DSEX, the key index of the Dhaka Stock Exchange (DSE), yet again extended its free fall on Wednesday as panic-driven sell pressure continued to dominate the market amid subdued market sentiment and rising tensions over the market outlook.

The benchmark index is extending its free fall as the market failed to recover from the enduring pessimism pervading the trading floor owing to the dampened confidence of investors amidst an uncertain market outlook, market insiders said.

DSEX lost 71.71 points, or 1.23 per cent, and closed at 5,762.68 at the end of trading. This is the first time the index dropped below the 5,800 mark after three years.

The blue-chip index, DS30, and the Shariah-based index, DSES, closed at 2,012.07 and 1,252.35 points, respectively.

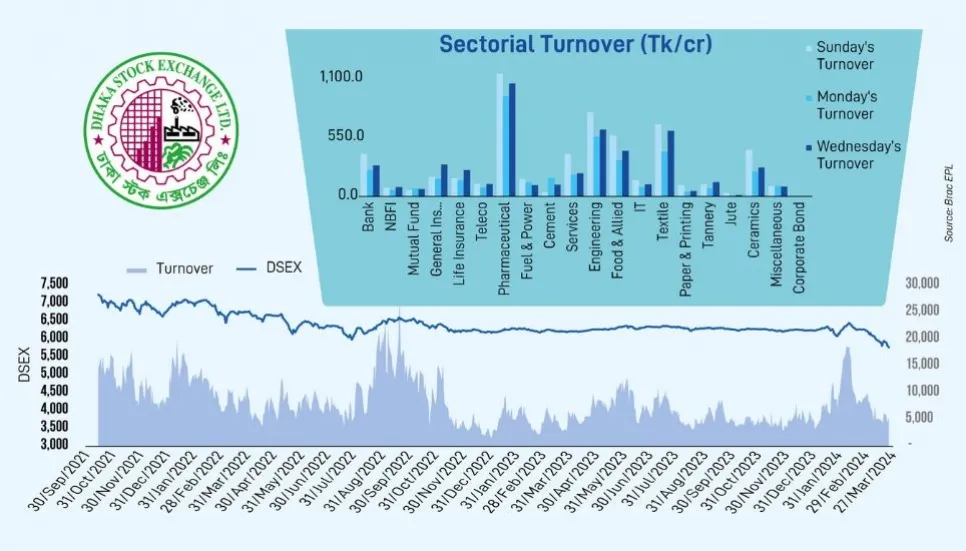

Meanwhile, market turnover increased by 20.9 per cent to Tk 538 crore, from the previous session’s Tk 450 crore, as jittery investors continued their selloffs to prevent further fund erosion from the ailing market.

The market witnessed a free fall, failing to recover from the enduring pessimism pervading the trading floor, as a result of lasting concerns stemming from sudden policy changes, which have significantly impacted investor sentiment, market insiders said.

In the last three sessions, the DSEX dropped by 179 points. On Monday alone, DSEX lost 66 points and closed at 5,834 points.

The market witnessed a downward trend throughout the session as investors shied away from taking positions in equities and opted to stay on the sidelines to observe the market momentum amidst the prolonged subdued market sentiment, EBL Securities said in its daily market review.

Top officials of stock brokerages said that the situation has been exacerbated by the shortened trading hours during Ramadan and the anticipation of fund withdrawals ahead of Eid. Market volatility persists as market confidence is yet to be restored owing to concerns regarding the market outlook.

Moreover, a portion of investors opted to remain on the sidelines, waiting for a clear indication of the market momentum ahead, they said.

BRAC EPL Stock Brokerage in its daily market review said that all the large-cap sectors posted negative performance on Wednesday. Food and Allied experienced the highest loss of 2.21 per cent while the block trades contributed 8.8 per cent of the overall market turnover.

Central Pharmaceuticals Limited had the most traded share with a turnover of Tk 32 crore.

Of the 396 issues traded, 36 advanced, 320 declined and 40 remained unchanged at the Dhaka bourse.

Stakeholders said that jittery investors continued to dump their holdings to avoid further erosion of their portfolio as the prolonged bearish trend frustrated them enough to put in fresh funds.

The market was already bearish after the withdrawal of floor price from the largest and second-largest market-cap stocks, while the rising interest rate coupled with Ramadan kept investors reluctant to put fresh funds into stocks.

Meanwhile, the Chittagong Stock Exchange (CSE) also settled on red terrain on Wednesday.

The Selective Categories Index, CSCX, and the All Share Price Index, CASPI, declined by 72.2 and 124.3 points, to settle at 9,956.21 and 16,579.84, respectively.

Of the issues traded, 167 declined, 40 advanced and 19 issues remained unchanged on the CSE.

The port city bourse traded 24.19 lakh shares and mutual fund units with a turnover value worth about Tk 10 crore.