The Universal Pension Scheme (UPS) has been launched with the aim of fostering socio-economic growth and ensuring social security for the citizens of Bangladesh.

The notification was issued by the Finance Division under the Finance Ministry on August 13. It was followed by the formal inauguration by the prime minister on August 17.

The scheme categorises individuals into four primary groups based on their income patterns: private employees, workers in the informal sector, low-income individuals, and Bangladeshi expatriates.

UPS can serve as a dependable safety net for individuals from diverse backgrounds, including Bangladeshi expatriates. The digitised management ensures seamless registration and information management. All citizens stand to benefit from this service. It will address prior pension-related issues and foster broad participation in the scheme.

This article will discuss how Bangladeshi expatriates can register for the Probash Scheme of the UPS. Prior to that, let’s get familiarised with the fundamental regulations of this initiative.

General rules

In recent years, the growing elderly population due to increased life expectancy has resulted in heightened dependency ratio. It potentially leads to future challenges. Simultaneously, financial instability has implications for the productivity of the working population.

Addressing these concerns, the Universal Pension Management Act of 2023 was made as a solution.

The following are the general regulations pertinent to the wider public encompassed by the scheme:

- Bangladeshi citizens aged 18 to 50 can engage in this scheme with their national identity cards (NID). Citizens above 50 may participate with special consideration, limited to the 10-term scheme. It entails a lifetime pension after ten years of subscriptions.

- Applicants can enrol in any of the schemes through the online platform. But those already benefiting from the social security programme must relinquish their prior benefits.

- Bangladeshi expatriates can join the programme, registering with their passport if they lack a NID. However, prompt preparation and submission of the NID is required.

- Each contributor will have a separate pension account created at the outset of the scheme. If a pensioner passes away before reaching the age of 75 during the pension period, the remaining pensions will be disbursed to nominated heirs.

- If a contributor passes away before completing 10 years of contributions, the entire deposited subscription amount will be returned. The amount, along with accrued profit, will be given to the nominated heir.

- Pension contributions will be viewed as investments, subject to tax concession. Subsequent monthly pension payments will be exempt from income tax.

- It is noteworthy that a standardised service charge for mobile financial services was fixed on August 16. The existing cash out charge of 0.70 per cent applicable to government services will also be imposed on this programme.

Registration process

All categories of Bangladeshi citizens, including expatriates, must initiate the registration process on the U-Pension website. Then, click on the pensioner registration on the top right corner.

Identity verification

The initial phase of registration necessitates the confirmation of the candidate's identity. It is essential that the candidate is not affiliated with any governmental, semi-governmental, autonomous, or state-owned entity. Furthermore, outside this scheme, no beneficiaries from government or autonomous institutions are permissible. Those already receiving allowances under the social security programme are ineligible for registration.

Applicants carefully need to review the provided forms and affirm their agreement by selecting the 'I agree' button. It is crucial to ensure accurate information, as incorrect applications will be rejected. Any subsequent pension contributions made based on such applications will not be refunded.

Selection of income category

Candidates should select their category, with expatriates choosing the appropriate category. Additionally, they have to input the NID number and date of birth. They should use their frequently used phone number and email address. These will be utilised for all communications related to registration, subscription, and pension.

An OTP (one-time-password) will be dispatched to the candidate's mobile number and email.

Personal details

The succeeding page pertains to personal information. Here, data from the NID, including the NID number, photograph, full name in both Bengali and English, parents' names, and current and permanent addresses, will be automatically populated.

Candidates need to provide annual income information by inputting numeric values. They are required to select Division, District, and Upazila from the drop-down lists. Then they have to choose their profession from the provided options. Completing this section will let them move on to the 'Scheme Information' page.

Scheme information

In this segment, applicants can select their desired contribution mode: monthly, quarterly, or yearly. It determines the monthly contribution amount and payment method.

Modes of payment

Here, candidates need to enter the bank account holder's name and number. They need to choose between a savings or current account. It is followed by filling in the routing number.

In case of not knowing the number, applicants are required to click the right-side button -- 'don’t know the routing number'. Here, the bank's name and branch will be asked. By selecting the right bank and its branch, the routing number will be automatically linked.

Nominee information

Applicants will need to provide the NID number and date of birth of their nominee. Upon clicking 'Add', they are required to input further details such as the nominee's mobile number, relationship, and the information of the nominee’s rate. Multiple nominees can be added using the 'Add More Nominees' feature.

Verification and submission

The final step involves verifying all previously entered personal, scheme, bank, and nominee details. The applicant is required to confirm their accuracy and agreement before completing the application. Once confirmed, the application can be downloaded and saved.

How to pay subscription

Subscription rates and monthly deposit dates will be communicated via email and mobile number. Contributions should be deposited into the designated National Pension Authority bank account. Expatriates can utilise valid channels to pay in foreign currency using credit or debit cards.

In cases of delayed payment, a one-month grace period with no penalty will be provided. Beyond this period, a penalty of 1 per cent will be levied daily.

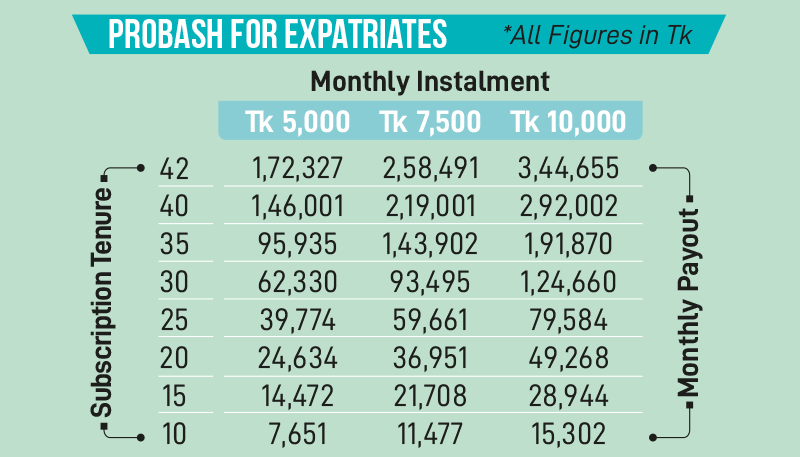

Expatriates will pay subscriptions in taka and receive pensions in taka upon the subscription period's conclusion. Moreover, scheme changes can be made upon permanently returning to the country if necessary.