Dhaka Stock Exchange (DSE) started September on a positive note on Sunday, with the key index extending its gaining streak for three consecutive sessions owing to a revived investor confidence in anticipation of favourable market momentum following the recent reformation attempts taken by the stock market regulator.

DSEX gained 24.95 points, or 0.43 per cent, and closed at 5,829.37 at the end of the trading session. The blue-chip index, DS30, and the Shariah-based index, DSES, closed at 2,128.84 and 1,245.55 points, respectively. Most of the large-cap sectors also posted positive performance on Sunday.

Market turnover slightly decreased by 3.1 per cent to Tk 933 crore from the previous session’s Tk 963 crore.

Of the 397 issues traded, 254 advanced, 98 declined and 45 remained unchanged at DSE.

NBFI booked the highest gain of 6.23 per cent while Block trades contributed 3.1 per cent of the overall market turnover.

British American Tobacco Bangladesh Company Limited was the most traded share with a turnover of Tk 86 crore.

CRYSTALINS was the day's top gainer, rising 9.94 per cent, while KPCL was the worst loser, shedding 10 per cent.

The Chittagong Stock Exchange (CSE) also settled on green terrain on Sunday. The selected indices, CSCX, and All Share Price Index, CASPI, advanced by 61.6 and 103.7 points, respectively.

Of the issues traded, 65 declined, 140 advanced and 16 issues remained unchanged at CSE.

The CSE traded 3.6 million shares and mutual fund units with a turnover value of Tk 8.44 crore.

On August 28, the Bangladesh Securities and Exchange Commission (BSEC) removed the floor price for the shares of four more companies — BSRM Ltd, Khulna Power, Meghna Petroleum and Shahjibazar Power.

Now, the floor price remains only for two companies — Beximco Ltd and Islami Bank Bangladesh.

BSEC also decided that all companies' share prices may increase or decrease by up to 10 per cent a day, which was the lowest limit of 3 per cent instant.

On January 18 this year, after the session's closing bell, BSEC issued an order rescinding the floor price for all listed companies and mutual funds, except for 35 companies' shares, complying with a long-standing demand from stakeholders. The floor price for the other companies was removed later as well in phases.

Previously, on July 28, 2022, BSEC imposed floor prices on all securities to prevent shares from falling beyond a certain level amid domestic and global macroeconomic strains.

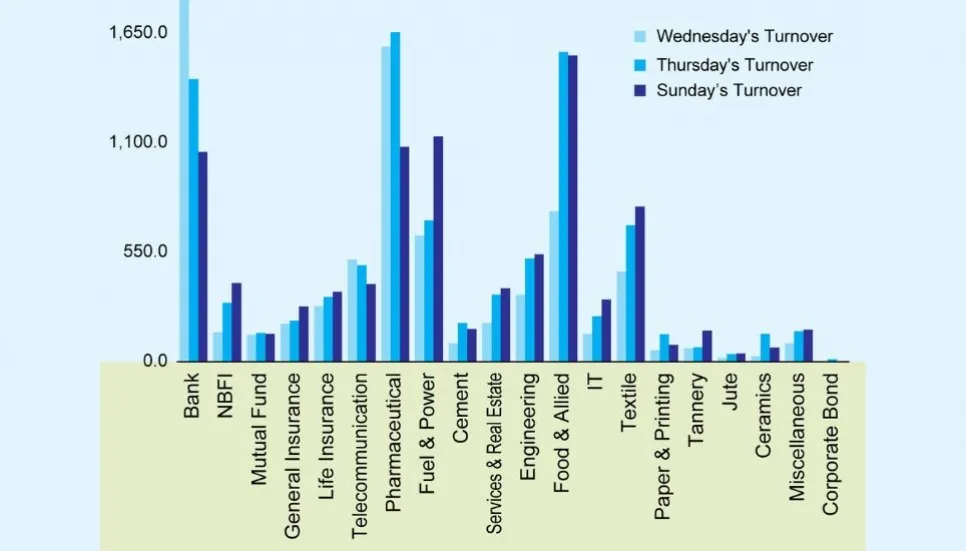

The banking sector dominated the transactions at DSE last week. Almost one-fourth of the daily transactions at DSE last week were held by the banking sector.

Market analysts said that the share prices of well-founded companies, including banks, have increased significantly in the last month. A section of investors are withdrawing some profit from these shares.

As a result, the share prices of companies are being corrected. Investors are taking profits from one sector and investing in another sector. In stocks where investment is increasing, their prices and trading volume are also increasing. This is identified as the normal trend of the market by the concerned persons, said the analysts.