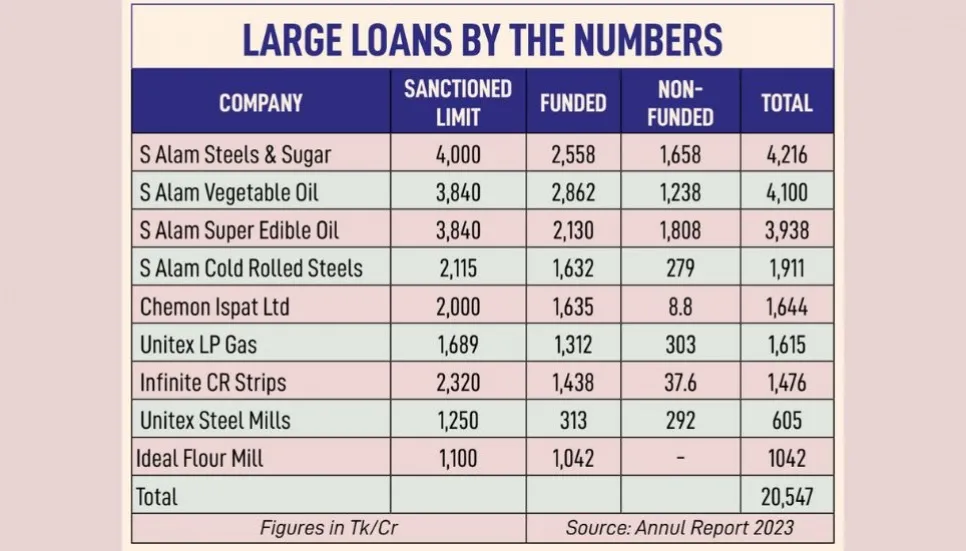

Islami Bank Bangladesh PLC shows Tk 20,547 crore large loans (which Islamic banks officially call investments) of S Alam Group – the controversial conglomerate which took over the bank in 2017 with the political backing from the Hasina regime.

The bank also disbursed Tk 3,047 crore large loans to the Nabil group, which is actually a distributor of S Alam in the Rajshahi area.

These two groups occupied Tk 23,594 crore from the Islami Bank under large loans until December 2023, according to the bank’s latest annual report. The amount was 14.74 per cent of the bank’s total disbursed loan amount in 2023.

Last year, Islami Bank’s loan disbursement amount stood at Tk 1,60,026 crore.

The annual report mentioned 39 large borrowers’ loan amounts. Among the borrowers, the number of S Alam Group companies was nine and the number of Nabil group companies was two.

From the Islami Bank, S Alam Steels and Sugar borrowed Tk 4,216 crore, S Alam Vegetable Oil Tk 4,100 crore, S Alam Super Edible Oil Tk 3,986 crore, S Alam Cold Rolled Steels Tk 1,911 crore, Chemon Ispat Tk 1,644 crore, Unitex LPG Tk 1,615 crore, Unitex Steel Mill Tk 605 crore, Infinite CR Strips Tk 1,476 crore, and Ideal Flour Mill Tk 1,042 crore.

Nabil group directly borrowed Tk 2,047 crore and its parent company Naba Farm borrowed Tk 1,000 crore from the bank at the end of December last year, according to Islami Bank’s annual report 2023.

However, several media reports have claimed that the S Alam Group borrowed Tk 74,972 crore loans from the bank under its own name, as well as under names of many companies that only exist on paper. But those figures did not come up in the bank’s annual report.

Giving clarification on the matter, Association of Bankers, Bangladesh former Chairman Nurul Amin told The Business Post, “There is no obligation to list the entirety of a business group’s loans in the annual report. Only large loans have to be shown. In this context, some banks may show the largest twenty, while some the largest thirty borrowers.”

Moreover, according to the annual report, S Alam Steel & Sugar Industry, Vegetable Oil and Super Edible Oil Company have taken loans that exceeded the limit imposed by the bank company rules.

S Alam Steels & Sugar Industry has taken Tk 4,216 crore even though they have a loan limit of Tk 4,000 crore, showed the data until December last year.

On the other hand, the loan limit of S Alam Vegetable Oil was Tk 3,840 crore, but the total loan amount stands at Tk 4,100 crore. S Alam Super Edible Oil has a limit of Tk 3,840 crore loans, but Tk 3,980 crore has been taken.

The Business Post reached out to Islami Bank Managing Director and CEO Mohammed Monirul Moula for comments, but he did not respond to calls or texts till the filing of this report.

Last week, Bangladesh Bank’s spokesperson and executive director Md Mezbaul Haque told The Business Post that the central bank will instruct the banks to review questionable loans.

Defaulted loans

The total disbursed loan amount of the Islami Bank was Tk 1,60,026.56 crore until December last year. Among the disbursed loans, the classified/defaulted loan amount was Tk 6,918.81 crore or 4.32 per cent of total loans.

However the bad loan amount was Tk 4,594.63, which was 66 per cent of the total classified loan. Bad loans are also known as loss loans, because such debt cannot be recovered easily. Many banks are also reluctant to go through the lengthy legal process to recover it.

Apart from this, Islami Bank’s written off loan amount stood at Tk 1,216.79 crore last year, which also adds to the classified loans. So the bank had total defaulted loans to the tune of Tk 8,135.6 crore at the end of last year.