The profits of most of the listed general insurance companies have fallen due to slow business last year. This was indicated by several general insurance companies who recently published their financial reports for the year 2023.

There are currently 58 insurance companies listed in the capital market. Out of those, 43 are general insurance companies, and 15 are life insurance companies.

As of last Thursday, 31 general insurance companies had released their 2023 financial reports, whereas the profits of 16 companies have decreased compared to the same period of previous year. Profits of the remaining 15 companies have increased.

Industry insiders say that the general insurance companies are general fire and allied insurance, marine cargo insurance, and income from motor vehicle insurance.

As motor vehicle insurance is stopped by Insurance Development and Regulatory Authority (IDRA), companies have no income from this sector. Also, marine cargo insurance depends on the price of the dollar.

In mid-2023, companies did not get good business from this sector due to the dollar crisis. As a result, the business of general insurance companies will be negatively affected in 2023.

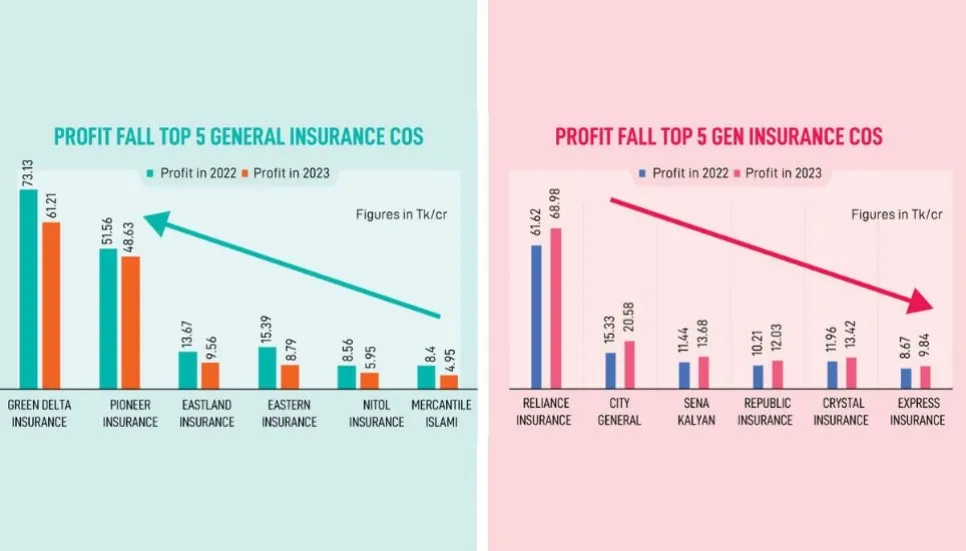

Green Delta Insurance posted the highest decline in 2023 compared to the same period last year among companies that published financial reports.

The company made a net profit of Tk 61.21 crore in 2023, compared to a profit of Tk 73.13 crore in the same period of the previous year.

The company earned Tk 6.11 per share in the last financial year, compared to Tk 7.3 in the same period of the previous year.

Pioneer Insurance Company is in the second phase of declining profits. The company's net profit at the end of 2023 fell by 5.68 per cent compared to the same period of the previous year.

The company made a net profit of Tk 48.63 crore in 2023, a net profit of Tk 51.56 crore in 2022.

Eastland Insurance Company’s net profit fell nearly 30 per cent compared to the same period last year. Company Secretary MA Rahman said the profits were down mainly due to the lack of expected premium income in 2023. But we are trying to maintain the same profit next year.

Eastland Insurance posted a net profit of Tk 9.56 crore in 2023, compared to a profit of Tk 13.67 crore in the same period last year.

Besides, the profit of Eastern Insurance Company has also decreased by about 42 per cent in 2023 as compared to 2022. The company posted a net profit of Tk 8.79 crore in 2023, compared to a profit of Tk 15.39 crore in the same period of the previous year.

Eastern Insurance Secretary Kazi Farhana said profits declined significantly due to business slowdown in 2023, compared to 2022.

Meanwhile, Reliance Insurance has made the highest profit in 2023 compared to the previous year in the data published till Thursday. The firm made a net profit of Tk 68.98 crore during the period, compared to a profit of Tk 61.62 crore in the same period of previous year.

Besides, the profit of City General Insurance increased by 34.22 per cent compared to the previous year. The company posted a net profit of Tk 20.58 crore in 2023, compared to a profit of Tk 15.33 crore in the same period of the previous year.

City General Insurance Company Secretary Mohammed Ashaduzzaman Sarkar said, “This time our profit increased because the company's underwriting profit and other income have increased significantly.”

Sena Kalyan Insurance Company’s profits in 2023 stood at Tk 13.68 crore, which is 19.58 per cent higher than the same period last year.

Besides, Republic Insurance Company, Crystal Insurance Company, and Express Insurance have been placed in the list of companies with the highest profit growth.