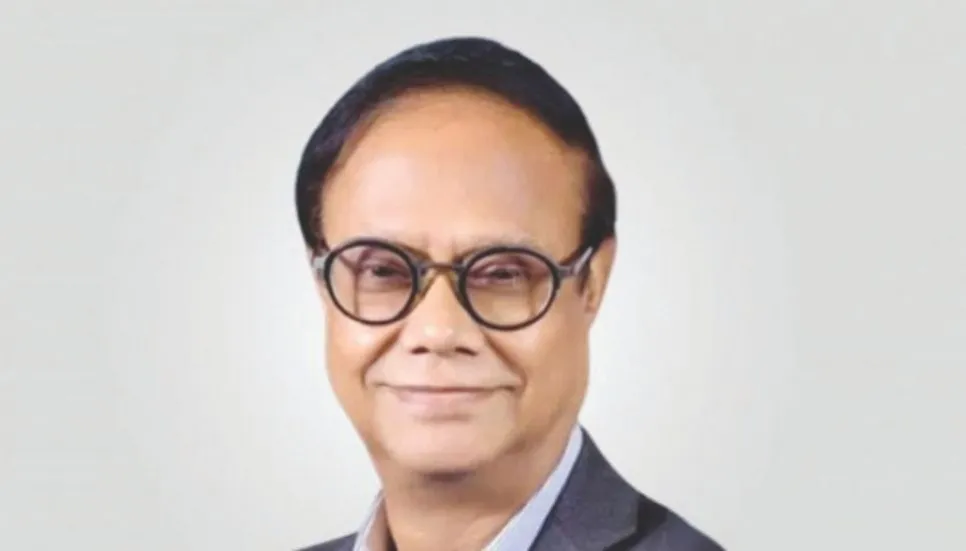

Bangladesh Bank (BB) Governor Dr Ahsan H Mansur on Sunday clarified that no bank accounts of any company, whether belonging to S Alam or Salman F Rahman, have been frozen under directives from the central bank.

All the accounts that have been frozen are individual bank accounts, he said during a press conference held at the Bangladesh Bank headquarters.

"So far, we have not frozen any organisation’s bank accounts, whether they belong to S Alam or Salman F Rahman. All the accounts that have been frozen are personal accounts. We do not wish to target any business entities, as we never want to disrupt employment or hinder production," said the central bank governor.

Speaking on the purchase or acquisition of S Alam’s property, he added, “If anyone buys or acquires ownership through transfers, purchase, or any other means, of assets belonging to S Alam Group during the 15-year rule of the previous Awami League-led government, they will do so at their own risk and Bangladesh Bank will not be responsible.”

Anyone found to have bought S Alam Group companies, assets, or anything else will have to forfeit them, he said.

Without naming the ten banks in a struggling condition, Ahsan H Mansur said he does not expect any bank to go bankrupt.

“The fact is that several banks are near insolvency. Around ten banks are facing such conditions and the government is working to turn things around for them,” he said.

Urging depositors to remain patient and trust the reforms in the banking sector, Ahsan H Mansur reassured that, regardless of the sector's condition, no customer will face any losses.

“For this reason, the deposit insurance has been increased from Tk 1 lakh to Tk 2 lakh, ensuring that 95 per cent of depositors’ interests are protected,” he said.

“If any bank goes bankrupt, 94.6 per cent of the depositors will be refunded immediately from this scheme,” he added.

“No country in the world offers a 100 per cent guarantee on bank deposits, yet we are providing a 95 per cent guarantee. Therefore, depositors have nothing to fear,” the central bank governor affirmed.

Foreign exchange reserves, stability

Ahsan H Mansur further said that foreign exchange reserves have increased by $300 million as the central bank stopped selling dollars in the market, in a significant departure from the previous administration's policies.

Prior to Dr Mansur's appointment as governor on August 14, Bangladesh Bank was losing about $1.1 billion each month through dollar sales from the reserves.

Currently, foreign exchange reserves amount to $21 billion as per the IMF formula, which is the universally accepted definition of forex reserves.

Dr Mansur said that the foreign exchange market has stabilised and will gradually normalise as the flow of remittances and foreign aid increase, alongside efforts to curb money laundering.

SME loans and microcredit flow

The BB governor also said, "The central bank has money for SME loans. But I cannot provide it to small entrepreneurs. Moreover, the World Bank and the IMF want to invest in small entrepreneurs. However, due to certain issues, these loans are not being distributed through the banks."

Bangladesh Bank has asked these banks to explain the reasons and propose solutions in writing, he added.

The governor expressed hope that the flow of microcredit will increase soon and confirmed that a special taskforce on banking sector reforms will begin their work within the next ten days.

Banking sector reforms

Dr Mansur said that with the path they have outlined, the problems in the banking sector will be resolved and previous policies will be reviewed.

"If any policy is found to have been made to benefit only a few businesses, it will be considered void," he said, adding, "And if necessary, it will remain."

He also assured that directors from the same family dominating bank boards will be removed.