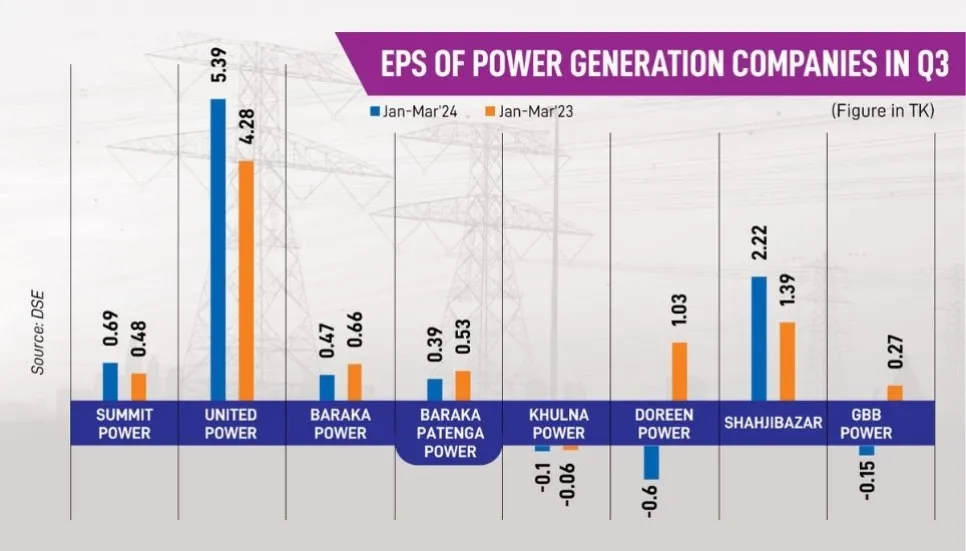

Five listed power generation companies have reported negative growth in their earnings per share (EPS) in the third quarter (January-March) of FY2023–24, compared to the same period of the previous fiscal year.

However, earnings of two leading private power generation companies — Summit Power Ltd (SPL)and United Power Generation & Distribution Company —rose in Q3, according to reports filed by the companies with the Dhaka Stock Exchange (DSE).

SPL, the private power generator giant, reported its consolidated EPS was Tk 0.69 for the January-March period. It was Tk 0.48 in Q3 of FY2022-23.

The company recorded a profit of Tk 441.64 crore in the July-March period of FY24, up by a substantial 49 per cent year-on-year,even though it witnessed a decline in revenue. SPLhad booked a profit of Tk 296 crore in the same period of FY23, according to its unaudited financial statement.

SPL's EPS grew to Tk 2.40 in the first ninemonthsof FY24, compared to Tk 2.05 in the same period of FY23.

Its revenue declined by 47 percent to Tk 819.74 crore in Q3 ofFY24. It was at Tk 1,556.75 crore in the same period in FY23.

Meanwhile, United Power Generation & Distribution Company's profit rose to Tk 312.45 crore in Q3 of FY24, from Tk 248.1 crore in Q3 of FY23, supported by the stability in the foreign exchange market and a higher finance income.

During the period, its consolidated EPS climbed to Tk 5.39 from Tk 4.28, according to its unaudited financial statements published last Thursday.

The country's first commercially independent power generator's revenue, however, dropped 14 per cent year-on-year to Tk 742 crore due to lower electricity demand, placed by the government, particularly from its oil-fired power plants.

Top officialsof the company said that their net profit increased in Q3 due mainly to higher finance income, stability in foreign exchange rates and reduction in administrative costs.

The company’s consolidated EPS dropped to Tk 13.22 for the July-March period of FY24 from Tk 14.13 in the same period of FY23. Its consolidated net operating cash flow per share was Tk 7.65 for the first nine months of FY24, a significant decrease from Tk 13.07 from the same period of the last fiscal year.

On the other hand, private company Doreen Power Generations and Systems Limited’s (DPGSL) consolidated EPS was negative Tk0.60 for Q3 of FY24,down from Tk 1.03 in Q3of FY23.

The company said that its EPS has decreased significantly due to a significant decrease in sales revenue of all plants as 15 years tenure of the PPAs of DPGSL has expired and demand for electricity from DNPGL, DSPGL and CPGL was lower than last year.

But operating expenses, general and admin expenses and finance expenses were not decreased to the extent compared to revenue decrease, it added.

Khulna Power Company’s per-share loss was at Tk 0.10 for Q3 of 2024. It was Tk0.06 for the same period of FY23.

In Q3 of FY24, Baraka Patenga Power’s consolidated EPS fell to Tk 0.39. It was Tk 0.53 during the same period of FY23.

Another power company of the same group, Baraka Power’s consolidated EPS declined to Tk 0.47 in Q3 of FY24. It was Tk 0.66 in the same period of FY23.

Meanwhile, GBB Power reported a per-share loss of Tk0.15 for Q3 of FY24. It was Tk0.27 for the same period of FY23.

However, Shahjibazar Power Company Limited posted an impressive profit in Q3of FY24 owing to reduced operating costs.

During the period, its EPS was Tk2.22. It was Tk1.39 in the same period of FY23.