Home ›› 23 Apr 2022 ›› Front

Owing to the continuing high demand for yarn and fabric by the domestic textiles industry, Bangladesh’s cotton consumption is forecasted to increase in the upcoming marketing year (MY) 2022-23, according to the United States Department of Agriculture (USDA).

In a report titled “Bangladesh: Cotton and Products Annual” published on April 15, the USDA estimates that the total domestic raw cotton consumption will increase by 5.6 per cent year-on-year to 9.31 million bales in MY 2022-23 (September-August).

Bangladesh is currently consuming approximately 8.5 million bales of raw cotton annually.

The report predicts that in the MY 2022-23 cotton imports would reach 8.9 million bales, up 7.2 per cent from the USDA official estimate for MY 2021-22, assuming increasing yarn and fabric demand by the garment industry.

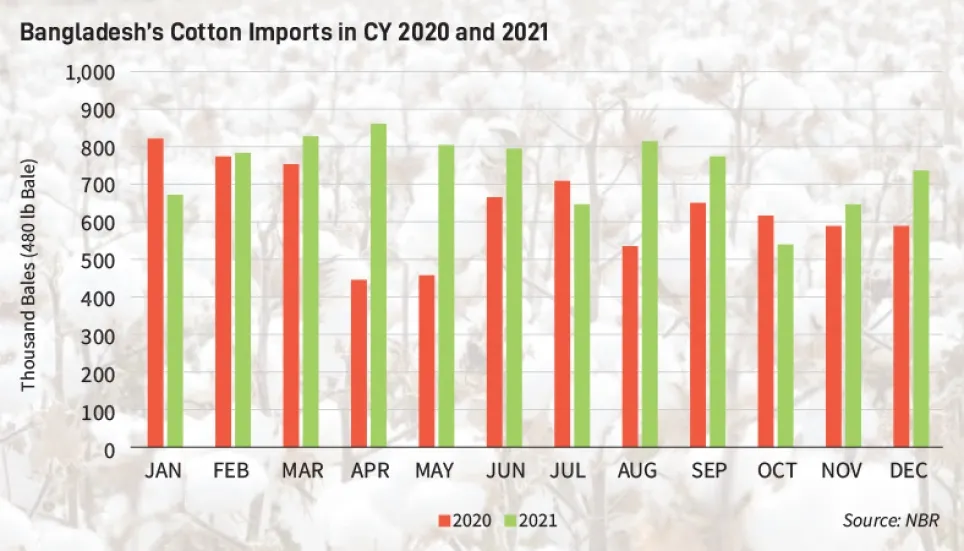

The USDA estimates the MY 2021-22 cotton imports to be 8.7 million bales, up 4.8 per cent over initial USDA official estimates. According to the National Board of Revenue data, Bangladesh has imported approximately 5 million bales of cotton in the first seven months of the MY 2021-22.

Total cotton cultivation in Bangladesh covers only 0.55 per cent of the country’s 8.1 million hectares of arable land. The report estimates MY 2021-2022 cotton harvested area and production at 45,000 hectares and 151,000 bales, respectively.

The forecast for MY 2022-23 cotton production is 155,000 bales, up 2.6 per cent over the MY 2021-22 USDA official estimate, assuming favourable weather conditions and continuous government support.

“Local production is still not up to the mark. There is no other option but to import cotton as the RMG sector’s orders grow,” Md Ali Khokon, president of Bangladesh Textile Mills Association (BTMA) told The Business Post.

Yarn, fibre consumption also to rise

The country has been receiving more work orders since the beginning of 2021 as many brands are shifting their orders from some of the competitor countries such as Vietnam and Indonesia. Contacts also stated that Bangladesh is expecting more work orders in the coming months due to recent Covid-19 lockdowns in China, said the USDA.

The USDA data forecasts that in the MY 2022-23 yarn and fabric consumption would reach 0.96 million tonnes and 6.4 billion metres respectively.

For the MY 2021-22, the data estimates yarn and fabric consumption to be 0.95 million tonnes and 6.3 billion metres respectively.

According to Trade Data Monitor (TDM), in Calendar Year CY 2021, the value of yarn imports was up 150 per cent over CY 2020 to a record $2.1 billion.

On the other hand, the value of Bangladesh’s yarn exported in CY 2021 was $34.9 million, up 120 per cent over the previous year. Total fabric imports in CY 2021 dropped to $1.8 billion from $2.6 billion in CY 2020, as Bangladesh imported more yarn. According to TDM, the value of Bangladesh’s fabric exports in CY 2021 was $27.83 million, 40.6 per cent lower than the previous year.

The Commerce Ministry amended the wastage rate again in February 2022, setting the new maximum wastage rate at 29 per cent for basic knitwear, 32 per cent for special items, and 16 per cent for sweaters and socks.

The higher permissible wastage rate will likely encourage apparel manufacturers to import more yarn and fabric due to reduced duties, USDA forecasted.

“Yarn price is high in Bangladesh. In India, yarn is cheaper by around $ 1 per kg. That is why yarn import is increasing. Due to the price difference, the yarn import will increase in future,

“Yarn price is high in Bangladesh, whereas in India, yarn is cheaper by around $ 1 per kg. That is why yarn import is increasing and will continue to increase in future,” Md Hatem, executive president of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) told The Business Post.

India captures largest market share

In CY 2021, raw cotton imports have increased substantially over CY 2020 because of the high domestic demand for yarn triggered by the end of the Covid-19 lockdowns.

By quantity, Indian cotton had a 29 per cent market share, followed by Brazil at 15 per cent, Benin at 13 per cent, and the United States at 9 per cent in CY 2021.

Indian cotton is exported via Kolkata seaport and Benapole land port, with traders noting that transportation and logistics are cheaper as compared to other origins, with shorter shipment times due to geographic proximity, USDA stated.

India is also the largest exporter of yarn to Bangladesh. In CY 2021, India took 84 per cent of the yarn import market share, followed by China at 8 per cent, Indonesia at 4 per cent, and Turkey at 3 per cent.

Ending stock will be reduces

For MY 2022-23, the report forecasts ending stocks at 2.25 million thousand bales, approximately 11 per cent lower than the MY 2021-22 USDA official estimate.

Due to global cotton supply chain issues and increased prices, local spinners will reduce their stock. USDA Dhaka office MY 2021-22 cotton ending stock estimate is 2.51 million bales.

The textiles industry in Bangladesh is composed of yarn, fabric and dyeing-printing-finishing mills.

According to Bangladesh Textile Mills Association (BTMA), in the calendar year (CY) 2021, the number of spinning mills reached 510 with an annual spindle capacity of 15 million bales, up 18 per cent and 7.1 per cent respectively from that the previous year.

There are 901 fabric manufacturing mills and 317 dyeing-printing-finishing mills in the country.

In CY 2021, Bangladesh’s RMG exports hit a record high of $35.81 billion, and the country became the second-largest exporter after China. Knitwear products exports were $19.6 billion and woven products were $16.21 billion, up 37.72 per cent and 22.45 per cent, respectively, compared to CY 2020.