Home ›› 31 Mar 2022 ›› Front

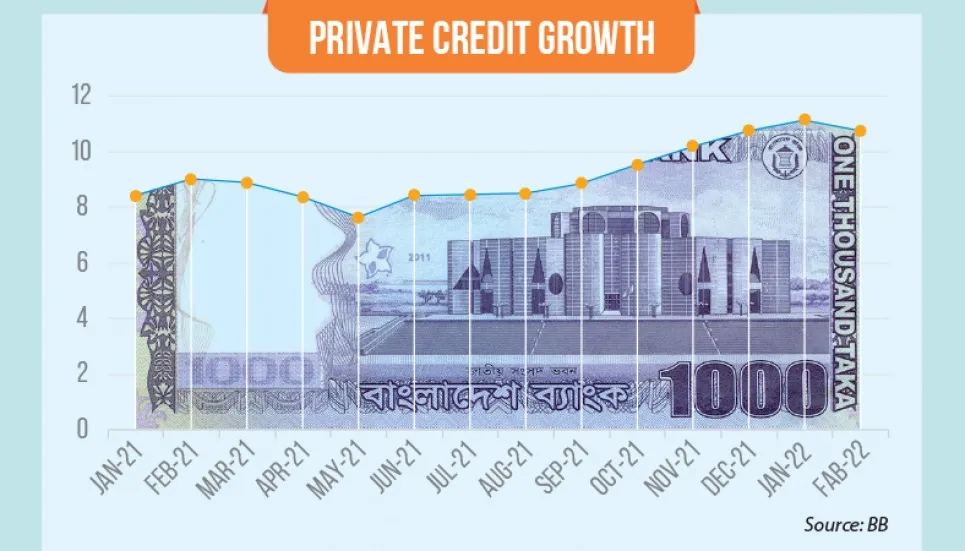

Private sector credit growth dropped slightly in February as banks remained cautious on lending after the pandemic period.

The credit growth stood at 10.87 per cent in February, down from January’s 11.07 per cent, according to the latest data from the Bangladesh Bank.

“Most of the banks adopted a “go slow” policy as the number of borrowers failed to repay the low-cost stimulus loans,” said Southeast Bank Managing Director M Kamal Hossain.

“This may cause the slight fall in the credit growth,” he said.

But the private sector credit growth recorded higher growth in recent time compared to the pandemic period, he added.

The February 2022 credit growth was 3.93 percentage points lower than the projection of Bangladesh Bank in the current fiscal 2021-2022.

The central bank kept the target unchanged at 14.8 per cent for the fiscal year.

The private sector credit growth might hover around 10 to 11 per cent in the upcoming months, the Southeast Bank managing director predicted.

However, Mutual Trust Bank Managing Director Syed Mahbubur Rahman said the private sector credit growth may rise at the end of March due to the stimulus disbursement.

“Most of the banks are disbursing loans under the second round of stimulus packages, which will help faster pace in the private sector credit growth,” he told The Business Post.

The private sector credit growth was recorded at 11.07 per cent in January—the highest since July 2019 when it was 11.26 per cent. However, the recent growth trend is much better than the pandemic period in 2020 and 2021.

The pandemic which hit the country in March 2020 dampened the demand for credit. When the pandemic reached its peak, private sector credit growth hovered around 8 per cent.

Dhaka Bank Managing Director and Chief Executive Officer Emranul Huq said the demand for credit continued to increase as industries kept expanding after the second wave of coronavirus.

Despite rising demand for credit, the banking sector’s surplus fund still remained above Tk 200,000 crore. As of February this year, outstanding loans in the private sector stood at Tk 12,78,855.9 crore, according to the central bank data.