Home ›› 22 Dec 2021 ›› Front

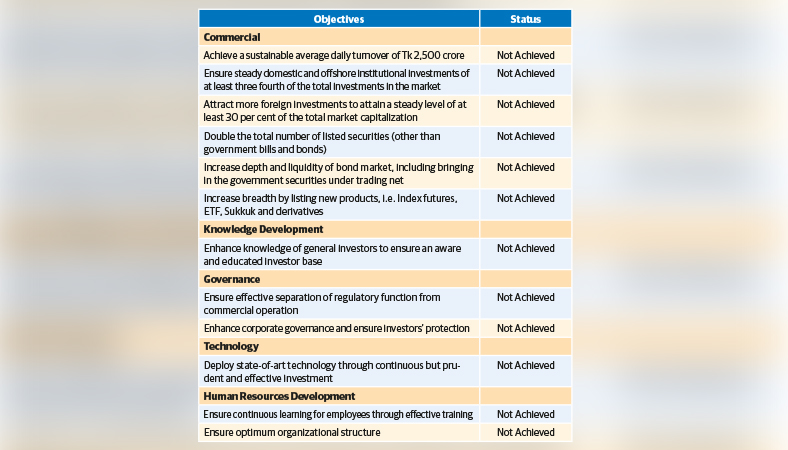

The securities regulator BSEC has expressed its utter dissatisfaction at the Dhaka Stock Exchange (DSE)’s failure in achieving all 12 objectives laid out in the demutualisation scheme in the last eight years.

Against this backdrop, it plans to appoint an independent auditor in the DSE to evaluate the reasons behind the failure. “The 12 objectives were supposed to be achieved by the 2020 deadline. But none was attained,” said the evaluation report.

The commercial objectives are: achieving a sustainable average daily turnover of Tk 2,500 crore, ensuring steady domestic and offshore institutional investments of at least three-fourths of the total investments in the market, attracting more foreign investments in order to maintain a steady level of at least 30 per cent of total market capitalisation, and increasing the total number of listed securities, the depth and liquidity of the bond market, including bringing government securities under the trading net and bringing the breadth of the market by listing new products, such as index futures, ETFs, Sukkuk, and derivatives.

The knowledge development objective is enhancing the knowledge of general investors to ensure an aware and educated investor base.

The governance objectives are: to ensure effective separation of regulatory functions from commercial operations and enhance corporate governance and ensure investors’ protection.

The technology objective is deploying state-of-the-art technology through continuous but prudent and effective investment. Human resources development objectives are ensuring continuous learning for employees through effective training and optimal organisational structure, ensuring continuous learning for employees.

“The stock exchanges failed to achieve the main objective of the demutualisation scheme within the scheduled time that expired in 2020,” BSEC Commissioner Shaikh Shamsuddin Ahmed told the Business Post. “In the last eight years, the two stock exchanges failed to enjoy the benefits offered by the demutualisation scheme. There is no progress on their listings,” he said.

“We are also planning appointing an independent auditor in the stock exchange to further evaluate its failure in meeting the goals,” said the BSEC commissioner. As part of the demutualisation process, the BSEC ordered the DSE and CSE to submit their IPO plans as per the scheme after a meeting called last week by the regulator to review the progress of the objectives.

According to the Demutualisation Act 2013, forty per cent of the stock exchanges’ shares must be credited to its member accounts and the remaining 60 per cent in a blocked account. Of the blocked account, the bourse will have to sell 25 per cent of its total issued shares to strategic shareholders and the remaining 35 per cent through an IPO.

After the stock market crashed in 2010, stakeholders demanded that the government ensure monitoring to stop manipulation and bring transparency to the stock market, to restore investors’ confidence. Following the demand, the Act was passed in parliament in 2013.

Market experts said it appears to be business as usual at the DSE.

With the view to making it a more professional and profitable organisation, the bourse went through demutualisation in 2013, a process that separated the bourse’s ownership from management.

“Eight years on, none of the goals laid out in the demutualisation agenda have been achieved, which is unfortunate,” said an analyst.

On condition of anonymity, a DSE member blamed the failure of the former and current board members for not achieving the targets. “Most board members do not have stock market experience. Inefficient management is also a big factor.”

However, DSE Director and former President Shakil Rizvi told The Business Post, “We’ve got strategic partners. It is a major achievement for demutualisation. We’re working to implement other issues.”

“To create a good capital market, it’s not just the DSE alone, everyone has to work together,” he said.

On May 14, 2018, the DSE struck a deal with the Chinese consortium of the Shenzhen Stock Exchange (SZSE) and the Shanghai Stock Exchange (SSE) to sell 25 per cent of its shares for

Tk 947 crore. But the prime bourse’s performance left the strategic investors disappointed.

A DSE shareholder said the consortium had yet to make any contribution to the market’s development.

As per the Act, the bourse has 13 members: seven independent directors, four shareholder directors, one strategic investor, and the bourse’s managing director.

The DSE logged a profit of TK 113.49 crore in fiscal 2020–21, a jump of 314.26 per cent or 4.14 times over the previous fiscal year, according to the DSE’s latest audit report.

The profit sharply declined in fiscal 2019–20, when it fell to its lowest level in 13 years as a result of the pandemic that brought the bourse to a halt. In FY20, it made TK 27 crore in profit.

The bourse’s board of directors recommended a 4 per cent dividend for its shareholders in FY21. The DSE’s annual general meeting is scheduled for December 28.

In FY21, its earnings per share rose to Tk 0.63 from Tk 0.15 during the period. The total number of shares is more than 180.38 crore. It has a paid-up capital of TK 1,803 crore.

The Chittagong Stock Exchange (CSE), the country’s second bourse, has not yet found strategic partners

to meet the regulatory requirements. It found no takers for its 25 per cent stake despite trying for eight years.