The Dhaka Stock Exchange (DSE) on Thursday observed a sharp upturn owing to increased investor participation riding on rebounded optimism across the trading floor.

There has been an influx of investors focusing on heavily discounted fundamental stocks and technically cheap scrips, which tends to show a buying spree in the market, say market insiders.

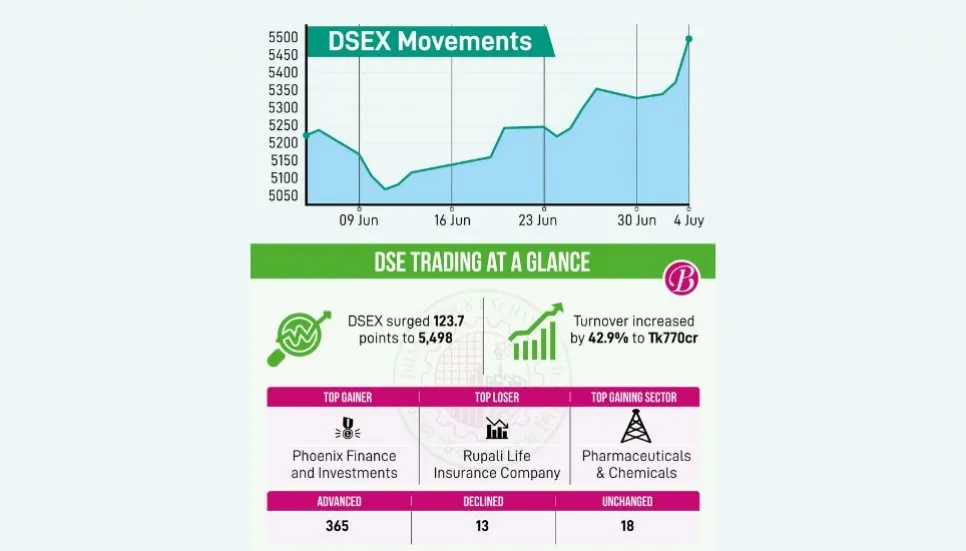

The key index of the country’s prime bourse, DSEX, gained 123.72 points, or 2.30 per cent, on Thursday and closed at 5,497.56, a record jump in the last two years.

The blue-chip index, DS30, and the Shariah-based index, DSES, closed at 1,951.34 and 1,208.70 points, respectively. All the large-cap sectors also posted positive performances on the day.

Meanwhile, market turnover increased by 42.9 per cent to Tk 770 crore from the previous session’s Tk 540 crore.

Market insiders said that the news that the government may allow government servants to trade in the share market, a reversal of a decades-old rule, boosted the investors’ confidence.

The public administration ministry recently sent a draft amendment to the Government Servants (Conduct) Rules, 1979, to the law ministry, which vetted and returned it, sources said.

In its daily market review, EBL Securities said that Dhaka stocks observed a sharp upturn owing to increased investor participation riding on rebounded optimism across the trading floor, along with some fresh fund injections following the refund amount of the latest IPO subscription hitting investor portfolios.

The market heated up as buyers remained predominant throughout the session, which led most of the scrips to witness price appreciations, adding further strength to the market recovery, it said.

Al Amin, a capital market analyst and associate professor of the accounting and information systems department at Dhaka University, said that the IPO refund money arrived at Thursday's market. “Those who applied for the IPO by selling shares at a very low price are buying shares at a very high price.”

Royal Capital in its daily review said that volume increased by 61 per cent and turnover rose by 43 per cent. All 19 sectors were gainers. Five stocks were traded at the floor price. In the block market, shares of Tk 72.6 crore were transacted, representing a turnover of 9.42 per cent.

Of the 398 scrips traded, 365 advanced, 13 declined and 18 remained unchanged at DSE.

Orion Pharma topped the turnover chart while S Alam Cold Rolled was the top gainer and Rupli Life Insurance was the top loser.

The SME index, DSMEX, increased by 21.66 points, and the market generated a Tk 12.7 crore turnover, a 48 per cent increase from the previous session. The market was in bullish conditions prevailed in the market from the start.

The NBFI booked the highest gain of 4.55 per cent on the day at the Dhaka bourse.

Meanwhile, the Chittagong Stock Exchange (CSE) also edged higher in the last session of the week, with the CSE All Share Price Index, CASPI, rising 20.18 points to settle at 1,110.22 and the Selective Categories Index, CSCX, gaining 185.52 points to close at 9,315.06.

Of the issues traded, 31 declined, 199 advanced, and 17 remained unchanged at CSE.