Home ›› 03 Apr 2023 ›› Front

Bangladesh’s export-oriented industries have been hit once again by the ongoing global economic crisis – triggered by the Russia-Ukraine war. The sector experienced negative export growth this March, marking the third such occurrence in FY23.

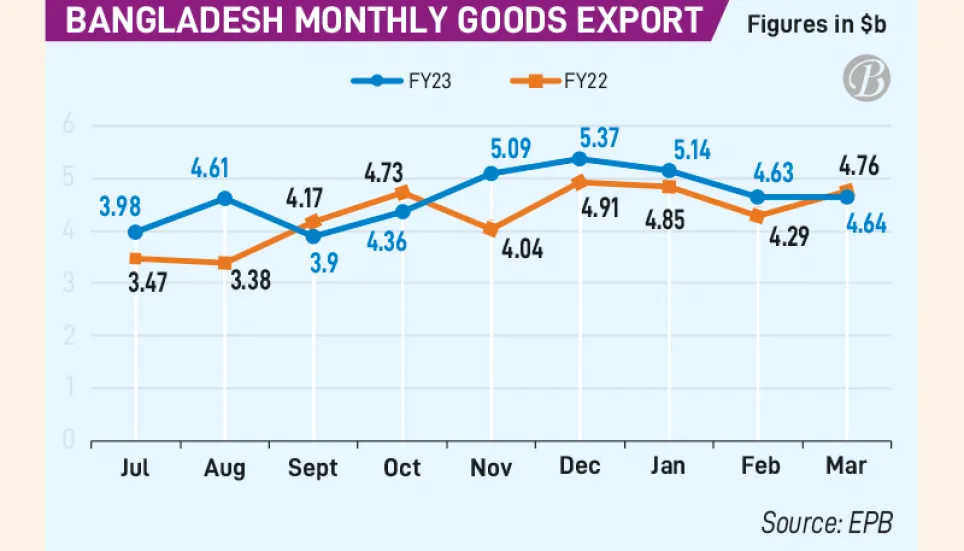

Published on Sunday, the Export Promotion Bureau (EPB) monthly provisional data show that the country earned $4.64 billion in March, which is 2.49 per cent lower when compared year-on-year.

Bangladesh had witnessed negative export earnings during the last September and October as well.

Even the apparel sector earnings, the country’s leading segment, dropped by 1.04 per cent to $3.89 billion in March when compared year-on-year, marking the second such occurrence in FY23.

All major sectors, except leather and leather goods, posted negative growth during that month.

In the first nine months of this FY, however, Bangladesh was able to retain the growth and its earnings rose by 8.07 per cent to $41.72 billion year-on-year.

Speaking to The Business Post, Policy Research Institute of Bangladesh’s Executive Director Ahsan H Mansur said, “Although the export sector is facing a shortage of orders, the country will be able to retain growth in FY23.

“Despite the global economic crisis, our readymade garment (RMG) sector performed well. But it declined for two months in this FY. Non-RMG sectors are in a vulnerable situation as well, and they failed to retain growth.”

He added, “I think that in terms of value, Bangladesh – especially the RMG sector – will be able to retain a slow growth this FY, but in terms of volume, our exports will decrease.

“At end of this FY, the apparel sector’s contribution to total exports will be up to 86 per cent – 87 per cent.”

Apparel industry

The EPB data shows that the apparel sector, which is the leading export segment for Bangladesh, failed to retain growth in March, but its earnings rose by 12.17 per cent to $35.25 billion in the first three quarters of FY23.

During March, RMG industry earnings dropped by 1.04 per cent to $3.89 billion. Among this figure, the knitwear sector contributed $2.08 billion, posting a 1.32 per cent year-on-year growth. Woven sector earnings decreased by 3.61 per cent to 1.81 billion.

Besides, in the first three quarters of FY23, earnings from knitwear items rose by 11.78 per cent to $19.14 billion, while earnings from woven items rose by 12.63 per cent to $16.11 billion.

Industry insiders say due to the ongoing economic crisis, their orders have been severely impacted, and the high inflation has pushed up their production costs. But the apparel manufacturers are exporting high-values items.

Bangladesh Garment Manufacturers and Exporters Association (BGMEA) President Faruque Hassan said, “This is why our export earnings are high. But in terms of volume, our exports have decreased. We are focusing on non-traditional markets to recover from this situation.”

Industry insiders, however, expect that the order situation is likely to improve after this FY.

Leather and leather goods

EPB data show that the leather and leather goods industry, another major export segment, has been able to retain its growth in the first nine months of FY23, though the rate is sloth. During the period, the sector earned $920 million, posting a 2.56 per cent year-on-year growth.

Among this figure, leather items posted a 19.50 per cent year-on-year negative growth and earned $93 million, however, leather products export earnings rose by 20.77 per cent to $292 million and leather footwear sector earnings dropped by 0.88 per cent to $534 million.

Md Ashikur Rahman Tuhin, Managing Director of TAD Group, who is also a trader of footwear items, said, “Footwear sector has a huge potential as buyers continue to shift from China. But we have to boost our marketing and change the strategy.”

Home textile, jute and jute goods

Another two sectors with great potential – home textile and jute and jute goods – have failed to retain their growth since the first quarter of this FY, and their earnings dropped significantly because of the ongoing global economic crisis.

EPB data show that the home textile industry earnings dropped by 25.73 per cent to $860 million and earnings from the jute and jute goods dipped by 21.23 per cent to $699 million in the first nine months of this FY.

Discussing the situation, industry insiders say they do not know when this difficult situation will be resolved. They added that if the ongoing war and global economic and political crisis become prolonged, their performance will suffer further.

Tulika Eco Chief Executive Officer Esrat Jahan Chowdhury said, “Orders from buyers have dropped by almost 40 per cent due to the economic crisis, and their price is not covering our production costs. Thousands of tonnes of finished jute goods are now stocked in warehouses.”

Ahsan H Mansur said, “The dipping performance of the non-RMG sector is a cause for concern. The government should focus on these sectors, and provide appropriate policy support to retain their growth.”