Home ›› 17 Jan 2023 ›› Front

The Bangladesh bank has cut the interest rate by at least 5.5 per cent for manufacturers taking loans from the Long Term Financing Facility (LTFF), and the move will be in effect retroactively from January 1 this year.

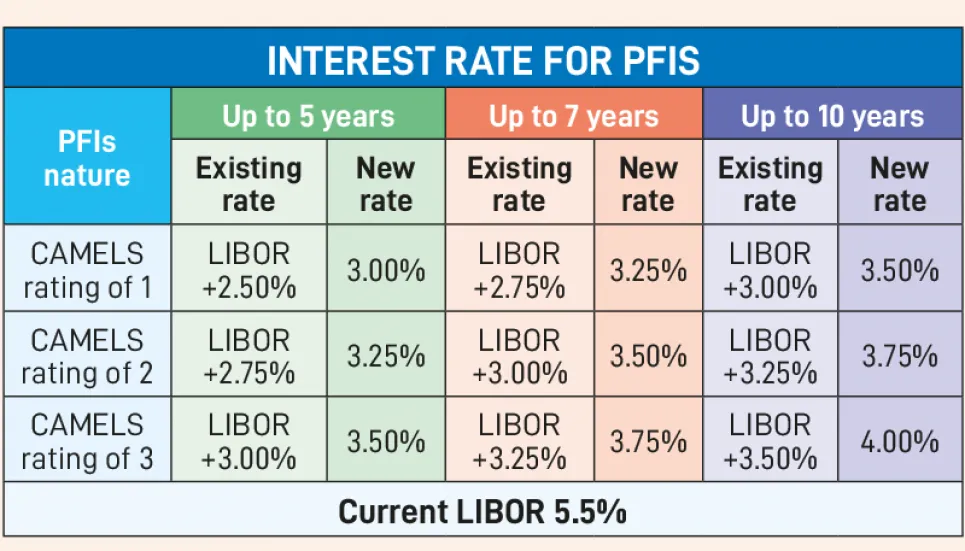

On Monday, the Foreign Exchange Policy Department (FEPD) announced the decision through a circular. LTFF is a Financial Sector Support Project (FSSP) by the World Bank, and the $300 million fund – managed by the central bank – became available to Bangladesh’s manufacturers from 2016. The London Interbank Offered Rate (LIBOR), which currently stands at 5.5 per cent, will no longer be applicable on loans taken from this fund. This move automatically cuts down the LTFF interest rate, which in turn takes down the cost of this fund.

From now on, banks and non-bank financial institutions (NBFIs) will be able to collect from the LTFF fund from the central bank at a minimum of 3 per cent and a maximum of 4 per cent interest rate.

These participatory financial institutions (PFIs) will then be able to loan out the money to customers with an additional minimum of 1 per cent and maximum of 3 per cent interest. Under these rates, a customer will have to shoulder a minimum of 4 per cent and a maximum of 7 per cent interest rate.

Previously, the interest rate of this loan was minimum LIBOR and 2.5 per cent or maximum LIBOR and 3.5 per cent. If the 5.5 per cent LIBOR rate had remained active for LTFF, and if the bank profit of 1 per cent to 3 per cent is taken into consideration, the lowest interest rate would stand at 9 per cent, while the highest would have been 13 per cent.

An official of the central bank, on condition of anonymity, told The Business Post, “Due to the exclusion of LIBOR, the cost of funds will go down significantly and entrepreneurs will be benefited greatly.”

Mohammad Hatem, executive president of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said, “During the ongoing economic crisis this is undoubtedly good news for us. This move will help us cut down production costs a little.

“However, many manufacturers do not know about this fund, so the central bank should take the initiative to inform the industry about this facility.”

The manufacturing sector, including export-oriented readymade garments (RMG), textile, footwear, plastic, and pharma getting, are getting loans from this LTFF.

According to the World Bank, the goal of the support fund is to improve financial market infrastructure, the regulatory and oversight capacity of the Bangladesh Bank, and access to long-term financing for private firms in Bangladesh.

What is this fund’s purpose?

According to the Bangladesh Bank manual, the LTFF can be used for the purchase of capital machinery, equipment and expenses related to installation services for upgradation (including improvement in health and safety compliance), expansion or for newly set up manufacturing industries.

It can also be used for expenses related to construction, refurbishment and ancillary cost for relocation or expansion of existing factories or setting up of new manufacturing factories, and relocation of factories to designated industrial zones (other than EPZs/specialized zones).

However financing under the LTFF will not be provided to any loans that result in direct economic and/or social/environmental impacts through (i) land acquisition, (ii) involuntary resettlement, (iii) impact on indigenous people, (iv) loss of income sources or means of livelihood, etc, the manual reads.

The LTFF can support purchase of ocean-going vessels and specialised transport vehicles supporting transportation of goods manufactured in the country.