Inflation is not coming down due to repeated rescheduling of classified loans and the central bank’s ongoing support on repurchase agreement (Repo) for scheduled banks, said former central bank governor Dr Mohammed Farashuddin.

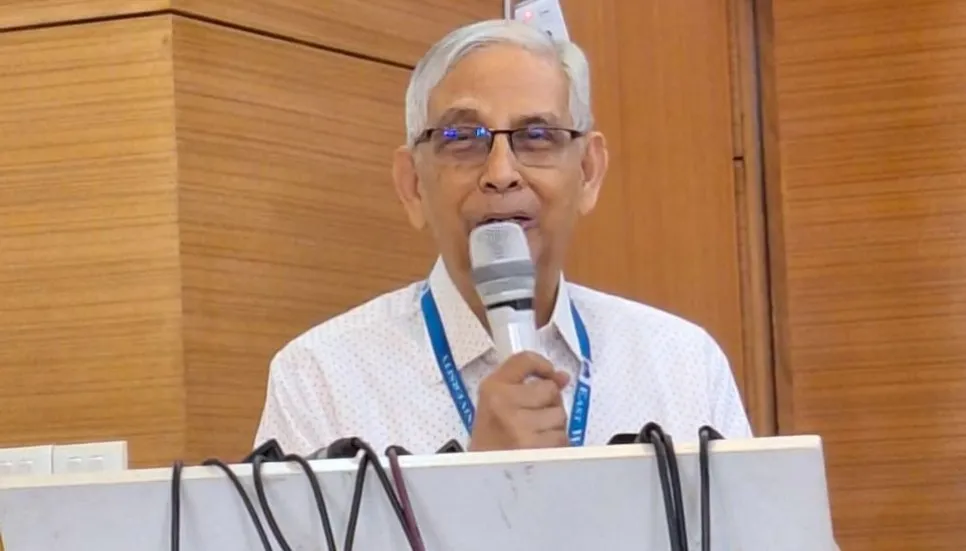

He made the remarks at a programme titled “Conversation with Dr Mohammed Farashuddin” at the Economic Reporters' Forum (ERF).

Farashuddin pointed out, “Banks could not get back the money from influential quarters. As a result, the banking sector is suffering a liquidity crisis. So, every day, the central bank is supporting them through Repo and assured liquidity support facility (ALSF), and it has already printed money as well.

“That is why the country has been witnessing high inflation, more than 9 per cent, for the last ten months. If banks do not recover the money, then it would be difficult to stop printing money as well.”

He then added, “The big defaulters get the big privileges. Interest is waived on such defaulters. I do not know why the government and International Monetary Fund (IMF) are silent about money laundering. Every year around $700 crore is being laundered from the country.

“The banking sector faced the default culture when commercial banks started long term loans from short term deposits. India depreciated their currency by nearly 77 per cent, Bangladesh depreciated by 27 per cent. As a result, some people benefited.”

Farashuddin said, “Multiple exchange rates are not good for the economy, so a unified exchange rate should be implemented to stabilise the USD market. The remittance rate should not be more than Tk 3 compared to the unified exchange rate.

“This will help boost remittance in the banking sector. Bank merger acquisition is a global practice and it is good when both banks agree willingly. Forced merger procedures would not be good for the banking sector.”

If the central bank and finance ministry remain strong, then there is no need for a banking commission, he pointed out.

He said the private sector is growing but unfortunately the empowerment has not grown as expected. Need Tk 1 crore insurance against the deposit of depositors in the banking sector.

Farashuddin added, “I think all obstacles should be removed towards the arrival of 3-6 months of deposits. Right now the banking sector needs more deposits. Most of the deposits are collected from the rural areas of the country, while 80 per cent of the lending is taking place in big cities such as Dhaka and Chattogram.

“Many countries have managed to bring down inflation, but we are still close to 10 per cent. We need to emphasize on monitoring. Food products which are 2/3 dependent on importers, they need to be exploited and not just supplied. The number of importers needs to increase.”

ERF president Refayet Ullah Mridha chaired this programme, while ERF secretary Abul Kashem moderated the event.