Home ›› 24 Oct 2022 ›› Front

At a time when the manufacturing industry is badly suffering due to gas shortage, the prime minister’s energy adviser Tawfiq-e-Elahi Chowdhury has cited the dwindling foreign exchange and rejected the business community’s call to import 200 million cubic feet per day (MMcf/d) of liquefied natural gas (LNG) from the spot market to ensure uninterrupted supply.

Earlier, industry leaders had placed the proposal to tackle the country’s ongoing gas crisis considering export earnings. They even offered to pay, more if needed.

However, Tawfiq on Sunday denied the proposal and urged everyone to reduce electricity consumption by lowering air conditioner use. “This will help cut at least 5,000-megawatt electricity consumption.”

He also claimed that another 80 MMcf/d gas will be added to the national grid from the Bhola gas field within two to three months.

“If we import 200 MMcf/d gas in the next six months at the current spot market rate, it will cost about $1.2 billion more than long-term LNG. But the government is not in a position to invest this amount,” he said.

Tawfiq added, “None of us knows in which direction the global situation will go. So, everyone needs to be prepared. Our delegates will visit many countries to bring in long-term loans to strengthen the forex currency reserve.”

He made the remarks during a seminar, titled “Mitigation of the Impact of Energy Crisis on the Industrial Sector,” organised by the Bangladesh Chamber of Industries (BCI) in Dhaka and presided over by the chamber’s President Anwar-ul-Alam Chowdhury Parvez.

During the programme, former Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) President AK Azad said, “We have to stop production for 12 hours every day because of the ongoing gas and electricity crisis.

“Whoever owns a 50,000-spindle capacity spinning mill, they are facing a loss of a minimum of Tk 2.5 crore in a month. If the situation prolongs, buyers will likely shift to other countries just like they came to us from other manufacturers.”

Marks and Spencer Country Manager Shwapna Bhowmick said she visited 27 apparel factories in the last two months and was worried about the whole experience. “Their machinery is severely affected due to the energy crisis. I can’t imagine how long they will be able to sustain.”

Md Saiful Islam, the president of the Metropolitan Chamber of Commerce and Industry, Dhaka (MCCI), said, “The government has increased fuel prices when we are facing a severe crisis. They are also charging Tk 24 per litre as import duty, VAT and tax. Is this necessary?”

Gas and exports

BCI claimed in a keynote paper that, out of the total national consumption, the industries consume 28.4 per cent of electricity and 17.86 per cent of gas. But now they are facing a huge gas and electricity crisis since mid-2022, which has reduced their production by 60 per cent but increased the production costs.

Amid the situation, apart from being willing to pay more for the government to buy more LNG from the spot market to ensure uninterrupted gas supply, they also recommended making the gas utilisation policy consistent with present-day reality, reducing gas supply to power and fertiliser sectors, and using LPG in domestic and commercial sectors.

Tawfiq said they were not sure about the possibility of a proposal to get 200 MMcf/d gas from a source at a cheap rate. “If you want to run your industry using compressed natural gas (CNG), do it. If you have any plans to use liquefied petroleum gas (LPG), I don’t know how it will work! Please place a proposal,” he told the businesses.

“Load-shedding will increase if we reduce gas supply to power plants. Food production and industries are our top priorities, and to ensure power and energy supply, we will cut electricity supply to other sectors if necessary.

“So, there is no chance to reduce gas supply to fertiliser factories and power plants. Food grain and fertiliser prices in the international market are too high,” said Tawfiq.

However, Bangladesh Textile Mills Association (BTMA) President Mohammad Ali Khokon said that their exports earn $2.4 million foreign currency daily on average by consuming $0.1 million worth of gas.

“Give us $2.4 billion worth of gas annually if possible and we will give you $60 billion in export earnings,” he said addressing the government.

Addressing the seminar, FBCCI President Jashim Uddin wondered why the government was not setting up separate industrial gas lines when it already knows the locations of most of the industries.

“We need additional investments for doing business in Bangladesh, which is rare in the world. We have to set up a captive power plant, diesel-fired generator, and electricity connection and all these are expensive. But we are still doing business here,” he said.

Trying to allay concerns, Tawfiq said that some coal-fired power plants will come into production by December and start adding electricity to the national grid.

“Afterwards, we will be able to reduce the gas supply for electricity generation and divert some gas for industrial use. But if the situation does not improve after this, then we may have to refrain from using any electricity during the day,” he added.

Current situation

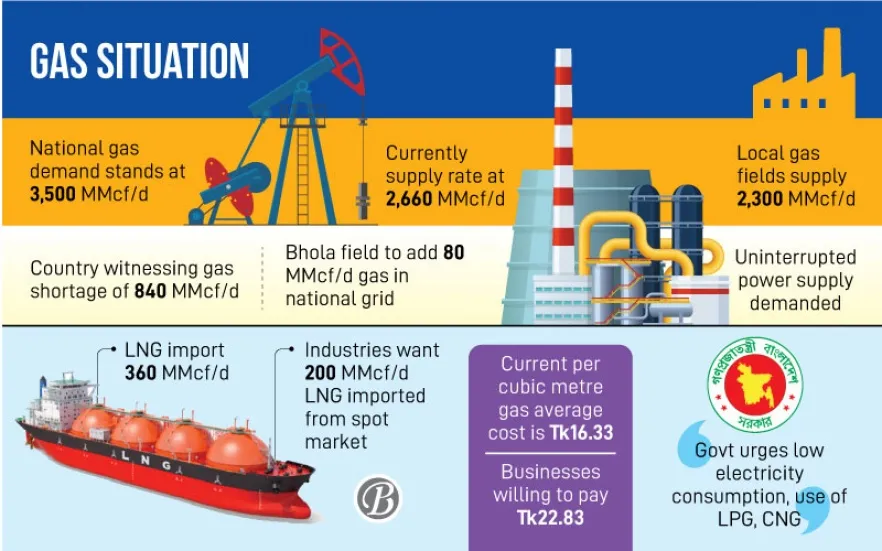

Bangladesh currently has 20 operational gas fields which supply 2,300 MMcf/d against a national demand of 3,500 MMcf/d, according to Petrobangla.

To cover this gap, the government signed a long-term agreement with Qatar and Oman and has been importing 500 MMcf/d of LNG. Besides, the government also imports LNG from the spot market on occasion to meet the domestic demand.

After Russia invaded Ukraine in February, the price per cubic metre of gas in the spot market rose from $5 to $58. Bangladesh’s forex reserves also recently started to decrease steadily, going under $37 billion this month from last year’s $48 billion.

This forced the government to stop LNG imports from the spot market to save forex reserves and failed to import 140 MMcf/d gas under the agreement due to a notification glitch. This string of events triggered a severe gas shortage in the country several months ago, hitting the industries and general people hard.

Under the circumstances, BTMA President Khokon on Saturday proposed that if the government starts importing 200 MMcf/d of LNG from the spot market at $25 per Metric Million British Thermal Unit, per cubic metre average cost will rise from Tk 16.33 to Tk 22.83 and the businesses were ready to pay it.

BCI also backed the proposal at Sunday’s seminar but the prime minister’s energy adviser vetoed it.