Along with enhancing macroeconomic stability, the government should raise tax to control inflation because direct tax is better than inflation.

“We are now paying hidden tax in terms of inflation through deficit financing which is a wrong way,” said Executive Director of Policy Research Institute Ahsan H Mansur at a press briefing organised by PRI at its office in Dhaka on Wednesday.

The government borrowed money from domestic sources and global lenders and there is interest rate. The country is now spending around 12 per cent of the budget on paying the interest rate which is hindering growth-enhancing infrastructure and social protecting programmes.

In addition, as the financial sector has faced liquidity crunch, the government printed money to budget financing which is fuelling inflation. Taking that into consideration, raising income tax is better than inflation as it hurts the poor ones more, but income tax gives room for them, experts claim.

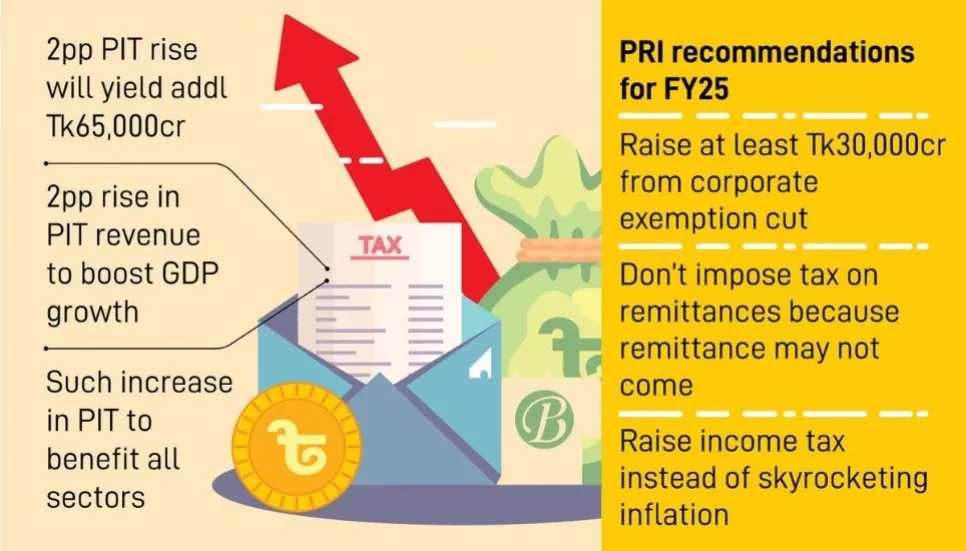

About the IMF’s recommendation to impose tax on remittances, Mansur said, “I am not favouring tax on remittances in our country. Don’t impose tax on remittances. If the government imposes tax on remittances, it may not come to the country.”

The renowned economist, however, said that tax rebate on income from capital gains, capital market investment and securities should be lifted. “It is equitable and rational to reduce income equality as rich men get benefited from land, capital gains and others and it does not create more tax burden. But the government can give tax relief to those who are in the lower ladder.”

“There is no scope to raise the tax rate. Rather, the government should reduce leakage and increase efficiency. Now there are a lot of loopholes in the laws and systems that should be plugged,” he added.

“We expect the government will carry out major reforms of the tax administration and tax reform packages which will commence in next FY and conclude within three to four FYs. It also will raise at least Tk 30,000 crore in FY25 from the corporate sector through rationalising which is found in the tax expenditure analysis,” he said.

PRI Director Mohammad A Razzaque said, “The country’s 30 per cent national income is occupied by only 10 per cent households. If the government imposes 15 per cent income tax, the country’s revenue will be raised by 2.5 per cent.”

He said that import is a tool of controlling inflation. But due to forex crunch, the government reduced imports. If it continues, there will be stagnation and further inflation as capital machinery and intermediate goods imports have already been reduced.

2pp PIT rise will yield addl Tk65,000cr

In his keynote speech, PRI Director Bazlul Haque Khondker said that the government should focus on personal income tax (PIT) – which is most desirable in comparison to VAT and customs duties – to boost revenue, because increasing the tax-to-GDP ratio by 2 percentage points from PIT will yield additional revenue of Tk 65,000 crore.

Besides, such raising income tax positively drives overall economic activity up all sectors, but the services sector will get highest benefits.

He said, “Increasing revenue from personal income tax would have a measurable positive impact on growth and reduce inequality because it would create room for the government to spend more on growth-enhancing infrastructure projects and public services like social protection and agriculture.”

A 2 percentage point increase in overall tax revenue would lead to a 0.2 percentage point rise in real GDP growth, assuming additional revenues were invested in public services.

Here, an increase in overall tax revenues, to fund increased spending, would also contribute to reduced poverty and inequality. The poorest 40 per cent of households would experience highest gains.

If the increase in tax revenue is focused on personal income tax, this would have greatest benefit on the overall economy with a 2 percentage point increase resulting in a 0.5 percentage point increase in real GDP growth above current levels.

This level of increase in personal income tax would also benefit all sectors, including industry, agriculture, and services. Increases in corporate income tax would have a weaker impact on growth but would improve household income and consumption, particularly among poorer households.

Due to the inflationary effects, increases in VAT revenues would have a negative impact on economic growth, as well as household income and consumption. VAT reform is still required, but tax increases should focus more on personal income taxes, he recommends.

PRI Chairman Zaidi Sattar said, “Protected tariff in the import stage is hindering export diversification. If manufacturers benefit in local market, they will not explore the global market. Due to higher protection, our exports have not been diversified yet.”

He also suggested setting the target through reforms of the National Board of Revenue (NBR). Otherwise, NBR will only pressurise those who are paying taxes. “Without major reforms, we cannot recommend raising tax by 2 per cent because then it will affect badly.”