Home ›› Economy ›› Budget FY25

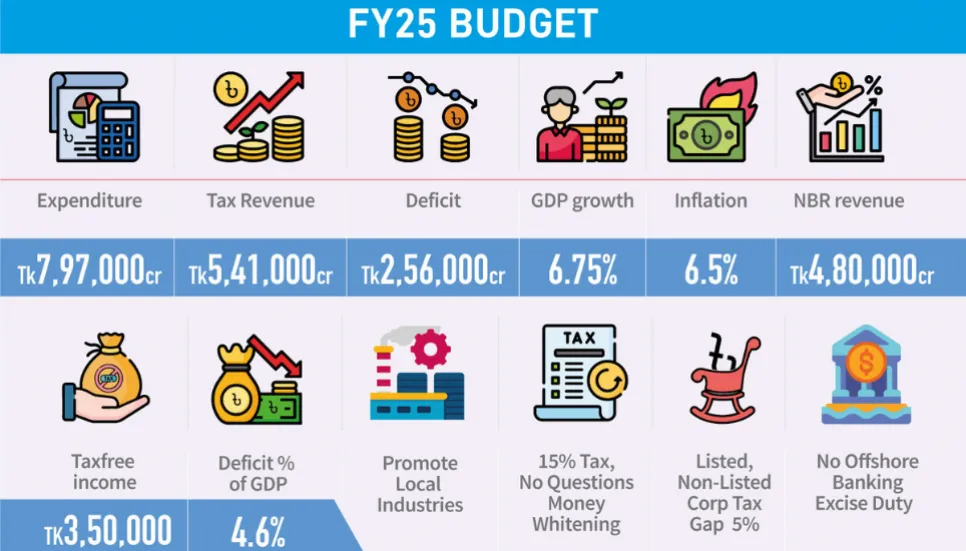

Without major changes, parliament on Sunday passed a Tk 7,97,000 crore national budget for the fiscal year 2024-2025, aiming for a 6.75 per cent GDP growth.

The FY25 budget, which is Tk 35,215 crore higher than the FY24 budget, will be effective from July 1 after approval by President Mohammed Shahabuddin. The allocation for development programmes is Tk 2,81,453 crore, while Tk 2,65,000 crore is earmarked for the Annual Development Programme (ADP).

To meet the expenditure, Finance Minister Abul Hassan Mahmood Ali will borrow Tk 2,56,000 crore from local and international lenders, with the bank borrowing target set at Tk 1,37,500 crore despite a liquidity crisis.

Despite criticism from its members, the parliament passed a controversial provision in the finance bill on Saturday, allowing the whitening of undisclosed wealth on a “no questions asked” basis by paying a 15 per cent tax.

Before passing the budget, parliament members discussed it for 11 days after the proposal was placed by Mahmood Ali on June 6.

During Sunday’s session, Speaker Shirin Sharmin Chaudhury presented the proposed budget for a voice vote, focusing on maintaining economic stability and furthering the government's "Smart Bangladesh" vision.

With this budget, the government aims to achieve 6.75 per cent GDP growth and a 6.5 per cent inflation rate. However, the Bangladesh Bureau of Statistics (BBS) estimated FY24 growth at 5.82 per cent, with the May inflation rate at 9.89 per cent due to ongoing economic challenges.

Experts doubt govt’s ability

Experts doubt the government's ability to implement the budget, citing global and domestic economic headwinds, stagnation of private investments, limited fiscal capacity, and pressure to repay foreign debt.

In a post-budget reaction on June 7, the Centre for Policy Dialogue (CPD) stated that the FY25 budget fails to provide concrete measures to address ongoing economic concerns.

The CPD highlighted inadequate measures for curbing inflation and providing relief to the poor and fixed-income people.

CPD Executive Director Fahmida Khatun remarked, “On the whole, the FY25 budget is an ordinary budget during an extraordinary time.”

Allocations & expenditures

Of the nearly Tk 8 lakh crore budget for FY25, Mahmood will spend Tk 5,06,971 crore on operational purposes and Tk 1,13,500 crore on debt interest payments. Additionally, interest on foreign debt is projected to be Tk 20,500 crore, up from Tk 12,376 crore in FY24.

The budget also allocates Tk 2,81,453 crore for development programmes. Of this, Tk 2,65,000 crore will go to the ADP, with Tk 7,627 crore allocated for special projects outside the ADP.

Before this, 59 allocation proposals for various ministries and departments were rejected by voice vote. In contrast, seven members of parliament, including opposition and independent members, placed 251 cut proposals. Discussions were held on proposals to cut allocations for the Ministry of Law, Education, and Social Welfare.

Earnings goal

Mahmood plans to earn Tk 5,45,400 crore in revenue in FY25. The National Board of Revenue (NBR) will be responsible for generating almost the full amount, with Tk 4,95,000 crore from NBR sources, Tk 15,000 crore from non-NBR sources, Tk 46,000 crore from non-tax sources, and foreign grants fixed at Tk 4,400 crore.

The total budget deficit is Tk 2,56,000 crore, with a foreign borrowing target of Tk 90,700 crore and a domestic borrowing target of Tk 1,60,900 crore.

Economic crises and IMF assistance

Persistent high inflation has severely affected lower and lower-middle-income consumers, with rates hovering around 9.5 to 10 per cent. Bangladesh’s forex reserves are at $18.72 billion (BPM6 method), with net reserves below $14 billion. The country witnessed five months of negative export earnings growth year-on-year out of 11 months of FY24.

Importers are facing difficulties opening letters of credit (LCs) due to the USD shortage, and as of December last year, foreign debt exceeded $100 billion. The official USD exchange rate exceeds Tk 117, while in the informal market, it goes up to Tk 124. Lending rates have risen to 14 per cent, and the government faces a liquidity shortage due to lower-than-targeted revenue collection.

To stabilise the macro economy, the government has sought $4.7 billion from the International Monetary Fund (IMF) to improve forex reserves. In response, the IMF has provided several recommendations, many of which have already been implemented, such as floating market-based lending rates, a crawling peg for exchange rates, reducing the export development fund size, and adjusting cash incentives.

Additionally, a proposal to impose a 25 per cent duty on imported vehicles for MPs has been dropped, and a law amendment will be made soon. Prime Minister Sheikh Hasina announced an allocation of Tk 17,000 crore in the budget for food security.