Home ›› 19 Apr 2022 ›› Front

Despite the fact that the raging pandemic hit the country’s economy hard as elsewhere, insurance companies, however, could manage to increase their settlements of insurance claims.

At the end of 2021, insurers paid Tk 7,724 crore for insurance claims which was Tk 6,728 crore in 2020 displaying a hike of Tk 996 crore in just one year.

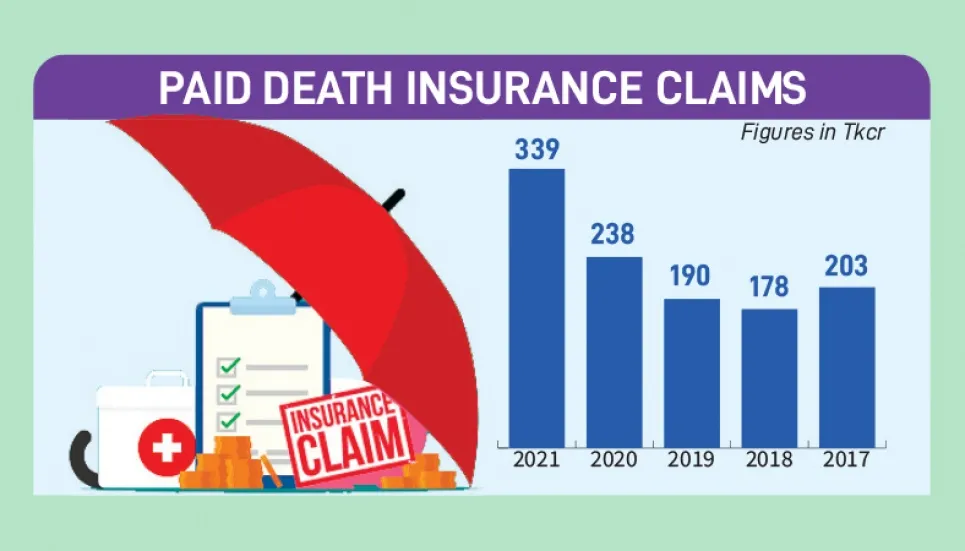

On the other hand, the amount of death insurance claim payments also increased.

In 2020 and 2021, it was Tk 238 crore and Tk 339 crore respectively marking a Tk 101-crore hike in one year, according to the Insurance Development and Regulatory Authority (IDRA).

Top performers in claim settlement

Meghna life Insurance, Life Insurance Corporation, Popular Life Insurance, Sonali Life Insurance and Rupali Life Insurance are top performers that paid 100 per cent life insurance claims among the total of 33 insurance companies in 2021.

Worst performers in claim settlement

BAIRA Life Insurance Company Limited managed to settle insurance claims below 50 per cent in 2021 while Fareast Islami Life Insurance Company Limited settled 20.64 per cent, Golden Life Insurance 27.28 per cent, Swadesh Life Insurance 42.61 per cent and Padma Islami Life Insurance 45.89 per cent.

Death insurance claims in last five years

All insurance companies paid Tk 339 crore insurance claims against Tk 432 crore in 2021, settled Tk 238.67 against Tk 343.43 crore in 2020, Tk 190.08 crore against Tk 280.76 crore in 2019, Tk 178.31 crore against Tk 271.18 crore in 2018 and Tk 203.37 crore against Tk 396.33 crore in 2017.

Alamger Feroj, deputy managing director, Popular Life Insurance, told The Business Post, “We have never neglected the death insurance claims since the beginning. We pay our clients in due time if they are qualified for a death insurance claim.”

Due to its persistent popularity in insurance claim settlements, the regulatory authority lauded the work of Popular Life Insurance and asked other companies to follow its track record, he added.

Meanwhile, as per the section no. 72 of Insurance Act 2010, the companies have an obligation to settle the claims within 90 days after the policy tenure ends.

In case of payments after crossing the 90-day limit, companies have to pay additional 5 per cent interest along with the bank rate for the excessive period.

But many insurance companies are allegedly escaping the settlement payments for years without bothering any regulations. Amid such conditions, IDRA later appointed inspectors for many insurance companies. Recently, the rate of insurance claim settlements increased significantly due to different steps taken by the regulatory authority.

Md Shah Alam, director of Insurance Development and Regulatory Authority (IDRA), told The Business Post that the culture of insurance claim settlement has developed because of several measures taken.

“Still we are facing numerus problems due to long-term mismanagement of some companies,” he said.

Chief Executive Officer (CEO) of Rupali Life Insurance Golam Kibria said: “Our agreement with clients is to pay their claims in time and we have been serving their interest from the beginning and settling insurance claims accordingly. In future it will be faster.”

Bangladesh Insurance Association president Sheikh Kabir Hossain told The Business Post that the insurance companies are currently maintaining more transparency than earlier. As a result, now they are paying insurance claims in larger amounts.

Settling insurance claims is the key to client satisfaction which has been neglected by the insurers for a long time.

Every year insurance companies collect 75 per cent of their premiums from life insurance sector.