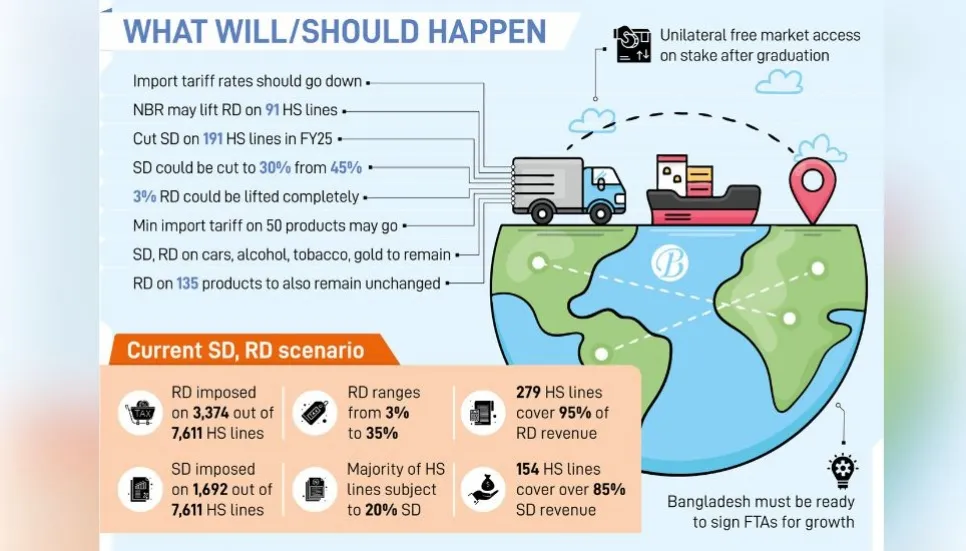

To lower trade barriers and ease the process of doing business with other nations following LDC graduation, Bangladesh is going to cut supplementary duty (SD) on 191 HS lines, lift regulatory duty on 91 HS lines, and phase out minimum import tariff value on around 50 products.

In line with Bangladesh’s tariff commitment to the World Trade Organization (WTO) and the review of Customs Act, 1969 first schedule, the National Board of Revenue (NBR) is likely to propose these moves in the upcoming budget for FY2024-25.

However, as the country’s forex reserves is in a vulnerable situation, and manufacturing industries are yet to shine enough to capture a bigger slice of the local and global markets, the revenue board excludes such products from the lists which may fuel more forex pressure and hamper local industries, say finance ministry officials involved in the budget formulation.

The proposal will be placed for Prime Minister Sheikh Hasina’s approval on May 14, but it will be placed before the finance minister on May 12.

These 191 HS lines now have 45 per cent Supplementary Duty (SD), which will likely be reduced to 30 per cent, while the 91 HS lines contain 3 per cent Regulatory Duty (RD), which may be lifted fully.

Besides, minimum import tariff value on around 50 products for up to four digits of HS line will be withdrawn. It should be noted that every HS line has one or more similar products, and four digits of an HS line contains more than one product.

Socially undesirable products or HS lines containing goods such as tobacco, alcoholic beverages, arms, and ammunition will not get any duty cut or lift benefits. Luxury products such as cars and diamonds will also be excluded from the benefits.

Imports of products that will not increase pressure on the forex reserves will be in the list.

In such cases, the NBR move in 2022 to impose 20 per cent RD on around 135 items, including cosmetics, flowers, fruits and furniture, will remain unchanged. The move was to discourage imports.

Products that are not produced locally and those which are not in demand in the domestic market due to cultural or other reasons, will be in the list so that it does not create a trade gap, forex pressure, while helping to reduce tariff barriers, officials say.

Current state of tariff regime

Tariff regime of Bangladesh is complicated by the imposition of a number of duties and taxes, in addition to customs duty. These duties and taxes are supplementary duty (SD), Regulatory duty (RD), Value added tax (VAT), Advance Tax (AT) and advance income tax (AIT).

Even in some cases these duties may overtax the domestic industry when these are imposed on intermediate goods, which are essential for production, according to a study group on tariff rationalization led by NBR’s customs policy member Md Masud Sadiq.

Imposition of these duties also raises concerns about the compatibility of these duties with Bangladesh’s commitment to the WTO’s Report of Study Group on Tariff Rationalisation as mentioned earlier.

Currently, regulatory duties are imposed on 3,374 HS lines out of 7,611 HS lines of National Tariff Lines, which account for 47 per cent of Total HS lines while RD ranges from 3 per cent to 35 per cent.

ASYCUDA world data shows that only 279 HS lines cover 95 per cent of revenue collected from RD and many intermediate products are subject to RD.

Currently, Supplementary duties are imposed on 1,692 HS lines out of 7,611 HS lines of National Tariff Lines, which account for 26 per cent of Total HS lines.

The majority of HS lines are subject to 20 per cent SD It was found that 154 HS lines cover more than 85 per cent of revenue collected from SD.

60 HS lines where CD, SD exceed bound tariff

Bangladesh’s tariff commitment to the WTO covers only 955 HS lines in the HS2012 version. Of them, 763 HS lines fall under WTO agricultural products and the remaining 192 HS lines are non-agricultural products.

Rates of tariff binding range from 0 per cent to 200 per cent. Review of Bangladesh’s tariff commitment to the WTO and first schedule showed that there were six HS lines where customs duty exceeded the bound rate.

This issue was addressed in the budget for FY23, the report reads.

However, there are 60 HS lines where CD and SD together exceed the bound tariff.

The group proposes that RD may be imposed at 2.5 per cent and increase CD up to level of the bound rate bringing down SD to minimum or making SD trade neutral by slapping SD on locally produced goods.

Earlier at an event, PRI Chairman Zaidi Sattar said, “Such high protection undermines export performance now. More critical is the adverse impact of tariffs on export performance. High exporting countries have low import tariffs.

“Research findings of PRI show that apart from RMG products which are highly competitive, nearly 500 non-RMG products are also highly or moderately competitive in markets where 30-40 other suppliers compete.”

Mostafa Abid Khan, a former member of the Bangladesh Trade & Tariff Commission (BTTC) told The Business Post, “Industries would not be competitive if they become habituated to the protective tariff.

“Many industries do not export goods as they get many benefits from the local market. It means that we invest more in purchasing their products.”

He added, “We, as the country, should have to go through this painful process. Otherwise, we will suffer following the country’s graduation from LDC status.”