax-free income threshold, tax rates and tax slabs for individual tax payers, other than companies and local authorities, have remained unchanged since FY 2020-2021.

“Considering the matter of comfort of the genuine and valued taxpayers with regard to payment of taxes, I propose to increase the tax-free income threshold applicable for the individual taxpayers, other than companies and local authorities,” he said.

This reduction of tax burden will hopefully give them some relief and encourage them to pay taxes regularly, Kamal said.

He proposed to increase the tax-free income threshold of male taxpayers from Tk 3 lakh to Tk 3 lakh 50 thousand and tax-free threshold of female taxpayers and taxpayers above 65 years of age from Tk 3.5 lakh to Tk 4 lakh respectively.

“At the same time, I propose the minimum tax rate for individuals at 5 per cent and the maximum tax rate for them at 25 per cent. The following table presents the proposed tax-free income threshold, tax rates and tax slabs for all categories of individual taxpayers except companies and local authorities,” he added.

He also said that surcharge is collected from wealthy individual taxpayers in Bangladesh at certain rates based on their income tax. This provision of surcharge has been in force for the last few years. Surcharge of individual taxpayers ensures balanced distribution of income and wealth along with economic development of society.

Kamal said, “In case of levy surcharge, on the basis of individual taxpayers disclosed net wealth value to simplify enforcement of surcharge 154 levy and reduce the burden of the middle-class taxpayers, I propose to raise the limit of surcharge from Tk 3 crore to Tk 4 crore.”

“I propose a minimum surcharge amounting to 10 percent, where net wealth of an individual exceeds Tk 4 crore and 35 percent surcharge for individuals who have net wealth exceeding Tk100 crore, he added.

Earlier, the government increased the tax-free income Tk 3 lakh back in fiscal 2020-21.