The Cottage, Micro, Small and Medium Enterprise (CMSME) sector is the lifeblood of an economy. However, 75 per cent of CMSME businessmen of Bangladesh still have no relationship with banks or non-bank financial institutions (NBFIs).

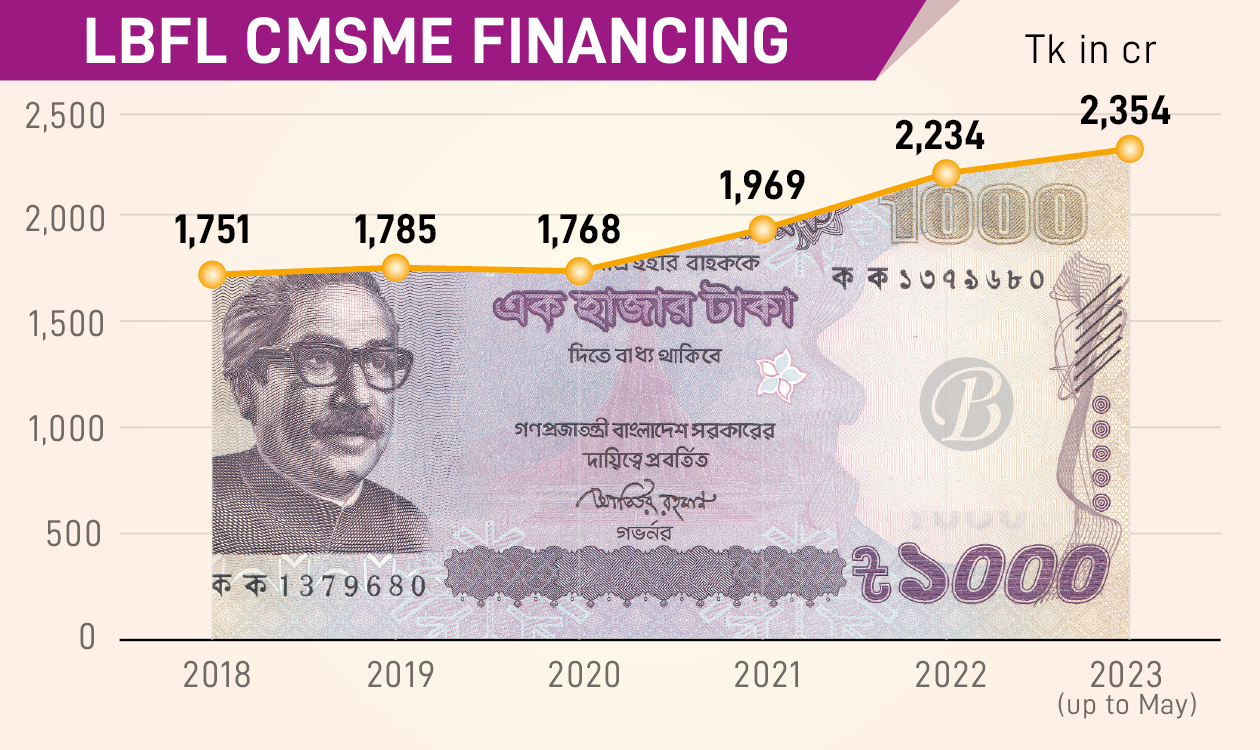

LankaBangla Finance wants to expand its business in the coming days by focusing on this potential sector. In the last eight years, the company has grown its CMSME portfolio from zero to Tk 2,354.3 crore.

Md Kamruzzaman Khan, executive vice president & head of CMSME, CMSME Finance Division of LankaBangla Finance, spoke with The Business Post’s Talukder Farhad about the challenges and opportunities of Bangladesh’s CMSME sector ahead of the World SME Day.

How do you see the CMSME sector’s current situation, what are its prospects in the future?

CMSME was the worst affected sector during the Covid-19 pandemic. The situation is still vulnerable due to a lack of proper recovery. As you know, this sector contributes 25 per cent to GDP. Besides, it generates 80 per cent of employment in the country.

There are about 80 lakh businessmen in the CMSME sector. Only 25 per cent of them are covered by bank or non-bank financial services. The remaining 75 per cent is still untapped. This is because services provided by financial institutions are document dependent.

But 80 per cent of the enterprises in this sector are sole proprietors, and they do not keep documentation.

So it is a huge opportunity to work with those untapped 75 per cent traders. If we can bring them into a framework, a revolution will happen. Even if it brings at least 50 per cent, the contribution of the CMSME sector may increase to 40 per cent of the GDP.

How do you plan on bringing them under financial services?

The financial industry will have to come forward to bring such people under financial services, and work on their development.

That is why there are Bangladesh Small and Cottage Industries Corporation (BSCIC), National Association of Small and Cottage Industries of Bangladesh (NASCIB), SME Foundation, and various NGOs. But in reality it is not working as expected.

Those of us working in the financial sector are actually working towards meeting targets, not reaching new customers. That is why 75 per cent of CMSME traders remain untapped. Besides, the big challenge of this sector is sustainability and high credit risk.

On the other hand, special supervision is required. That is why the cost-of-fund is higher compared to other sectors.

How is LankaBangla Finance growing its portfolio to meet such challenges?

We took some exceptional initiatives, mainly the mobile lending officers. We are covering 47 districts with only 27 branches. LankaBangla is now well known to the businessmen of these districts.

We appointed mobile lending officers in different districts. Through them we are covering many districts with fewer branches.

For example, there are only three branches in North Bengal - Bogura, Rajshahi and Dinajpur. We are covering 16 districts of the region with these three branches.

Mobile lending officers set up their offices wherever they go. We have given them laptops, motorcycles and modems for internet access. They survey their designated areas and send data on potential borrowers to the branch.

Our credit division then approves the loans. These lending officers again collect the loan installments from the field. As a result, our recovery is also good.

What is LankaBangla Finance’s future business plan?

As you know, the Bangladesh Bank recently lifted the loan interest rate cap. Besides, we can charge an additional 1 per cent in the case of CMSME and consumer loans. It created a win-win situation for NBFIs as well.

Previously, we could not expand our business due to the loan interest cap. Because the supervision cost is higher in the CMSME sector, the margin was very limited. Now, with the new move, we can expand the business with a massive target.

We are also digitally focused, and we are paying more attention to CMSMEs that focus on employment generation. By 2025, the LBFL targeted to expand business in 58 districts. Our mobile lending officers will play a key role to achieve this goal.

How can Nano loan facility play a role to expand business?

We are already working on it, and also have signed an agreement with Dana Fintech. We may be able to give full-fledged nano loans from this July.

How are you implementing the refinance scheme of Tk 25,000cr?

It is now a pre-finance scheme. The CMSME sector would have suffered more if this fund was unavailable during the pandemic.

This loan is very beneficial for businessmen as it is a long term loan. Other schemes were of one year, but this one is of three years. This fund is playing a very positive role in this ongoing liquidity crisis.

We have been given Tk 250 crore from the central bank and have already pre-financed and disbursed Tk 175 crore.

CMs face the most problems. Do you have any special plans for them?

Cottage and micro businesses have been hit the hardest by the Covid-19 pandemic. We are trying to keep them alive with incentives. LankaBangla has separate products for CMs and loan amounts make up 20 per cent of our portfolio.

The amount of such sectors’ loan is almost Tk 400 crore. Our portfolio in the CMSME sector is currently Tk 2,290 crore.

What kind of work do you do for new entrepreneurs?

The Bangladesh Bank has a fund for creating new entrepreneurs. The amount of this fund is Tk 100 crore. From there we took Tk 60 crore. A loan can be taken from this fund up to a maximum Tk 25 lakh with collateral and maximum of Tk 10 lakh without collateral.

We have given loans to about 1,200 customers. We give more importance to cottages in giving these loans. We have a product called SOMPORKO to create new cottage entrepreneurs (cottage will be omitted).

The government prioritises women in creating new entrepreneurs, what does LBFL do?

We have a separate platform called SHIKHA to create women entrepreneurs. We are giving them loans at a special rate of 4 per cent interest. We are also providing training to women who are interested in business.

Training is given twice every year. We provide this training by selecting the aspirants from various forums.

The Bangladesh Bank has set a cap that 15 per cent of borrowers in the CMSME sector should be women. But the reality is a little different. Our country has not yet reached that point. We have 8 per cent. It is expected to increase to 10 per cent by the end of this year.

What is your plan on CMSME financing?

No bank or NBFIs can survive without CMSMEs, because large customers have become saturated. LankaBangla started its journey in 1996. The firm had a corporate focus, with 90 per cent of the portfolio being corporate.

There was no SME financing in LankaBangla till 2012. I joined here in 2013 and started the CMSME journey in 2014. We are currently going from zero to Tk 2,354.3 crore, which is 33 per cent of the loan portfolio. It has changed rapidly.

Our current focus is fully oriented towards CMSME. We will cover 58 districts, and increase our portfolio to 50 per cent. There are many challenges ahead of us, but we are optimistic that we can reach our desired target.