Home ›› 05 Feb 2022 ›› Front

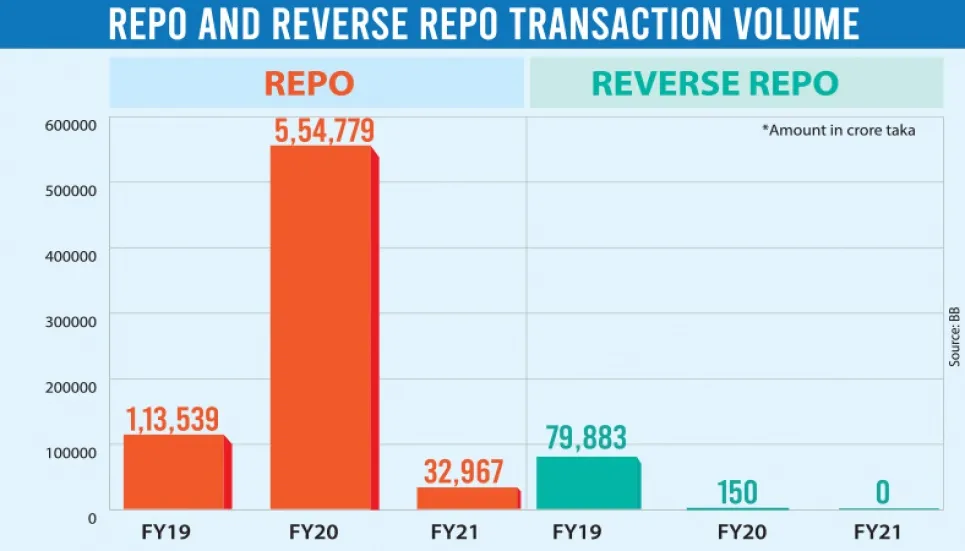

A stagnant economy and excess liquidity in banks and non-bank financial institutions caused a nosedive in borrowing from the central bank through repo to Tk 32,967 crore in the last fiscal year.

The amount is paltry compared to over Tk 5.5 lakh crore in FY20, the highest in the last six fiscals, according to ‘Government Securities of Bangladesh Report for the FY 2020-21’ report prepared by the central bank’s Debt Management Department.

Low credit growth and import payment demand, implementation of stimulus packages, good remittance earnings, less government borrowing from banking sector and high sales of savings certificates led to a massive excess liquidity in banks last FY, said Zahid Hussain, a former lead economist of World Bank (Dhaka office).

BB data show that average private sector credit growth fell to 8.35 per cent in FY21, which was 8.61 in FY20. Besides, excess liquidity stood at Tk 2.32 lakh crore in the banking sector at the end of June last year, up from Tk 1.40 lakh crore in the same period of 2020.

In FY21, the central bank did not withdraw money from the market because it wanted to maintain the necessary liquidity to help the economy turn around during the pandemic. So, it did not hold any reverse repo auction.

BB also cut the repo rate from 5.25 per cent to 4.75 per cent in the last FY. The reverse repo rate was reduced from 4.75 per cent to 4 per cent in FY21.

“Although there was excess liquidity in the last FY, due to lower credit demand there was no risk of money coming out from the bank and a rise in inflation. As a result, the central bank did not withdraw any money from the banking sector through reverse repo,” Zahid told The Business Post.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank and former president of Association of Bankers, Bangladesh, told The Business Post that the remittance inflow was high, Bangladesh Bank bought dollars from the market, and the government had not taken much loan from the banks.

“Besides, private sector credit growth was low due to the pandemic. As a result, banks had so much liquid money in their hands that there was no need to borrow from the central bank,” he said.

Reverse repo auction started at the beginning of the current FY to reduce some liquidity. From August-November 2021, the central bank cut Tk 6,897 crore from the banking sector by BB bills auction.

BB bill’s auction has been closed since November last year. Zahid said that there was no need to withdraw money through reverse repo as BB kept selling dollars.

Repo and reverse repo are tools that central banks use to manage the money supply in the banking system for implementing monetary policy.

Repo facilities alleviate transitory liquidity problems and raise money supply in the economy, besides reverse repo crunch excess liquidity from the money market.

The central bank has overnight (one-day) or 7, 14 and 28-day basis Bangladesh Bank (BB) bills to repo facilities and 7, 14, 30-day basis BB bills for reverse repo facilities.

During the pandemic, the central bank established 360-day term-repo facilities. In addition, BB offers special repo and Assured Liquidity Support to banks against various types of government securities. Talked, Syed Mahbubur Rahman, managing director of Mutual Trust Bank and former president of Association of Bankers, Bangladesh (ABB), made a similar statement.

He told The Business Post that, lots of remittances had come, Bangladesh Bank has bought a lot of dollars from the market, and government had not taken much loan from the banks.

Besides due to pandemic private sector credit growth was low. As a result banks had so much liquid money in their hands that there was no need to borrowing from central bank.