The just-concluded FY2023-24 was a complete mess for the stock business and a year of disappointment for the capital market as the average turnover and foreign investment hit rock bottom, which was never encountered by investors at such a bad time since the 2010 collapse.

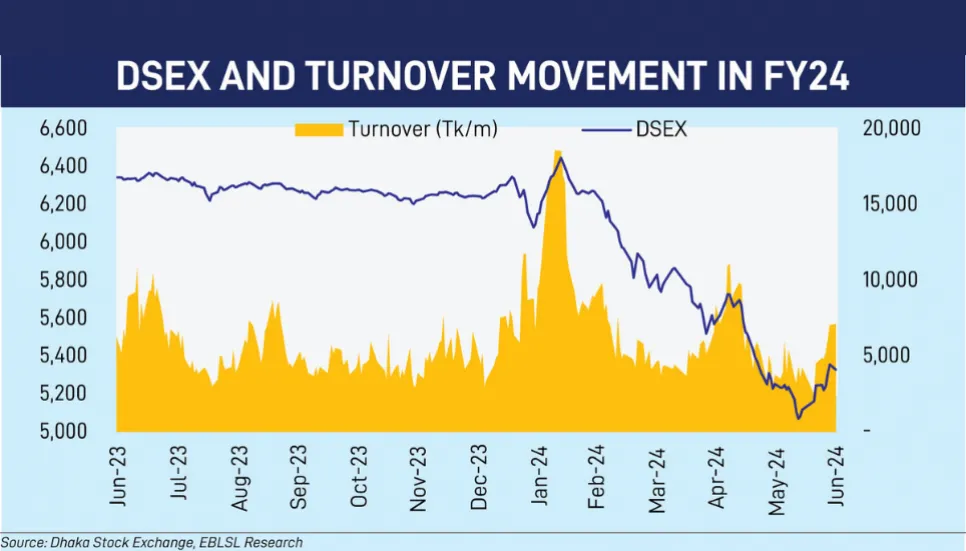

As of Sunday, DSEX, the key index of the Dhaka Stock Exchange (DSE), ended at 5,328.40 points on the last trading day of FY24, which was 6,344.09 points on the first trading day of the year.

In FY24, DSEX fell by 16.01 per cent, compared to 0.52 per cent in the previous FY2022-23.

In FY24, the DSE’s average daily turnover fell by 21.57 per cent to Tk 621 crore. It was Tk 792 crore in FY23.

The market capitalisation of the Dhaka bourse to GDP ratio declined to 13.12 per cent in the just-concluded FY24, down from 17.39 per cent in FY23.

Market analysts attributed investors’ worries over the country’s weak macroeconomy and the global economic outlook due to the Russia-Ukraine war to the recent stock market’s sharp downturn.

Although the stock market regulator, the Bangladesh Securities and Exchange Commission (BSEC), has taken many initiatives to correct the market’s behaviour, the market has remained unstable for a long time.

Despite the capital market almost moving in an isolated manner, the Russia-Ukraine war has affected the Dhaka bourse rudely. However, a newly added macroeconomic challenge arose from tightened money market conditions following the latest policy rate hike, which hampered the market’s recovery and led to the misposition of a new tax on capital gains.

In this situation, investors are leaving the stock market. They are losing faith that the falling prices will stop soon. Calculated from the beginning of this year, the number of beneficiary owner’s (BO) accounts closed stands at 80,000.

On July 28, 2022, the BSEC imposed floor prices on all securities to prevent shares from falling beyond a certain level amid domestic and global macroeconomic strains.

Because of the unstoppable market fall, investors are now afraid of making long-term investments, causing a severe liquidity crunch in the prime market.

On January 18, 2024, BSEC rescinded the floor price for all listed companies and mutual funds, except for 35 companies’ shares, complying with a long-standing demand from stakeholders. The floor price for the remaining 35 companies was removed later in phases as well.

Then in April, BSEC issued an order recalibrating the circuit breaker, saying that stocks of listed companies would not be allowed to fall more than 3 per cent from 10 per cent based on the previous day's closing price.

Stock market analyst Abu Ahmed, an honorary professor at Dhaka University’s economics department, told The Business Post, “The price of any share cannot fall by more than 3 per cent in a single day, and I think this rule is the main reason for the price fall.”

Mentioning that the country’s overall economic condition is not good, he said, “If a stock starts to fall, sales increase, and before it drops 3 per cent, buyers move. The market has been pushed into a permanent bear market by preventing the rate from falling.”

He also said that foreign exchange reserves are decreasing at an alarming rate. “Reserves cannot be maintained even by controlling imports. The IMF has reduced the reserves target to $14 billion, though it has set a condition to keep the reserves above $20 billion by this June.

“If the reserves drop like this, imports and exports will be disrupted. Naturally, businesses will suffer. This is why investors are selling shares as an early warning, and the price is falling.”

Other reasons are sell-offs by foreign investors and investors' lack of confidence because of disappointing data on major macroeconomic indicators.

A leading stock broker, requesting anonymity, told The Business Post that the big problem in the market was the floor price imposed by the stock market regulator. “This resulted in low-volume trades in the market for the last two years. There was no new investment and no return. The incomes of all stakeholder groups in the market have declined.”

Market insiders said that the market endured continuous volatility throughout the year, while the pre- and post-budget negative sentiment among investors caused the benchmark index to extend its correction mode for back-to-back sessions.

Moreover, investor participation remained stagnant as cautious investors shied away from taking positions in equities and remained observant in the absence of any major catalysts to counter the prevailing pessimism pervading the trading floor.

Nonetheless, investors’ subsequent buying interest in particular large-cap scrips helped the benchmark index recover from the initial plunge, causing the benchmark index of the capital bourse to cross the 5,300 mark after around one month.

In June, DSEX added 76 points, or 1.5 per cent, to settle at 5,328 points, although average daily turnover decreased by 30.5 per cent MoM.

However, investors seeking tax benefits opted to grab the last-moment opportunity of availing tax rebates from secondary market investments, which led to a slight increase in market participation by the end of June, with the single-day market turnover crossing the Tk 700 crore mark after one and a half months.

Nevertheless, the imposition of capital gain taxes on secondary market investments in the upcoming 2024-25 triggered investor sentiment again amidst an already depressed market.

Talking to the Business Post, a leader of the DSE Brokers Association of Bangladesh (DBA) said that FY24 was a big challenge for the overall economy, and the stock market was not immune to this challenge.

He also said that the big problem in the market was the floor price imposed by the stock market regulator. This results in low-volume trades in the market. There was no new investment. No return was found. The income of all stakeholder groups in the market has declined. All this has created constraints on the capacity of the stock exchanges.

The overall price-earnings (P/E) ratio rose to 10.22 at the end of FY24.

Meanwhile, the net foreign portfolio investments in companies listed on the DSE hit an eight-year low in December 2023.

As per the Bangladesh Bank data, at the end of December 2023, the portfolio investment stock position (equity securities and debt securities) in Bangladesh was at $2,080 million, recording a decrease of $497.52 million, or 19.3 per cent, and $1,520.74 million, or 42.2 per cent, compared to the end of December 2022 and over the end of December 2021, respectively.