Home ›› Economy ›› Budget FY25

Despite the government's strong commitment to reforming the revenue and financial sectors, progress is hampered by a united front of loan defaulters, tax evaders, and anti-reformists. This alliance hinders institutional changes, creates roadblocks in implementing budgetary measures, and ultimately fuels macroeconomic instability.

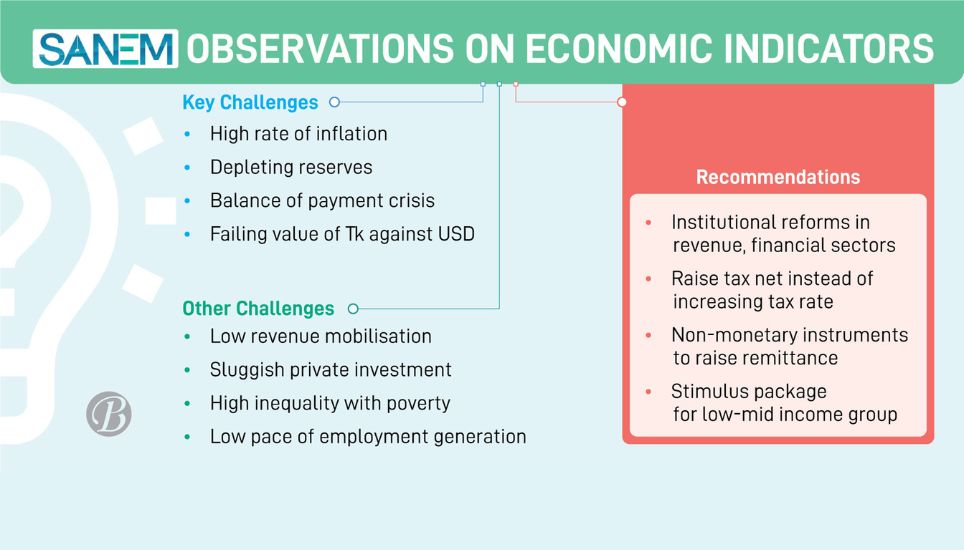

The country will fall in more strain in the next FY if the government does not address these ongoing challenges and take appropriate measures including institutional reforms in the revenue and financial sectors to bring the economy back on track and strengthen the economic pillars such as revenue, balance of payment, private investments and employment.

South Asian Network on Economic Modeling (SANEM) Executive Director Selim Raihan made these observations while chairing the event of SANEM's reflections on the proposed budget for FY2024-25 held at the BRAC Centre in Dhaka on Saturday.

He noted that the country's economy worsened in every economic indicator this year when compared to the previous year.

"The amount of defaulted loans in banks is increasing. Why can we not take any measures against them? Questioned Raihan while saying, "The Perspective Plan, the Eighth Five-Year Plan, do not seem to align with the proposed national budget. The government seems to be contradicting itself."

Raihan claimed that the targets set for inflation, reserve, private investment, GDP growth, revenue collection, in the proposed budget, is unrealistic amidst the ongoing economic headwinds. He raised the questioned that how and from which sources will the reserves be increased to $32 billion from the existing $18-20 billion?

According to SANEM, one of key challenges now is high inflation rate. "Even taking up a contractionary monetary policy, and lifting the interest rate cap, it is not possible to control the inflation yet as the policy was taken too late. Due to the delayed policy adoption, it had diminished its effectiveness.

"At this moment, further changes in interest rates would collapse the financial sector," Selim warned.

Stating that the proposed tax measures will be regressive rather than progressive, he said, "The proposed tax measures will increase the tax burden on low and medium income groups and will directly hit their livelihoods as they are already in financial strain caused by the inflation."

Stimulus package urged

He emphasised that the budget needs to provide a stimulus package targeting low-income and poor groups, similar to the one offered during the Covid-19 pandemic. These groups face extraordinary financial hardship due to the ongoing economic crisis fuelled by the Russia-Ukraine war, global supply chain disruptions, and persistent inflation. They have not yet fully recovered from the financial strain caused by the pandemic, making them particularly vulnerable.

SANEM executive director also recommended that the government raise the tax net, not the tax rate.

"If we cannot collect taxes from the ultra-rich, then the taxation will not be fair. We strongly condemn the 15 per cent tax on whitening black money. Specific measures should be taken to that end, and we hope that this will be amended in the revised budget," Raihan commented.

SANEM Research Director Sayema Haque Bidisha said that in addition to financial incentives, non-financial incentives are also needed for remittance providers. Measures can be taken for social recognition, such as special facilities for them at the airport, and special recognition for them in their villages, among other non-financial incentives.

Regarding the effective expenditure, she questioned whether the 22 per cent allocation in public administration is necessary.

Economic challenges

During the keynote speech, Bidisha highlighted several challenges the economy is currently facing. Among these, high inflation is the most pressing issue. Additionally, there are several macroeconomic challenges, such as the negative trend in foreign exchange reserves and the overall depreciation of the taka against the dollar.

"Furthermore, past experiences in revenue collection have not been satisfactory, and there is stagnation in private sector investment. Challenges in poverty alleviation, reducing inequality, and creating employment also remain significant.

"Overall, we do not see sufficient measures in the budget to bring inflation down to 6.5 per cent, boost reserves to $32 billion and necessary instruments to stabilise the economy," she added.