Home ›› 29 May 2023 ›› Front

The non-performing loans (NPLs) in Bangladesh’s banking sector are continuing to grow despite the government’s pledge to bring them down.

Finance Minister AHM Mustafa Kamal in January 2019 had said that the NPLs will not grow by even a single penny but he has failed to keep that promise.

Back in January 2019, the sector had Tk 93,911 crore as NPLs.

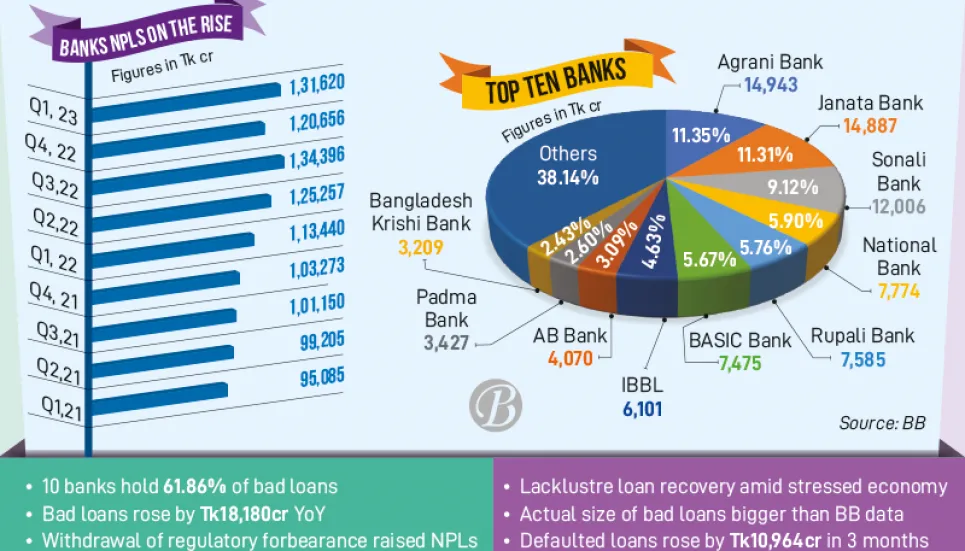

And at the end of March this year, the NPLs stood at Tk 1,31,620 crore or 8.80 per cent of the total disbursed loans, marking a significant 16.02 per cent increase year-on-year (YoY), according to the latest Bangladesh Bank (BB) data.

March’s figure is the second highest since Bangladesh achieved independence in 1971. The NPLs in the September quarter of last year had hit an all-time high at Tk 1,34,396 crore.

The defaulted loans at the end of March this year increased by Tk 18,180 crore YoY and Tk 10,964 crore quarter-to-quarter. The default loan figure was at Tk 1,20,656 crore in December 2022.

A senior BB official said that the bad loans of most banks increased after central bank inspections and it added to the March quarter figure.

The lack of good governance, policy relaxation for borrowers, corruption, and loan irregularities are the major reasons behind the growing NPLs, said Zahid Hussain, the former lead economist of the World Bank Dhaka Office.

He said that the actual amount of bad loans is much higher than the BB data as most of the banks are not providing accurate data on their bad loans.

The economist said that the regulatory forbearance has failed because defaulters just enjoyed the facility instead of repaying loans. “The business people have been getting regulatory forbearance since before the Covid-19 pandemic, which must be stopped now.

“Otherwise, it would be impossible to bring the defaulted loans under control,” he added.

The borrowers were just getting forbearance using the pandemic, Russia-Ukraine war, etc. as excuses, Zahid said. “The Bank Company Act has been amended but it will have to be implemented and all business people will have to come under the act’s purview.”

He said that the central bank will have to publish banks’ stress assets as per the recommendation of the International Monetary Fund. “And that will show how bad the NPL situation really is.”

At the end of March 2023, NPLs of state-run commercial banks stood at Tk 57,958.57 crore or 19.87 per cent of their total disbursed loans, BB data showed.

Also, it showed, bad loans of private commercial banks stood at Tk 65,888.70 crore or 5.96 per cent of their disbursed loans.

Defaulted loans of foreign banks stood at Tk 3,041.80 crore or 4.90 per cent of their disbursed loans and Tk 4,731.72 crore in specialised banks.

Multiple lingering reasons

Talking to The Business Post, Dhaka Bank Managing Director and CEO Emranul Huq said that the NPLs increased because of the withdrawal of the regulatory forbearance, which was introduced amid the pandemic.

Now, SME loans also are becoming defaulted and that is a concerning issue for the banks, he said.

“Banks were providing LC facilities against the industrial raw material import but those loans have become forced loans due to non-payment and forced loans became bad immediately,” he added.

Emranul said that the rescheduled loans are now also becoming defaulted because business people do not want to repay the loans using the current economic condition as an excuse.

He warned that the NPLs may increase further in the upcoming days as the economy is going through a very uncertain time.

Echoing Emranul, Jamuna Bank MD and CEO Mirza Elias Uddin Ahmed said that the borrowers were enjoying loan moratorium facilities amid the pandemic, but the major facility ended in December last year. “This is why the defaulted loans have increased in recent times.”

Mutual Trust Bank MD and CEO Syed Mahbubur Rahman also said, “The overall situation of the country’s economy is not so good due to skyrocketing inflation and crisis in the foreign exchange market.

“The recovery of loans is not at a satisfactory level amid the ongoing situation as people’s purchasing power has reduced.” At a recent press conference, the Association of Bankers, Bangladesh (ABB) said that the banking sector alone cannot tackle the challenge of the higher NPLs.

ABB Chairman Selim RF Hussain said that BB and commercial banks cannot solve this problem if the whole country and society do not take concerted efforts to address it.

At the same event, BB Governor Abdur Rouf Talukder said that despite their different initiatives, defaulted loans are on a rising trend and it is becoming challenging and a headache.

A few days later at another event, he also said that the NPLs were a major concern now and bank executives are liable to reduce it.