Home ›› 27 Apr 2022 ›› Front

Private sector credit growth reached a 34-month high in March largely due to an escalating trend of import financing and increased economic activities centring Eid-ul-Fitr.

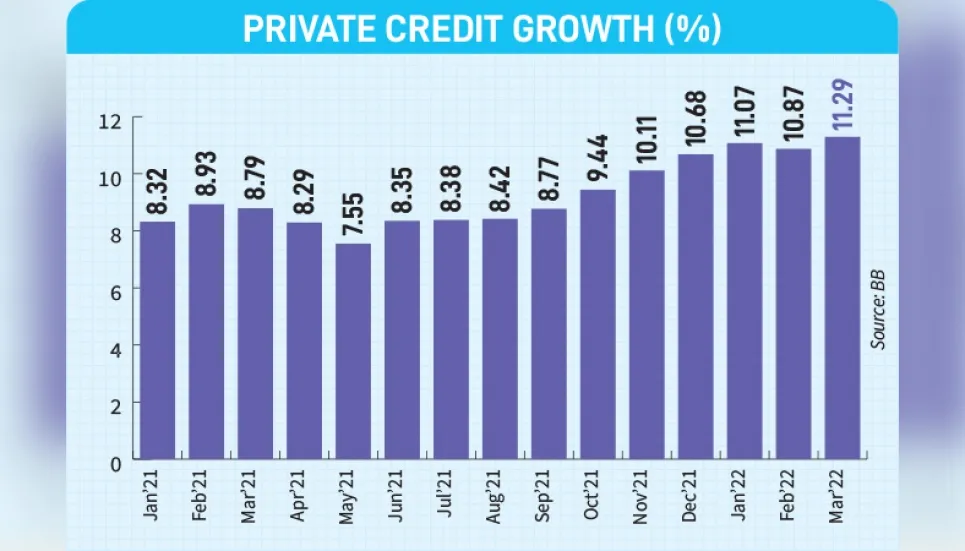

In March, private sector credit growth accelerated to 11. 29 per cent, the highest since May 2019 when it was 12.16 per cent, as per the latest data from the Bangladesh Bank.

According to bankers, the growing trend will continue even after Eid, as industry expansion has resumed after Covid-19’s second wave.

The pandemic, which hit the country in March 2020, killed the demand for credit. When the crisis reached its peak, private sector credit growth hovered at 8 per cent.

The credit growth stood at 7.55 per cent in May last year and credit expansion has been raising since then, data from the Bangladesh Bank shows.

The country’s import payments rose by 52.01 per cent to $52.6 billion from July to February of the current fiscal year, marking a sharp increase since the second wave of the Covid-19 pandemic.

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank, said that the stimulus loans disbursement was another reason behind the growing private sector credit.

“Most of the banks are implementing the stimulus packages for the second phase, which will push the private sector credit growth,” he added.

The credit growth of March was 3.51 percentage points lower than the Bangladesh Bank’s target for the current fiscal year. The central bank kept the target unchanged at 14.8 per cent for FY 22.

Pubali Bank Managing Director Saiful Alam Khan Chowdhury said, “Our bank is receiving a large volume of credit proposals from businesses after the economy began rebooting.”

An increasing number of borrowers have seeking loans since Ramadan, said southeast Bank Managing Director M Kamal Hossain.

He however said that the private sector credit growth would not rise drastically and will just hover around 10 to 11 per cent in the upcoming months.

The surge of import payment and rising trend of private sector credit growth helped to reduce the surplus fund from the banking industry.

At the end of February this year, surplus liquidity in banks stood at Tk 2,04,600 crore, down from Tk 2,11,506 crore a month ago, as per the latest data from the Bangladesh Bank.

The surplus fund in the banking industry hit an all-time high of Tk 2,31,711 crore at the end of June last year. The excess fund decreased by 11.68 per cent (Tk 27,076 crore) in just eight months.

At the end of March of this year, total outstanding loans of private sector stood at Tk 12,91,438 crore, as per the latest data from the Bangladesh Bank.