Home ›› 22 Nov 2022 ›› Front

Shareholdings of directors and their families in Sunlife, National, and Meghna life insurance companies are in violation of the legal limit imposed by the Insurance Development and Regulatory Authority of Bangladesh (IDRA), reveal a latest investigation report.

The Business Post has obtained a copy of the IDRA report, which shows that Sunlife Insurance sponsor Zahid Maleque, who is also the health minister, and his family members hold 28.43 per cent of that firm.

It should be noted that the insurance act limits this type of shareholdings to 20 per cent. Meghna Life Insurance Company Chairman Nizam Uddin Ahmed and his family members hold 25.52 per cent of the firm.

Similarly, National Life Insurance Director Matiur Rahman and his family members hold 23.06 per cent of the firm. The IDRA report mentions that they

had found proof of irregularities against the trio after National Security Intelligence complained against seven firms.

Commenting on the issue, IDRA Executive Director SM Shakil Akhter said, “We plan to take action against company directors and families whose shareholdings are in violation of the insurance act.

“There are some legal complications in the insurance act, which is making it difficult for us to take action against such directors and their family shareholdings.

Maleque’s family own 28.43% of Sunlife

Incumbent Health Minister Zahid Maleque is a sponsor at the Sunlife Insurance Company, holding 8.27 per cent of the firm. His sister Prof Rubina Hamid holds 5.33 per cent of the share.

Zahid’s wife Shabana Maleque holds 2 per cent of Sunlife, and serves as a sponsor director. His son Rahat Maleque holds 8.53 per cent of the firm, and serves as a director too. Zahid’s brother-in-law Dr Kazi Akter Hamid, a sponsor director, holds 2.2 per cent.

Zahid’s nephew Rayan Hamid holds 2.10 per cent of Sunlife, and serves as a director there. Commenting on the matter, Sunlife Insurance Company CEO Mohammad Nurul Islam said, “The definition of family is different for companies established before and after 2010. The family shareholdings of this company followed laws under the pre-2010 definition.

“There is nothing in this company that violates the law. We have already submitted our response to the IDRA on this matter.”

9 Meghna Life directors from same family

Meghna Life Insurance’s Board of Directors has 14 people, and among them, nine belong to Chairman Nizam Uddin Ahmed’s family. Nizam holds 3.08 per cent share, while his wife Hasina Nizam 2.15 per cent. Hasina is the vice chairman of the firm.

Nizam’s two sons – Nasir Uddin Ahmed and Riaz Uddin Ahmed – hold 4.12 per cent and 2.01 per cent respectively. They are serving as directors at Meghna Life Insurance. Nizam’s daughter Umme Khadiza Meghna holds 2 per cent, and she is also a director.

Nizam’s daughters-in-law Sharmin Nasir and Dilruba Sharmin hold 2.02 per cent and 2.01 per cent of the company, and both of them are directors there.

Two of Nizam’s family organisations – Karnaphuli lnsurance Company and Nizam Hasina Foundation Hospital – hold 5.73 per cent and 2.40 of the Meghna Life Insurance.

In response to a query, Nizam Uddin Ahmed said, “None of our operations are in violation of the law. My family shareholdings remain in accordance with the law. We will follow whatever directive the government issues regarding family shareholdings.

“The managing director of Meghna Life Insurance Company is operating independently, as we do not interfere with any of the firm’s operations.”

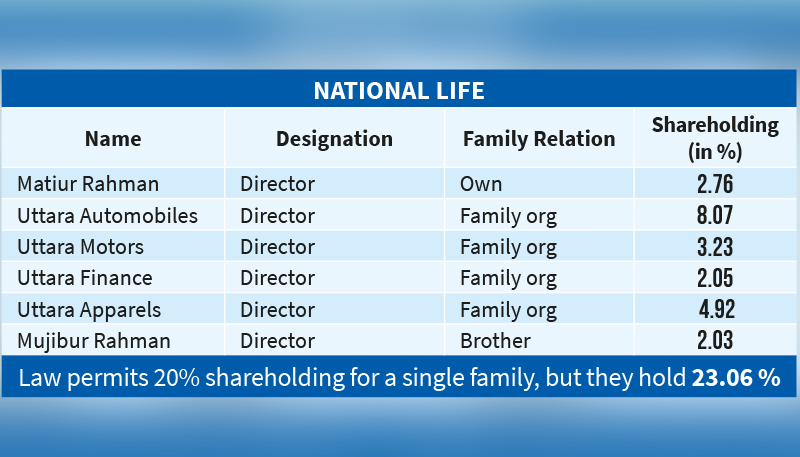

One family holds 23% of National Life

The IDRA investigation report shows that National Life Insurance Director Matiur Rahman holds 2.76 per cent of the firm’s share.

Four of Matiur’s family companies – Uttara Automobiles, Uttara Motors, Uttara Finance and Investment and Uttara Apparels – hold 8.07 per cent, 3.23 per cent, 2.05 per cent and 4.92 per cent of the life insurance firm respectively.

Matiur’s younger brother Mujibur Rahman holds 2.03 per cent of the firm.

A National Life Insurance official, on condition of anonymity, said, “If the IDRA directs us in writing to reduce the family shareholdings, we will comply.”

What does the law say?

According to the Capital and Share Holdings of Insurance Company Rule, 2016, family shareholdings for companies established after 2010 will be capped at 10 per cent. Meanwhile, as per the Insurance Act 1958, family shareholdings in a firm can never go over 20 per cent.

Meanwhile, the Insurance Act 2010 mentions that all dependents – including husband, wife, father, mother, son, daughter, brother, sister – will be considered members of the family concerned.

AKM Ehsanul Haque, an eminent expert on the issue, said, “The insurance act has a lot of loopholes and disparity. Insurance firm directors are directly responsible for the current dismal situation in this sector.

“Most of these directors are very influential. When their family holds a large number of shares in a company, they think that they own the venture. They do not consider the fact that insurance companies are public service oriented.”

He added, “If someone launches a grocery shop, they can run it as a family business, and do whatever they please. But when directors turn insurance companies into family businesses, it is not the right move. Such firms operate on public money.”