Home ›› 12 Jan 2023 ›› Front

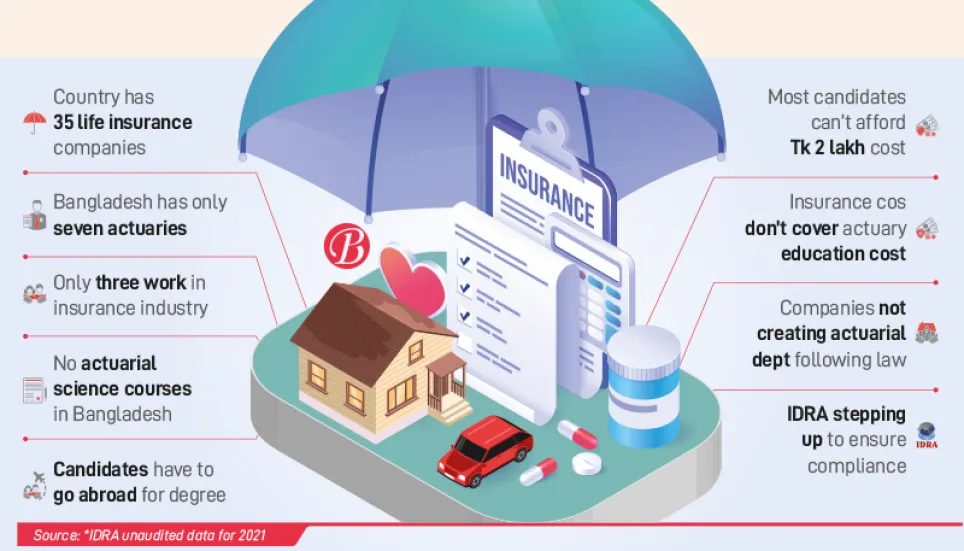

Although there is an acute crisis of actuaries in Bangladesh, the Insurance Development and Regulatory Authority (IDRA) has recently made it mandatory for all 35 life insurance companies in the country to open an actuarial department.

The directive is unrealistic as the country currently has only seven actuaries and just three of them are working in the insurance industry. All of them obtained their degrees from abroad since no institute in the country offers any course on actuarial science.

Industry insiders said that there are very few qualified people in the insurance sector to study actuarial science courses and not all of those interested in studying the subject can afford to spend over Tk 2 lakh.

Dhaka University (DU) and East West University once launched actuarial science courses but they had to shut them down due to different reasons, including failure to get a response from students and insurance companies.

An actuary’s role is crucial as the operation of insurance companies is largely based on the degree of risks they undertake and the returns they generate.

They need to employ advanced analytical and statistical skills to gauge the risks and returns associated with each proposal they receive.

An actuary specialises in the field of analysing financial risks by implementing statistical, financial and mathematical theories. In insurance, actuaries aid in assessing the risks which help companies in the estimation of premiums for their policies. Experts blame the lack of opportunity to study actuarial science in the country and the reluctance of companies to abide by the law or send professionals abroad to acquire the degree as the reasons behind the scarcity of actuaries in the life insurance sector.

No educational opportunity

The lack of educational opportunities is the main reason that has resulted in the severe shortage of qualified actuary candidates.

As there is no institute in the country to offer actuarial science courses, going abroad remains the only option for interested candidates to study the subject. Talking to The Business Post, Bangladesh Insurance Academy (BIA) Director SM Ibrahim Hossain said they have asked permission from IDRA to introduce a diploma course in actuarial science in 2023.

Dr Md Main Uddin, professor of the Banking and Insurance Department at DU, said that there are very few qualified people in the insurance sector to study actuarial science courses.

He said most of those interested in studying the subject cannot afford to spend Tk 2-2.5 lakh. Most insurance companies also do not cover this expense for any employees interested to pursue this higher education.

“We have discussed this with insurance company owners but they are not interested. That is why we dropped the course from our department’s curriculum,” he added.

Abdullah Harun Pasha, additional secretary of the ministry’s Financial Institutions Division, said, “To produce the required number of actuaries in the insurance industry, the Finance Ministry had taken an initiative to offer scholarships. But enough eligible students were not found for the scholarship in the last two years, despite our continued efforts.”

He said that in the academic year 2022-23, out of four, only two eligible students have been sent to the City University of London for a one-year Master’s programme in actuarial science.

Why insurance cos reluctant?

The lack of the required number of actuaries in the country is hampering the timely valuation of the insurance sector, especially in life insurance companies, according to industry insiders.

As a result, they said, the companies cannot announce bonuses to policyholders. Besides, complications in settling insurance claims are rising as well.

There is a distinct lack of initiatives from life insurance companies in training actuaries. For years, most companies have refrained from complying with the existing laws.

Sadharan Bima Corporation Director and industry expert AKM Ehsanul Haque said IDRA has issued several instructions to introduce actuarial departments in insurance companies. But most of the life insurance companies have ignored the directives.

“Unfortunately, insurance companies are not making proper use of the Master of Actuarial Science degree holders,” he said.

Apart from this, Ehsanul added, many of the actuary degree holders are assigned to other departments in the insurance companies, instead of the actuarial department.

Requesting anonymity, a senior official of a life insurance company told The Business Post that many insurance companies are purchasing actuarial services from non-resident Bangladeshi actuaries and foreign actuaries to meet the demand.

“This type of arrangement is not at all helpful for the development of the country’s insurance sector. To facilitate the growth of the industry, we need to take the necessary steps to increase the number of actuaries in the country now,” the official observed.

According to Finance Ministry sources, there is no recognised quality professional institute in the country for awarding actuarial degrees or certificates. Courses on actuarial subjects were introduced at the university level but due to a lack of suitable teachers and interested students, they have not yielded the expected results.

At present, professional actuarial certificates are issued by actuarial institutes in different countries around the world. One of them is The Institute and Faculty of Actuaries (IFOA) of the United Kingdom.

A student can become an actuary by obtaining an MSc degree in actuarial science by participating in the professional examination of this institute.

An official of another life insurance company, asking not to be named, said the board of directors of their company is reluctant in training actuaries due to the high cost and lack of qualified candidates.

IDRA’s steps

In a directive issued recently, IDRA said that the actuarial department should be introduced mandatorily in all life insurance companies to ensure transparent and orderly management.

IDRA Director (Deputy Secretary) Md Shah Alam told The Business Post that instructions have been issued to each life insurance company to have a separate actuarial department to address the inadequacy of actuaries in the country.

“If the companies do not follow the directive, we will force them to do it. Many companies have already set up actuarial departments and started following through,” he said.

According to IDRA data, the life fund of the country’s 35 insurance companies was at Tk 35,889 crore at the end of December 2021.

MetLife shows the way

According to Section 67(1) of the Insurance Act 2010, “Every insurer registered for life insurance business shall, with the approval of the authority, appoint an actuary as necessary.”

At present, only MetLife Bangladesh seems to be complying with the law.

All three working actuaries in the country’s life insurance sector are employed by this company. They are Md Imran Shikder, assistant director of MetLife Bangladesh, Sadhu Satyam, actuary at MetLife Bangladesh, and Afrin Haque, manager at MetLife Bangladesh.

The company’s Chief Executive Officer Ala Uddin Ahmed told The Business Post that the actuary profession has not yet been established in Bangladesh due to various reasons.

“Not just the government, the insurance companies must also come forward to encourage people to enter this profession. At MetLife, we have taken the initiative of creating actuaries over the last two years. We are offering scholarships to those who are studying at the undergraduate level in private and public universities,” he said.

“Last year, we gave scholarships to 10 people. We plan to offer scholarships to 10 more people this year as well,” he added.