Home ›› 16 Sep 2021 ›› Opinion

All businesses require Capital equipment such as machinery, premises, vehicles etc. The acquisition of such assets is known as Investment and is undertaken for the following reasons:-

Investment, like all other business activities involves an element of risks and uncertainty, since expenditure is incurred today to produce some benefit in future .By Investment appraisal the future can be predicted with total certainty. Investment appraisal techniques are designed to aid decision making regarding investment projects. Economists analyse the determinants of private sector investment in terms of and Microeconomic factors which affect the decisions of business. The major factors are:

Govt. policy in respect of (i) interest rates (ii) taxation(rate of taxation and rules on depreciation) (iii) availability of Govt. grants to subsidize investment (iv) Govt. spending (Keynesians support it for boosting private sector investment while Monetarists perceive it as “crowing out” the private sector).

The yield (benefit) from investment can come in one of the two ways. In the case of an expansion project, the benefit takes the form of increased production and hopefully sales revenue and profits. There are, however, problems with the concepts of profits and sales revenue. In the case of profit much depends on how it is defined and calculated. In the case of sales revenue new machinery does not benefit the firm if additional revenue is achieved at the expense of increased costs of complementary inputs. The way to avoid these problematic concepts is by analysing additional cash flows net of operating costs incurred in working the new equipment. Expansion projects are analysed by comparing expected additional net cash flow with the cost of the asset.

The other type of project does not add to output or sales but reduces costs (the acquisition of labour saving equipment). Hence, the benefit takes the form of lower costs but the principle is the same. The expected annual reduction in costs is compared with the cost of the equipment. Let us now take an example. A manufacturing company is considering investing $500,000 in new equipment. The equipment is expected to last seven years and to increase the firm’s cash flow ( net of operating costs) by $150,000 per year over its life. Is the investment worthwhile? The total yield from the investment is $150,000x7 which is equal to $1050, 000 compared with a cost of $500,000. However, we have failed to take into account the delay in receiving the yield. It is only in the 4th year of operation that the machinery has paid for itself. When investment projects are appraised it is necessary to take into account not only the size of the yield but also its timing. Hence, the issue of Pay Back comes into picture.

Pay Back

Pay back is the simplest method of investment appraisal and is usually preferred by small businesses because of its simplicity. Large businesses use it as screening process before embarking on one of the more complicated techniques. The payback period is the time taken for the equipment to generate sufficient net cash flow to pay for itself. Firms can use this technique in one of two ways. First a firm could set an upper limit on the time allowed for payback. Any project which is not expected to payback within 3 years should be rejected. Second when faced with a choice of projects, the payback method can e used to rank projects according to the speed with which they payback.

The payback method ignores the total return on investment, the earning after payback and the timing of the return period to payback. It discriminated the rates against projects which produce a slow but in the long run, substantial return. The payback method favours those projects which produce a rapid return. When the external environment is uncertain, where rivals are likely to catch up quickly or where the firm is short of liquid assets, a quick return is very important. Nevertheless, there is a danger that profitable project will be rejected because of the delay in producing return.

Average Rate of Return (ARR)

The ARR takes the total yield over the whole life of the asset into account. As such it overcomes the defects of the payback method. To understand the arithmetic, let us consider a capital equipment costing $1 million. It is expected to last 5 years and to produce an annual net cash flow of $0.5 million. The total yield net of both operating costs and initial capital cost is ( 5 X $ 0.5) --- $1 million=$2.5m---$1m=$1.5. Annually this works out at$1.5m divided by 5=$0.3m. As a percentage of the initial investment it is $0.3m divided by $1m X 100=30%.

The great defect of this method of investment appraisal is that it attaches no importance to the timing of the cash flow. ARR treats all money as of equal value irrespective of when it is received. Hence, a project might be favoured even though it only produced a return over a long period of time.

The more sophisticated methods of investment appraisal take timing as well as the size of return into account. Suppose your parent offered you a choice of $100 money gift today in anticipation of your good result in the final examination or $100 only after the publication of the result. Which would you prefer? Probably you will prefer the money today but let us analyse, why?

First, he will prefer the money today because of the greater uncertainty involved. Second aware of the inflation he would prefer to have the money today because its purchasing power will be greater today than it will be in the future. Both these points are valid but should not obscure the essential point. Even when money is guaranteed in the future and when inflation is non-existent, it is still preferable to have the money today. After all with money today one can buy more and enjoy in the immediate future. If one is prudent , one will deposit money in some interest carrying account and gain interest. It is always better to have the money today rather than waiting for it. This is known as the time value of money. $ 100 today is more valuable than $ 100 guaranteed in a year’s time. We can rewrite this statement as $ 100 guaranteed in a year’s time is worth less than $ 100 today. It has a lower present value because of the inconvenience of having to wait. That is one of the reasons why exporters want immediate disbursement of their cash assistance money without delay. With a delay of one year for disbursement, the money value erodes and exporters suffer a monetary loss.

Present value

The return on an investment comes in the form of a stream of earnings in the future. The Discounted Cash Flow method of investment appraisal takes into account the size of the return over the life of the equipment but makes adjustment for the timing. A greater weighting is given to the return in the early years.

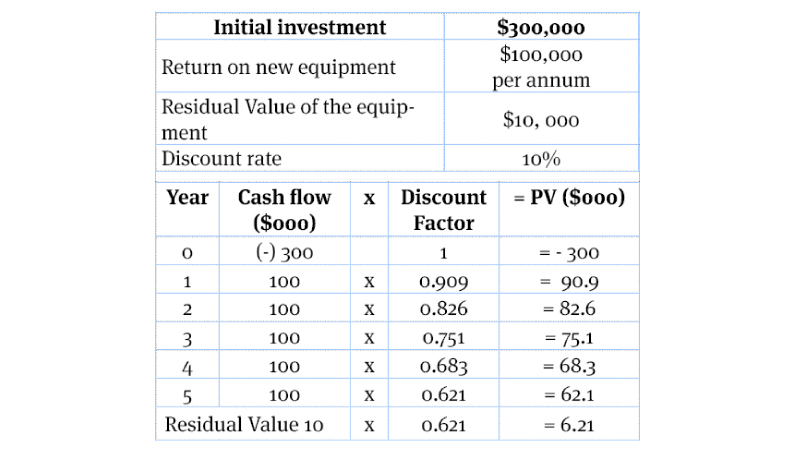

The sum of the PV is then compared with the initial capital cost of the project. If the sum of PV-Capital cost is positive, it is worthwhile proceeding If the resulting figure is negative then the project should not be undertaken. For our clear understanding let us calculate the NPV from the following:

Here two points should be noted. First the capital cost is included as a negative item since it is an outgoing. As it is incurred today, it has a discount factor of 1.0 (in reality it is not discounted). The residual value is a positive item since it is a cash inflow that the business expects to receive in the future. However, as it received at the end of 5 years, $10,000 is considerably discounted.

An important question to ask is why a specific rate of discount is chosen. This is significant since the profitability of the proposal of the project depends on the chosen rate of discount. The selected rate reflects interest rate in the market. This is important if the firm has to borrow money to finance the investment. It is also important if the investment is to be financed out of retained profits. The firm should consider what else it could do with the money; in other words, the opportunity cost of the investment in capital equipment is the sacrifice of interest in a financial investment the firm might have other wise undertaken.

Internal rate of return (irr)

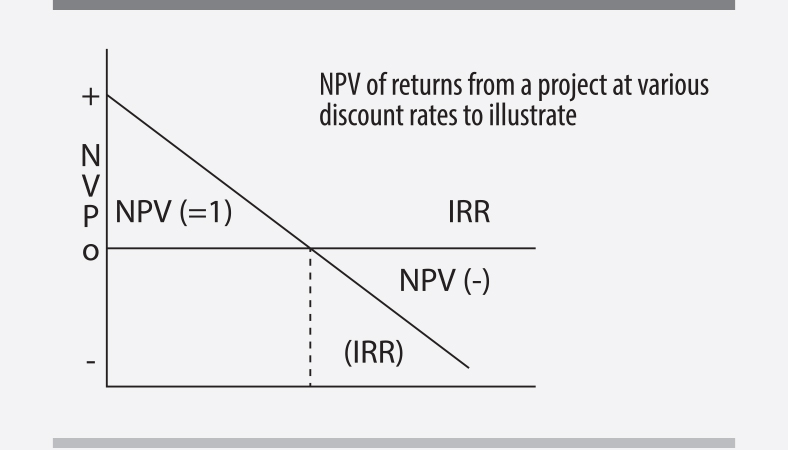

So far we have used a predetermined discount rate to assess whether the sum of present values minus the initial cost was positive or negative. An alternative method involves the determination, by trial and error of the discount rate which produces a net PV of zero. This is where the sum of the PV is exactly equal to the capital cost of the project. The discount rate which equates the two is known as IRR. If the IRR exceeds the market rate of interest (which has to be paid to secure the funds), then the project is worthwhile. If the IRR is less than the interest rate charged then the project should be rejected.

So far we have assumed that money will retain its value and that the discounting technique was necessary only because of the inconvenience of waiting for the return. As inflation has been a constant feature of the present economy globally, we should make adjustments for the declining value of money received in future. However , if we can accurately predict future inflation, it is possible to calculate Net Present Value (NPV) in real terms (i,e, at constant prices). The PV of a sum (s) received after n years using a discount rate (r) and assuming an inflation rate of ‘rf’ is given by the equation.

PV= S/(1 i + r +r x f)n

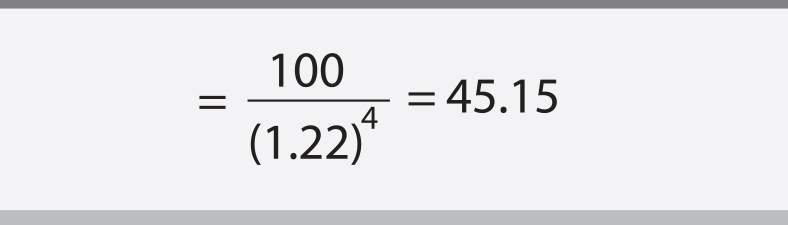

Hence, if the discount rate is 10% and inflation is 12% the revised discount rate is 22%. The PV of $100 in four years in real; terms is:

Obviously, the defect here is the difficulty of accurately predicting inflation even one year ahead. The other complication concerns the uncertainty about future. No matter how sophisticated the technique the whole appraisal process is based on assumption, expectations and guesses about uncertain future. There is uncertainty about:

All these uncertainties may lead businessmen to prefer projects with an early return. The appraisal may help to analyse a problem for decision making, but there is no sophisticated quantitative analysis available. Much will depend upon the hunch and the mood of business people or what Keynes called “animal spirits.”

The writer is former Director General, EPB and Adjunct Associate Professor at ULAB, Primeasia, South East and BGMEA University of Fashion & Technology.