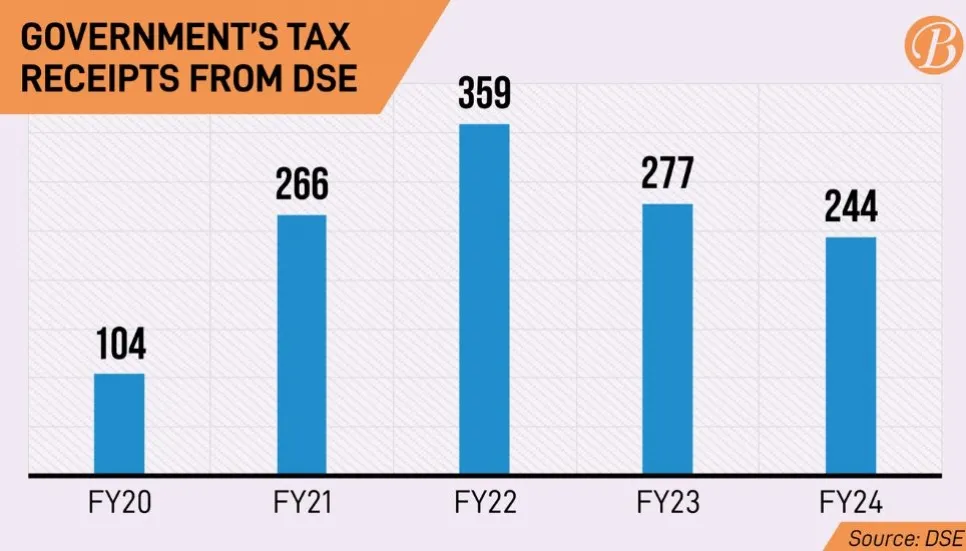

The government’s revenue earnings from the Dhaka Stock Exchange (DSE) declined by 11.85 per cent or Tk 32.80 crore in the just concluded FY2023-24 — compared to the income from the same period of FY2022-23.

In FY24, the National Board of Revenue’s (NBR) tax revenue collection from DSE was Tk 243.86 crore. The amount was Tk 276.66 crore in FY23, according to DSE data.

DSE, on behalf of the government, collects tax on trading right entitlement certificate (TREC) holders’ commission and share sales at the rate of 0.05 per cent and 5.0 per cent, respectively, and deposits the amount to the government exchequer.

In FY24, the government's tax revenue collection from members of the stock exchange or TREC holders’ commission fell to Tk 153 crore. It was Tk 192.5 crore in FY23.

Tax revenue from share sales by sponsor-directors and placement holders increased to Tk 90.6 crore in FY24 from Tk 84 crore in FY23.

Meanwhile, in FY24, DSE’s average daily turnover fell by 21.57 per cent to Tk 621 crore. It was Tk 792 crore in FY23.

DSEX, the key index of DSE, ended at 5,328.40 points on the last trading session of FY24, which was 6,344.09 points on the first trading day of the year.

In FY24, DSEX fell by 16.01 per cent, compared to 0.52 per cent in FY23.

Market analysts attributed investors’ worries over the country’s weak macroeconomy and the global economic outlook due to the Russia-Ukraine war to the recent stock market’s sharp downturn.

Although the stock market regulator, the Bangladesh Securities and Exchange Commission (BSEC), has taken many initiatives to correct the market’s behaviour, the market has remained unstable for a long time.

Despite the capital market almost moving in an isolated manner, the Russia-Ukraine war has affected the Dhaka bourse rudely. However, a newly added macroeconomic challenge arose from tightened money market conditions following the latest policy rate hike, which hampered the market’s recovery and led to the misposition of a new tax on capital gains.

In this situation, investors are leaving the stock market. They are losing faith that the falling prices will stop soon. Calculated from the beginning of this year, the number of beneficiary owner’s (BO) accounts closed stands at 80,000.

On July 28, 2022, the BSEC imposed floor prices on all securities to prevent shares from falling beyond a certain level amid domestic and global macroeconomic strains.

Because of the unstoppable market fall, investors are now afraid of making long-term investments, causing a severe liquidity crunch in the prime market.

On January 18, 2024, BSEC rescinded the floor price for all listed companies and mutual funds, except for 35 companies’ shares, complying with a long-standing demand from stakeholders. The floor price for the remaining 35 companies was removed later in phases as well.

Then in April, BSEC issued an order recalibrating the circuit breaker, saying that stocks of listed companies would not be allowed to fall more than 3 per cent from 10 per cent based on the previous day's closing price.