China’s economic transformation over the past few decades is one of the most significant phenomena in modern economic history. The country has shifted from a predominantly agrarian society to an industrial powerhouse, becoming the world’s second-largest economy.

Sakura Institute of Research published a joint article by Shigeo Kobayashi, Jia Baobo, and Junya Sano and they mentioned that the reform and open-door policy of China began with the adoption of a new economic development strategy at the Third Plenary Session of the 11th Central Committee of the Chinese Communist Party (CCPCC) in late 1978.

Under the leadership of Deng Xiaoping, who had returned to the political arena after his three previous defeats, the Chinese government began to pursue an open-door policy, in which it adopted a stance to achieve economic growth through the active introduction of foreign capital and technology while maintaining its commitment to socialism.

The obvious aim of this policy shift was to rebuild its economy and society that were devastated by the Cultural Revolution.

The policy shift also appears to have been prompted by recognition that the incomes of ordinary Chinese were so low, in comparison with incomes in other Asian economies that the future of the Chinese state and the communist regime would be in jeopardy unless something was done to raise living standards of its people through economic growth.

Before the reforms, China’s economy was characterized by state ownership and central planning. The Great Leap Forward and the Cultural Revolution were two significant movements that aimed to rapidly transform China’s economy and society but ultimately led to economic disruption and social upheaval.

The post-reform period saw China adopting a dual-track approach to the economy, maintaining state control over key sectors while encouraging private enterprise and foreign investment. Special Economic Zones (SEZs) were established, which became hotbeds for economic activity and innovation, attracting foreign capital and technology.

Economic Growth

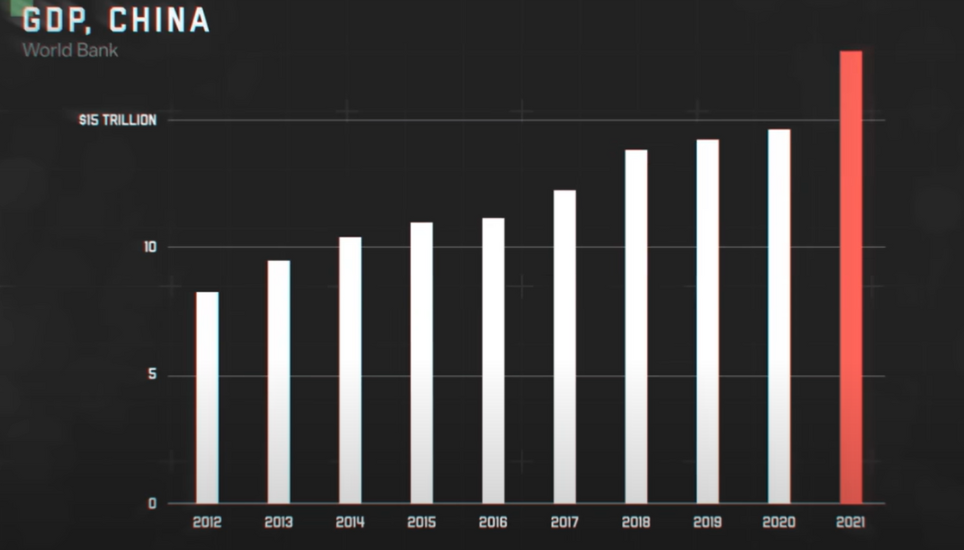

China's economic growth over the past few decades has been nothing short of remarkable and this economic reform journey has not only reshaped China but also had profound implications for the global economy.

Starting from the economic reform journey to the present day, China has experienced rapid and sustained economic expansion. Deng Xiaoping initiated economic reforms that shifted China from a centrally planned economy to a more market-oriented one.

This led to an average annual GDP growth rate of about 9.5 per cent from 1978 to 2013, significantly transforming the country's economy and lifting millions out of poverty.

As China entered the new millennium, it continued to maintain high growth rates. In 2001, China joined the World Trade Organization (WTO), which further integrated it into the global economy.

The early 2000s saw China becoming the “factory of the world”, with a focus on manufacturing and export-led growth.

Despite the 2008 global financial crisis, China's economy proved resilient, partly due to a massive government stimulus package. However, the crisis also prompted China to begin shifting its economic model away from reliance on exports and investment toward more domestic consumption.

Over a range of successes, China's economic journey has been characterized by a combination of strategic reforms, investment in infrastructure and education, and integration into the global economy.

While the pace of growth has moderated, China remains a key driver of global economic activity. As the country continues to evolve, it faces challenges such as environmental sustainability, demographic shifts, and the need for innovation-driven growth.

Global Impact of China’s Economic Development

China’s economic rise has had a significant impact on the global economy. It has become a major trading partner for many countries and a key player in international financial markets, which can be marked, as “its economic journey heralded a new era of economic interdependence and collective progress.”

China’s economic model and its success have provided an alternative pathway to development for many emerging economies. It’s Belt and Road Initiative (BRI) is a testament to its growing influence, aiming to enhance regional connectivity and economic integration.

The surge in China’s trade and investment flows has been a boon for global supply chains, altering investment patterns worldwide.

Its economic framework, characterized by state-led capitalism, has offered a divergent model of development, providing a viable alternative for other emerging economies seeking to navigate the complex waters of economic growth and modernization.

Emergency Lender for Developing Nations

China's role has evolved dramatically over the past two decades, positioning itself as a pivotal emergency lender to some of the world's most indebted nations.

The International Monetary Fund (IMF) has noted that the poorest countries globally have become significantly indebted to China, a trend that emphasizes the Asian giant's growing financial influence.

The People's Bank of China (PBOC), China's central bank, has been at the forefront of this lending spree, disbursing approximately $240 billion to 22 countries, including our country Bangladesh, Argentina, Pakistan, and Nigeria.

This financial outreach is reminiscent of the economic dominance once wielded by the United States, marking a shift in the geopolitical landscape of economic aid.

The period between 2016 and 2021 was particularly notable, with China channelling the majority of its financial aid—around $185 billion—during a time when the world grappled with the economic fallout of the covid-19 pandemic.

In a strategic move to bolster nations facing currency or credit crises, China established foreign-currency swap agreements with over 40 nations and trade groups, amounting to nearly $580 billion. These agreements are not solely for the promotion of the Chinese currency, the renminbi, but also serve as a lifeline for countries in financial distress.

The impact of China's lending is especially pronounced in Africa, where 14 out of 15 countries took emergency loans from China. Some of the countries are Sudan, Niger, Mozambique, Chad, and the Democratic Republic of Congo.

Bolivia, one of South America's poorest countries, is the only non-African nation among these heavily indebted countries. The US-China Economic and Security Review Commission noted that 60 per cent of China's debtor nations were in financial distress in 2022, a significant increase from 5 per cent in 2010.

China also appeared as a saviour for Iran when the country faced international isolation due to sanctions imposed by Washington, Iran, and China entered into a 25 year strategic and economic partnership agreement worth $400 billion. The deal encompasses cooperation in various sectors and is part of China’s Belt and Road Initiative.

As China continues to evolve, it faces the challenge of transitioning to a more sustainable growth model that is less reliant on exports and investment and more on consumption and services.

According to the US Wealth Management published an article Analysis, China’s Economy and its Influence on Global Markets on January 18, 2024, mentioning that China’s economy grew by 5.2 per cent in 2023, an improvement from the previous year, but still modest by the nation’s historical standards.

Problems in China’s property sector, slower export activity, and limited domestic consumer demand are all factors contributing to slower growth. Based on the latest indicators, it appears China’s GDP growth rate may be on a slower trajectory than was the case for much of the past two decades.

Indeed, it gives a belief that the Chinese government is now focusing on innovation, environmental sustainability, and social welfare to use as crucial tools in shaping China’s economic trajectory in the coming years.

The author, Sheikh Mohammad Fauzul Mubin, is the Chief Coordinator at Campaign Advocacy Program (CAP).