Navana Pharmaceuticals PLC, a publicly traded company, has approved to change the use of proceeds from the initial public offering (IPO) fund regarding modernisation and expansion of the small volume parenteral and ophthalmic (SVPO) facilities and replace it with the construction of a new generic production unit.

The decision was approved in the Seventh Extraordinary General Meeting (EGM) held on Tuesday.

The company has further informed that its shareholders, at the EGM, approved changing the use of the proceeds of the IPO fund regarding the modernisation and expansion of the SVPOfacility to Tk 13.12 crore, or 17.49 per cent of the total IPO proceeds of Tk 75 crore.

The company also said it would replace the construction of a new generic production unit and approved extending the time of full utilisation of IPO proceeds within 36 months after receiving them to accommodate the proposed changes in the use of IPO proceeds.

The drug company plans to invest Tk 145.27 crore to construct a five-story new generic production unit.

NavanaPahrma will finance Tk 132 crore from its funds and external sources, and the rest, Tk 13.12 crore will be used from the proceeds of its IPO funds.

The new generic production unit, with an approximate footprint area of 20,000 square feet, will fully comply with the World Health Organization's good manufacturing practices (GMP).

The drug maker is involved in the manufacturing, marketing and distribution of generic pharmaceutical finished products under two divisions— the human health division and the veterinary division.

In September 2022, NavanaPharma raised Tk 75 crore under the book-building method to build a general manufacturing building and utility and engineering buildings and for renovation of its cephalosporin unit and partial loan repayment.

The company said that they have already spent 71.31 per cent of total IPO proceeds.

Now, the company has decided to extend the timeframe of full utilisation of IPO proceeds to accommodate the proposed changes until September 2025.

In July last year, the drugmaker also revised IPO fund utilisation proceeds for increasing the production capacity of the existing facilities, instead of constructing new manufacturing units to immediately meet the growing demand.

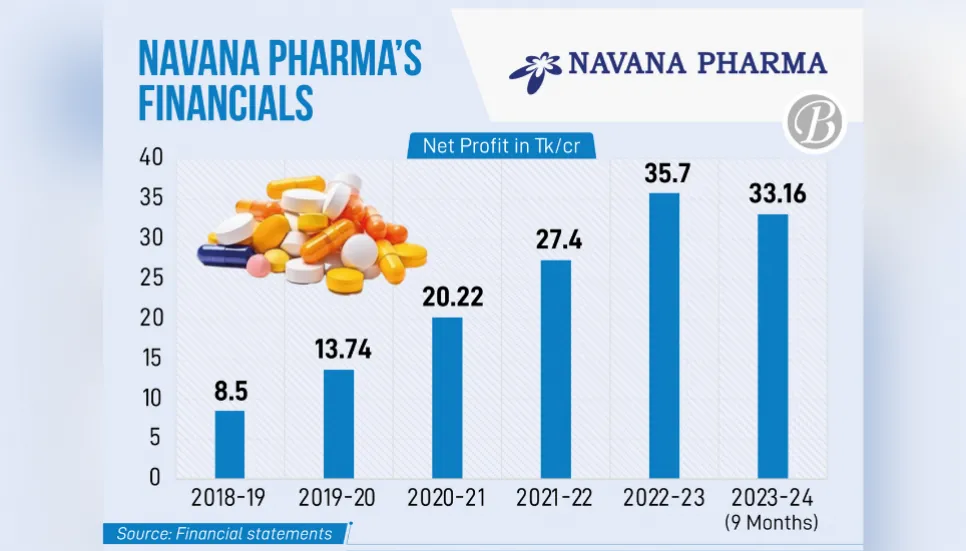

NavanaPharma posted an impressive 56 per cent year-on-year growth in profit for the July-December period of 2023, riding on higher sales revenue.

The drugmaker reported Tk 22 crore profits in these six months. It was nearly Tk 14 crore in the same period of the previous year.

As of April 30,2024, sponsors and directors jointly held 35.49 per cent of the company’s total shares, while institutions owned 10.37 per cent, foreign 27.73 per cent, and the general public 26.41.

The last trading price of each share of NavanaPharma,which was incorporated in 1986 and listed on October 18, 2022, on the Dhaka bourse was Tk 97.30 on Tuesday.