Home ›› 13 May 2022 ›› News

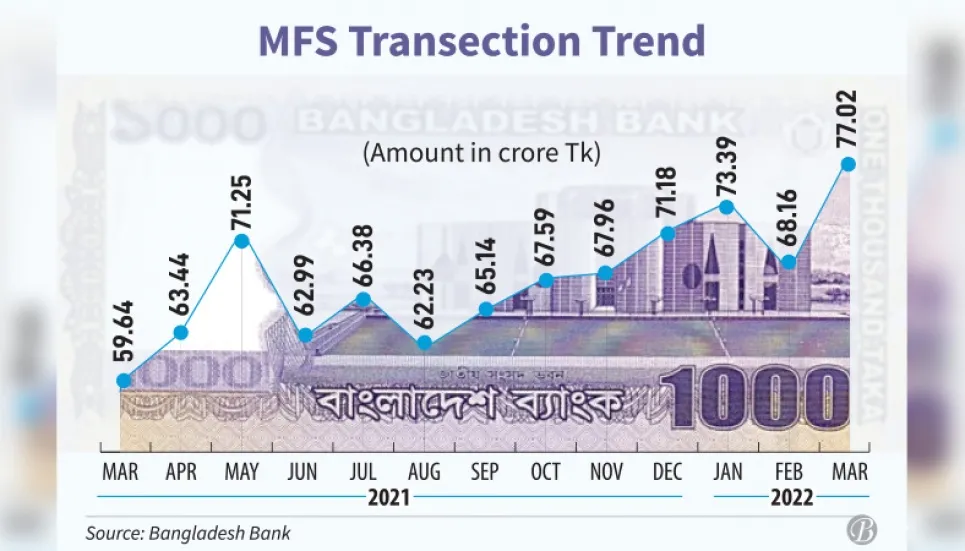

Mobile financial services (MFS) transactions reached Tk 77,022 crore, an all-time high, in March, clocking a 13 per cent increase compared to February and a 29 per cent rise than last year’s March.

The Bangladesh Bank released the data on Thursday, which shows MFS transactions were Tk 59,642 crore in March last year. March was the month before Ramadan and MFS transactions increased as consumption is usually ahead of the holy month, said industry people.

Cash in, cash out, person-to-person (P2P), government-to-person (G2P), salary disbursements, and talk time purchase though MFS increased in March. Tanvir A Mishuk, founder and managing director of Nagad, told The Business Post this was a true milestone for the cashless industry and credit goes to the mobile payment segment.

He said day-to-day MFS transactions had seen an upward trend over the past two years as people’s comfort and trust in the system increased.

Cash in amount increased by 13.74 per cent to Tk 23,707 crore, cash out by 14 per cent to Tk 20,791 crore, P2P by 14.5 per cent to Tk 22,288 crore, and G2P by 76 per cent to Tk 182 crore in March compared to February.

Besides, salary disbursements through MFS rose by 5 per cent to Tk 2,878 crore, utility bill payments by 22.6 per cent to Tk 1,232 crore, and talk time purchases by 12.4 per cent to Tk 694 crore that month.

Shamsuddin Haider Dalim, head of corporate communications at bKash, the largest MFS provider, told The Business Post the mobile banking ecosystem was growing riding on users’ demand.

“Transactions will increase more in the future. In addition, transactions usually rise ahead of and during Ramadan, Eid, or other festivals.”

Merchant payments, meanwhile, declined by 11.25 per cent to Tk 2,884 crore in March compared to February.

Dalim said consumers do not shop before Ramadan as much as they do in the holy month and this could be one of the reasons why merchant payments dropped in March. The number of registered MFS accounts declined by over 70 lakh in March compared to February. The total number of accounts was 10.91 crore in March, which was 11.61 crore in February.