Home ›› 02 Mar 2023 ›› Front

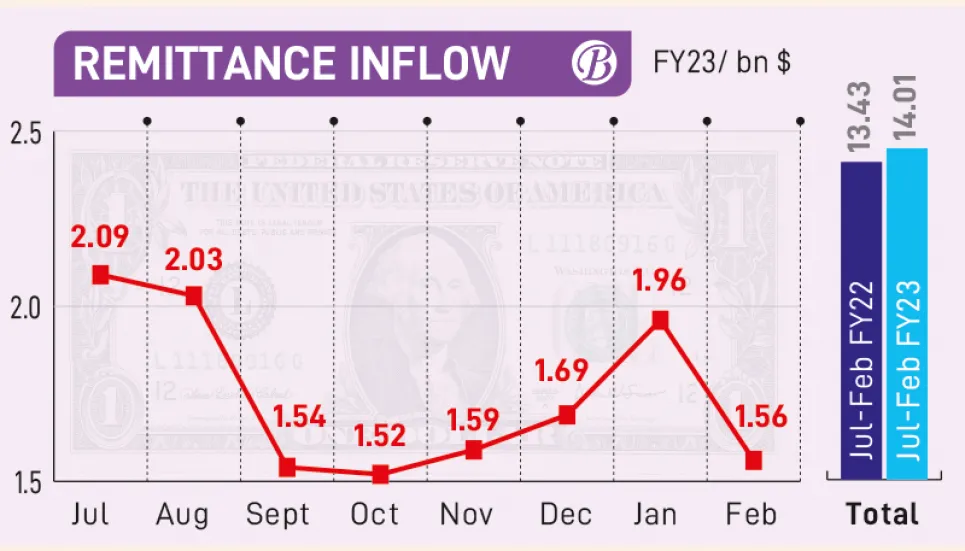

Bangladesh’s remittance income increased by 4.28 per cent to $14.01 billion during the July-February period of FY23, when compared year-on-year. This figure was $13.43 billion during the same period of FY22, show latest data from the Bangladesh Bank.

However, the country’s remittance income dropped by 20.3 per cent in February this year compared to the previous month. Remittance income stood at $1.56 billion in February, compared to $1.95 billion in January of 2023.

Commenting on the matter, Bangladesh Bank spokesperson and Executive Director Md Mezbaul Haque said, “The remittance inflow does not remain the same every month. The flow has decreased slightly compared to January as the month of February has three less days.

“It is expected that the remittance inflow will increase a lot during Ramadan and Eid.”

Regarding the overall increase in remittances, Haque said, “The central bank and the law enforcement agencies are very cautious about hundi [an illegal cross-border transaction of money]. Besides, technical initiatives have been taken to receive remittances in real time.

“Mobile Financial Service (MFS) providers have also been authorised to bring in remittances. Incentives also continue in the sector. Due to these reasons, the remittance income is higher than the same period of previous FY.”

Analysts however point out that the remittance inflow is not increasing in proportion to the amount of manpower exported after the easing of Covid-19 pandemic. Money laundering and high immigration costs are the key reasons behind this issue.

On the issue, Centre for Policy Dialogue (CPD) Senior Research Fellow Towfiqul Islam Khan said, “A large amount of manpower has been exported since 2021, but no positive impact is seen in the remittance inflow. However, the overall inflow is good.

“It is crucial to ensure that remittance flows in through the banking channel. But the trend of money laundering from the country is very high, so remittance inflow is not standing at an expected level.”

Bangladesh’s manpower exports reached 6.17 lakh in 2021, according to the Bureau of Manpower, Employment and Training (BMET). The country exported 11.35 lakh people in 2022, which is a record high for Bangladesh.

The figure was 1.04 lakh in January this year.

Khan further said, “The major problem in Bangladesh is that the cost of going abroad is very high. Due to our overseas requirement process, many workers fell into a vicious cycle. As a result, workers cannot send remittances at an earlier time after reaching abroad.

“But we should find out the answer, why is our migration cost so high compared to many other countries?”

In this context, the central bank spokesperson said, “A number of studies have shown that most of the workers cannot send remittance right after reaching abroad. So we will need more time to get the remittance of those who went overseas last year.”