The country’s banking sector – already in a heap of trouble – will take a serious blow if the top three borrowers of each bank defaults on their loan repayments, while nineteen banks will fail to maintain the minimum required Capital to Risk Weighted Assets Ratio (CRAR).

Already, ten out of 61 banks are unable to keep the minimum CRAR – also known as Capital Adequacy Ratio (CAR), according to a stress test result prepared by the Bangladesh Bank in its quarterly report on the “Financial Stability Assessment Report, July-September 2023.”

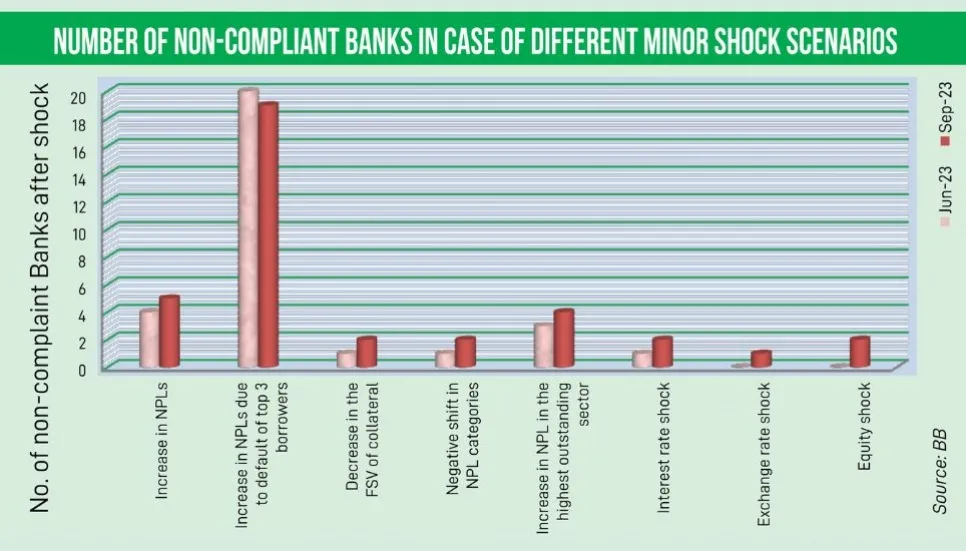

The report – published on Monday – pointed out that, if the volume of overall non-performing loans (NPLs) increases by only 3 per cent, five banks would fail to maintain the minimum required CRAR.

Besides, if the Forced Sale Value (FSV) of Mortgaged Collateral falls by as low as ten per cent, two banks would fail to maintain the minimum required CRAR.

In case of a combined shock [excluding default of top large borrowers and increase in NPLs of the highest outstanding sector], thirteen banks would fail to maintain the minimum required CRAR.

Commenting on the matter, Ex-president of Association of Bankers, Bangladesh (ABB) Anis A Khan said, “The Bangladesh Bank conducts the stress test because when a bank lends too much to a single or two or three companies, to figure out the impact it could have on the sector.

“Banks usually engage in such practices for the sake of completion. This accumulates debt and increases risk. If a strong bank merges with a weak one, this risk will be reduced a lot but merger must be voluntary.”

Another ex-president of ABB Nurul Amin said, “When a loan becomes bad or loss, it needs 100 per cent provision after classification. Any bank unable to keep provision must cover the amount from profits, which in turn hits the capital.

“We do not need the top three borrowers from every bank to default for a disaster, rather if the country’s top three borrowers default, ten banks will face a capital shortfall.”

Overall CRAR position

During the July-September quarter of 2023, the banking sector's CRAR decreased slightly year-on-year. The CRAR stood at 11.19 per cent at the end of June 2023, which declined to 11.08 per cent at the end of the review quarter.

However, the maintained CRAR was above the minimum regulatory requirement of 10 per cent.

At the end of September 2023, 25 banks, holding the CRAR ranging from 10 per cent to less than 15 per cent, occupied 60.25 per cent – the lion’s share – of the banking sector’s total assets, and 60.11 per cent of the total liabilities.

Besides, ten banks with less than 10 per cent CRAR held 20.42 per cent of total assets, and 21.76 per cent of the total liabilities of the banking sector.

NPL concentration

At the end of September last year, non-performing loans in the banking sector was Tk 1.55 lakh crore, but the figure decreased to Tk 1.45 lakh crore in December 2023.

The Bangladesh Bank report highlighted that, at the end of September 2023, the top five and top ten banks' NPL concentrations were 45.12 per cent and 63.28 per cent respectively.

Despite the decline in NPLs, the concentration of NPLs among the top 5 and the top 10 banks is still a concern for the overall banking industry, read the central financial stability report.

Furthermore, at the end of September 2023, the number of banks having an NPL ratio greater than 20 per cent remained at nine.

Ex-president of ABB Nurul Amin said, “Like the volume of NPLs, the amount of stress loans is also too high. The amount of NPLs in state-owned banks is more than 20 per cent. On the other hand, aside from two-three good banks, NPLs in private banks is over five per cent.

“So, around ten per cent of the overall loans are classified.”

The distribution of banks, based on their gross NPL ratios, showed that the number of banks having an NPL ratio within 5 per cent fell in the review quarter compared to the previous quarter.

At the end of September 2023, twenty-five banks maintained a non-performing loan (NPL) ratio below 5 per cent, showing a slight decrease from the 28 banks within the same NPL range recorded in the previous quarter.

The proportion of bad and loss category loans was 87.72 per cent of the total classified loans at the end of September 2023, which does not bode well for the banking sector, bankers say.

Provision and profitability

According to the central bank report, the required provision in the banking industry rose by Tk 5,344 crore or 5.29 per cent, and stood at Tk 1,06,375 crore at the end of September last year.

On the other hand, maintained provision increased by 1.93 per cent and reached Tk 81,104 crore. As a result, the provision maintenance ratio demonstrated a 2.51 percentage point drop to reach 76.24 per cent in the review quarter, from 78.75 per cent in the preceding quarter.

Due to the increase in the provision, the country’s banking sector profitability has taken a hit in that quarter.

This sector's key profitability indicators – Return on Asset (ROA) and Return on Equity (ROE) – experienced a slight decrease of 0.02 percentage point and 0.42 percentage point respectively in July-September of 2023,compared to corresponding ratios of the preceding quarter.