LankaBangla Finance PLC, a non-bank financial institution (NBFI), has announced a 10 per cent cash dividend for shareholders for the year that ended on December 31, 2023.

Alongside this announcement, the company on Tuesday also published its unaudited financial reports for the first quarter (January-March) and the second quarter (April-June) of 2024 on the Dhaka Stock Exchange website.

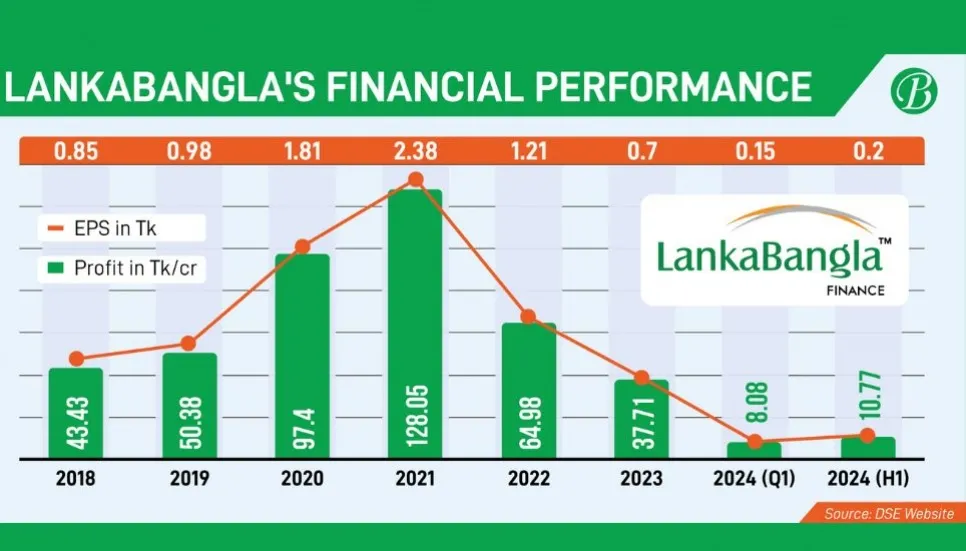

While the company’s Earnings Per Share (EPS) remained unchanged in Q1 compared to the same period of 2023, it declined in Q2, according to the reports.

For Q1 of 2024, LankaBangla Finance reported a consolidated EPS of Tk 0.15, unchanged from the same period in 2023.

The Net Operating Cash Flow Per Share (NOCFPS) for Q1 improved to Tk 1.35, compared to negative Tk 0.22 in Q1 of 2023, driven by increased customer deposits and higher income from investments. The Net Asset Value Per Share (NAVPS) stood at Tk 18.97 as of March 31, 2024.

In Q2 of 2024, the company's consolidated EPS dropped to Tk 0.05, down from Tk 0.17 in the same period of 2023. The half-yearly (H1) consolidated EPS for January-June 2024 was Tk 0.20, a decline from Tk 0.32 in H1 of 2023.

The NOCFPS for H1 of 2024 also saw a significant decrease, falling to Tk 0.14 from Tk 1.42 in H1 of 2023. The NAVPS as of June 30, 2024, increased slightly to Tk 19.02, up from Tk 18.82 as of December 31, 2023.

The company explained that the reduction in Q2 EPS was mainly due to decreased income from share investments, fees, exchange, and brokerage income, coupled with increased operating expenses.

The drop in NOCFPS was attributed to higher disbursement and settlement of deposits, reduced cash generation from operations, and increased income tax payments.

The dividend decision was approved by the LankaBangla Finance Board of Directors, with the Annual General Meeting on a digital platform scheduled for September 29. The record date for shareholders to be eligible for the dividend is September 4.

The company's financial performance showed mixed results for the year that ended on December 31, 2023.

LankaBangla Finance reported a consolidated EPS of Tk 0.70, down from Tk 1.21 in 2022. The NAVPS also saw a decrease, falling to Tk 18.82 from Tk 20.02.

However, the company reported a positive NOCFPS of Tk 1.21 in 2023, a significant improvement from the negative Tk 12.59 reported in 2022.

The company attributed the decrease in EPS to several factors, including a reduction in interest income due to a rate cap imposed by regulators, which was not in place the previous year.

Additionally, the lingering effects of the Covid-19 pandemic, the ongoing Russia-Ukraine war, and increased interest expenses due to foreign exchange losses contributed to the decline in profitability.

The NAVPS decrease was mainly due to the sale of shares in subsidiaries and the disbursement of dividends.

In contrast, the improvement in NOCFPS was primarily driven by reduced loan disbursements, resulting in lower cash outflows compared to the previous year.