Accepting the ongoing financial crisis and reality, the government is planning to cut the national budget size for ongoing FY2023-24 as it is likely to be unable to implement the budget to its desired level.

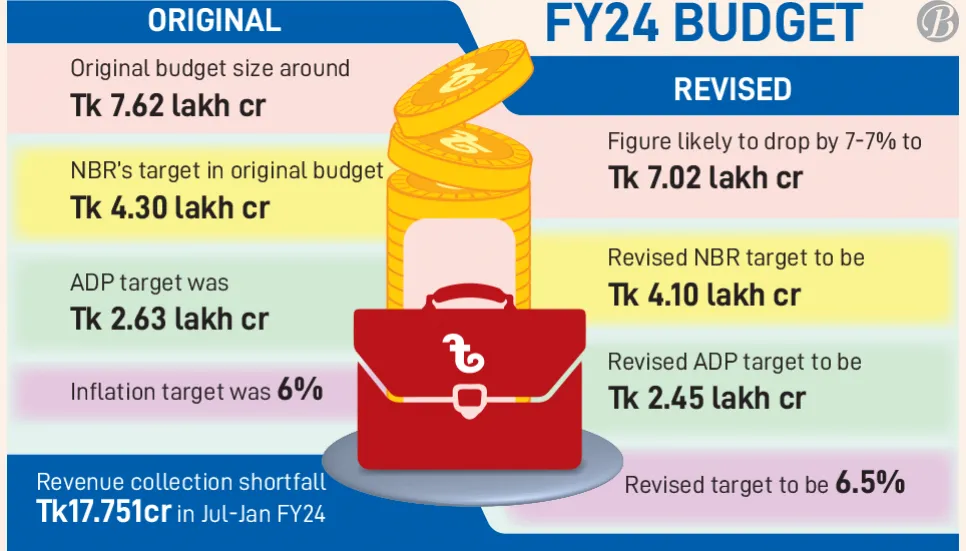

The government is likely to cut the budget by around Tk 60,000 crore, which is 7-7.5 per cent less than the current size of the budget — Tk 7,61,785 crore. Afterwards, the revised budget size will likely be Tk 7,02,000 crore, according to sources at the finance and planning ministries.

Of the major figures of the budget, the Annual Development Programme’s (ADP) allotment may be reduced by Tk 18,000 crore and the non-ADP segment’s allotment may drop by Tk 32,000 crore.

The ADP size was Tk 2.63 lakh crore in the FY24 budget, and the amount may come down to Tk 2.45 lakh crore in the revised budget.

A meeting of the Resource Committee on Budget Implementation may finalise the budget revision on Tuesday. Prime Minister Sheikh Hasina will chair the meeting, sources said.

A Finance Division official, requesting anonymity, told The Business Post that the revenue collection may fall short of Tk 17,751 crore than the target for the July-January period of FY24. During the same period, foreign aid has also decreased. Due to these reasons, the budget implementation rate is also dropping.

The National Board of Revenue (NBR) collected around Tk 1.98 lakh crore during the July-January period of FY24, against a target of Tk 2.15 lakh crore. If the primary target set in the budget is calculated, the deficit could be bigger, said related officials of the Finance Division.

In the FY24 budget, the revenue collection target was set at Tk 5 lakh crore, whereas NBR’s target is Tk 4.30 lakh crore. The revised target for NBR is likely to be set at Tk 4.10 lakh crore for the rest of the current fiscal year.

Former Bangladesh Bank (BB) governor Salehuddin Ahmed told Business Post that if the budget is to be implemented properly, the government will have to increase revenue collection. But, he said, Bangladesh's tax system is not good. NBR has considerable weaknesses in tax collection.

“Revenue collection should be increased and NBR should modernise the tax system. Through a new survey, it is possible to bring many grocery shops in the upazila towns under tax,” he said.

He said that if there is not enough income, the expenditure should be reduced. “And if you want to reduce expenses, you have to reduce the budget size by making cuts, which the government does every year. In continuation of this, the budget size may reduce.”

Sources said that there are allocations for the public-private partnership (PPP) projects in the budget and capital support of state-owned banks, but there has not been any need to release funds in these sectors as there is no demand for PPP projects. On the other hand, the government has already decided not to directly support the banks in the current fiscal year.

In the revised budget, the inflation rate target is likely to be fixed at 6.5 per cent, down from 6 per cent. However, the country already faced a 9.86 per cent inflation rate in January this year.

Economists believe that it will not be possible to sustain the revised inflation rate at the end of the financial year. They think the rate will ultimately remain above 7 per cent.

The Centre for Policy Dialogue’s (CPD) Distinguished Fellow Prof Mustafizur Rahman told the Business Post that the inflation target has been set at 6 per cent in the current budget but it is 9.5 per cent at present. “If the target rate is revised down to 6.5 per cent in the revised budget, it will not be realistic.”

It will not be possible to achieve even if something ground-breaking happens in the next three months, he said. “This will be a challenging issue. Since people's purchasing power has decreased, the ongoing shock will continue. So the government should continue social activities and selling goods in the open market.”

High-level meeting on economic situation

In the first week of February, a high-level meeting, chaired by Finance Minister Abul Hassan Mahmood Ali, was held at the finance ministry about the country’s overall economic situation.

BB Governor Abdur Rouf Talukder, Internal Resources Division Senior Secretary and NBR Chairman Abu Hena Md Rahmatul Muneem, Finance Secretary Md Khairuzzaman Mozumder, and the commerce ministry’s Senior Secretary Tapan Kanti Ghosh were present at the meeting.

There, the high officials informed the finance minister that remittance inflow is increasing and initiatives are being taken to boost skilled manpower export while inflation is gradually coming down to bearable levels. It is also expected that there will be no shortfall in the supply of daily commodities during Ramadan, they said.

The central bank and the finance ministry are working together to accelerate the remittance inflow in the country and new initiatives have been taken in this regard.

The NBR chairman informed the meeting that several initiatives have also been taken to increase revenue collection. He highlighted NBR’s measures that will be taken especially for tax collection as well.

Senior Secretary Tapan informed that a special initiative has been taken to increase the stock of products that are commonly used during Ramadan. The commerce ministry has also taken the initiative to import sugar and onion, especially with the aim of selling products through the Trading Corporation of Bangladesh.