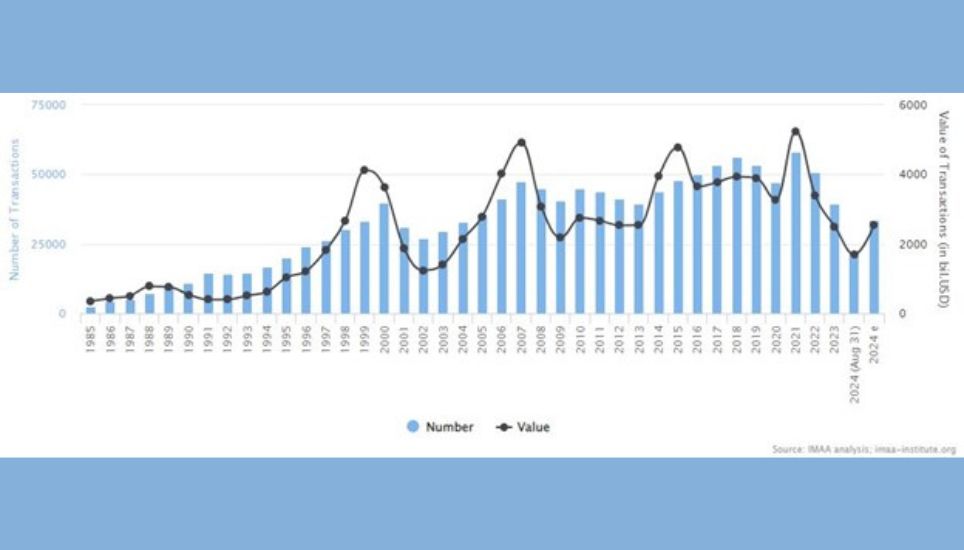

Large number of Mergers and Acquisitions activities has been an attribute of almost all developed economy since the mid 90’s. Since 2000, more than 790’000 transactions have been announced worldwide with a known value of over 57 trillion USD.

Though the M&A growth, is significant in our surrounding neighboring countries like India, Pakistan and Myanmar we are relatively in infant stage. But M & A concept and its practice are not new in Bangladesh.

For any organization, growth is the most important objective. Organization has two routes to achieve its growth objectives.

One route is; organizations can grow by using a strategy of internal growth which is also termed as organic growth or greenfeld expansion; where an organization builds its own infrastructure and sets up its own manufacturing, distribution, and selling networks internally, without impacting the corporate structure or the business model of its own.

The other route to growth is an inorganic one; through mergers and acquisitions. This route is also termed as brownfeld expansion which has certain benefits in terms of expansion of capacity at a faster pace, an easy entry in the new industry, or a new geographical market (Vinod & Priti, 2019).

For last three decade, it’s become a common practice to use M&A for corporate, organizational development and to acquire new knowledge and capabilities. Academics and practitioners as well, undergo lot of research to understand the relations of different factors of Domestic as well as cross-border M&As (McCarthy & Dolfsma, 2012).

Human Resource Management in M&A process

Human resource management (HRM) deals with the policies, procedure and practices those influence employees’ behavior, attitudes and performance of any organizations (De Cieri et al, 2008).

It is found from recent research that lack of involvement of human resource management is the vital factor causing mergers and accusations failed. (Weber & Tarba, 2014).

Value creation in mergers and acquisitions depends on the successful of people’s management and to do that HRM should take lead to be an effective strategic partner (Haspeslagh & Jemison, 1991).

The people’s management as it deals with people related processes played a critical role during the mergers and acquisitions to determine the success or failure of mergers and acquisitions (Evans et al., 2002).

Jeris, Johnson, and Anthony (2002) observed that HRM is not involved in the initial decision making of mergers and acquisitions, which is in the due diligence processes, although post-deal HRM initiatives are treated as crucial success factors.

According to the study by human resource (HR) consulting firm, Towers Perrin shows that in the year 2000, only 39% of HR people were involved in due diligence; by 2005 the number had grown to 62% in 2005 (Brown, 2005).

HR knowledge about the human side of the employees is extremely essential to managing the post-merger integration and for that acquired company’s HR management need to be given attention to job design, training, performance appraisal, career development, salaries, and other aspects (Mirvis & Marks, 1992).

Within an organisation, HRM focuses on human capital, cultural factors, organizational behavior, employee emotions, leadership, and management effectiveness/leaders effectiveness (Teerikangas & Thanos, 2018). In this article, we try anchoring shore of most of focus point of HRM in the context of mergers and acquisitions:

Culture

Culture has played an important and multi-dimensional role in mergers and acquisitions (Cartwright & Cooper, 1996; Reus & Lamont, 2009; Rottig, 2013). Influences of cultural on mergers and acquisitions are widely recognized both by academicians and practitioners (Angwin, 2001).

Organizational culture in definition of Hofstede (1980) refers to the collective programming of the minds of the members of the organization.

The term “cultural differences” refer to the dissimilarity or variation of important often unspoken assumption that organizational members shares. (Chatterjee, Lubatkin, Schweiger & Weber, 1992; Sathe, 1985).

The influence of cultural differences on the post-merger integration process is crucial for mergers and acquisitions success (Brannen and Peterson, 2009; Chakrabarti et al., 2009; Graebner, 2004; Weber et al., 2009).

Increase of the cultural difference between employees may lead to high personnel mobility, high potential cost, conflict between employees, rupture of internal communication network and high mergers and acquisitions risk.

Corporate culture, especially cross-cultural management (Weber et al., 2012) is a key factor in the successful integration of two organizations (Stahl and Voigt, 2008).

Cartwright and Cooper (1993) note that melding culture is a major managerial challenge. Weber (1996) reframes that the magnitude of cultural differences can effectively impede a successful integration during mergers and acquisitions, resulting in poor financial performance.

Walker (1998) suggests some advice to overcome “cultural differences” challenges by identifying eight steps for fruitful mergers and acquisitions.

The eight steps include celebrating small wins, recognize the past practices, measure progress, people’s involvement, identifying bedrock behaviors that might obstacles, communicating integration process, and provide a clear justification for the mergers and acquisitions.

A large number of employees were instructed to work from home during the Covid-19 epidemic period (Banjo, Yap, Murphy, & Chan, 2020).

To attract and retain this workforce, the firm must foster a good culture that encourages each and every employee to see themselves as valuable members of the team. A worker's point of view is that "working remotely might result in extended working days spent at home, which can eventually lead to feelings of isolation" (Pattnaik & Jena, 2020).

Communication

A review of the merger literature identifies three key important factors for considering the workforce stability: job security, procedural fairness, and communication (Jane Bryson, 2003).

Appelbaum et al, 2007 have pointed out that communication is an effective strategy for retention of human resources at the time of mergers and acquisitions. Communication is the key to a successful integration of the two clashing cultures (Balmer and Dinnie, 1999).

Communication in the initial stages is very important in reducing the uncertainty faced by the personnel, stabilizing the situation and restoring the employees’ commitment to the post-merger & acquisition (Klendauer & Deller, 2009).

‘Merger syndrome’ is a phenomenon that illustrates employees’ reactions following the announcement of the mergers and acquisitions deal. The term was first documented by Marks and Mirvis (1985, 1997) and it characterized by increased centralization and decreased communication by management with employees.

Communication is a key concern during socio-cultural integration (e.g. Schweiger and DeNisi, 1991; Kusstatscher and Cooper, 2005; Angwin et al., 2016). Frequent, immediate, honest and constant information is essential for the creation of integration capabilities to prevent negative reactions from employees (Bastien, 1987).

Managers should exhibit concern for their staff by delivering clear information when a crisis is present, like in the case of the COVID-19 epidemic. To create a positive environment, they should build a participative form of communication that allows them to shape the mood (Lee, 2021).

Emotion

Several important human side factors such as emotions (Reus, 2012); psychological contract of management team in the time of mergers and acquisitions processes has investigated by Hill, 2005.

These human factors which to be nourished by human resource management have been recognized as an important source of success in mergers and acquisitions (Lubatkin and Lane, 1996).

Organizational changes involved, especially at the time of cross-border mergers and acquisitions is extremely stressful (Ager, 2011), provoking wide range of emotions.

Mergers and acquisitions researchers have studied emotions from diverse points of view, such as acquisition outcomes (Gunkel et al., 2015), culture (Reus, 2012), identity (Ager, 2011), employee behavior (Sinkovics et al, 2011), change (Kiefer, 2002), rationalization (Vince, 2006), and coping (Fugate et al., 2002).

Communication regarding acquisition often triggers different type of emotion, particularly negative emotions such as anger, anxiety, distress, disappointment and fear (Frijda 1986; Lazarus 1998; Frost 2003).

A better understanding of human behaviors, emotion and social interaction with their colleagues inside the organization at the micro level provides an opportunity for progress of our understanding of the processes and outcomes of integration at the macro level (Barney & Felin, 2013).

Three main coping strategies or emotional behaviors observed by David L. Ager (2011) are: Exit, Avoidance, and Approach. These behaviors were common among members of the acquiring and target organizations, managers, and employees.

Exit simply means that employees chose to leave the organization. Avoidance means that an actor/employee chose to remain with the firm in solidarity with their in-group. Who chose the Approach strategy confronted the source of their emotional stress.

By focusing on problem solving, they transcended boundaries and facilitated integration. Separate efforts are needed to help improve the morale during a pandemic when employees are working from home, especially when they are in an isolated work setting (Mishra and Jena, 2020).

Employee Retention

Retaining top management talent and other key personnel of the organization at the time of integration largely assure the value creation of an acquisition.

But common consequences of mergers and acquisitions are high turnover of employee at post-acquisition stage (Hambrick, 2006) and loss of crucial human capital (Reus & Lamont, 2009).

Top management and key personnel who hold knowledge and skills of operational managerial and development, advancement, and considered most valuable human resource of acquiring firm are termed as the acquired firm’s high value human resources (HVHR) (Ranft & Lord, 2000; Reus & Lamont, 2009).

The turnover of the acquired firm’s managers not only implies the loss of knowledge and valuable role models, but also has a negative effect on the morale of those that remain (Buono & Bowditch, 1989).

The loss of these high value human capital damaging the firm’s key capabilities to compete (Coff, 2002), provides industry rivals with opportunities to acquire experienced resources along with their tacit knowledge and experience that may enhance the rivals’ firm’s capabilities and competitive positions. (Haleblian et al, 2009).

In the same time interpersonal communication permit employees to clarify doubtful or confusing aspects, ensuring the transfer of information to the message receiver in a way that reduces potential conflicting interpretations or misunderstandings (Daft & Lengel, 1986; Kupritz & Cowell, 2011).

Moreover, paying high permits the firm to attract, motivate, and retain highly quailed employees (Werner & Ward, 2004).

An increase in the pay level and in financial incentives generates higher performance and satisfaction and reduces the turnover of high performers and the intention to leave an organization (Werner & Ward, 2004; Ou & Wang, 2007).

Knowledge Management

Knowledge management is defined by Rastogi, (2000) as logical and integrative process of managing organization wide activities such as acquiring, creating, storing, sharing, diffusing and deploying knowledge activities done by individuals and groups in search of key organizational goals.

Knowledge is considered as a significant resource for sustainable competitive advantage (Bock & Kim, 2002). Knowledge as a human factor of mergers and acquisitions is a personal competence that allows a person to perform a task effectively (Grotenhuis & Weggeman, 2002).

Knowledge management is a conscious strategy of capturing and utilizing individual knowledge in a way that attempts to enhance learning and improve organizational performance (O’Dell & Grayson, 1998).

Therefore, knowledge management is critical to understand and address each phase of the mergers and acquisitions process: pre-Mergers and acquisitions, due diligence, integration, and post-Mergers and acquisitions (Daniel & Metcalf, 2001).

Junni (2011) has highlighted the importance of motivation of individual employee in the organization for the transfer of knowledge from the target to the acquirer.

According to the researcher, the knowledge transfer and capabilities from one firm to another mostly depends on the willingness of individual employee to share their knowledge.

If the employees of the acquired organization fear are being exploited by the receiver without getting anything in exchange, they may not share their knowledge.

Regarding the embedded knowledge Academy, N.Z (2020) stated that embedded knowledge can only be transferred through the contribution of the people, in whom it is rooted, requiring close personal contact between possessor and receiver.

The study shows that the embeddedness of the knowledge positively and directly affects the transfer.

Bresman, Birkinshaw, and Nobel (1999) found training programs in Mergers and acquisitions to be positively associated with knowledge transfer.

Mergers and acquisitions have potentials for expanding organizational knowledge and capabilities.

The literature also indicates that the acquisitions of a firm possessing important knowledge and capabilities does not guarantee that they will be transferred to or exploited by the new organization (Ranft & Lord, 2002; Reus & Lamont, 2009; Al-Laham, Schweiger, Amburguey, 2010).

Labor Relation

Labour relations, unions and trade union representatives influence the integration processes ( Colman et al., 2011). Perry et al., (1995) conclude that unions are able to “provide a force for stability in the organizational commitment to change”.

The ability to work independently without influence of management unions can prevail “to obtain the trust and confidence of the workforce to participate in a change program” (Perry et al., 1995).

Unions also in a position to provide a check on management action, and as Perry et al. also stated, “There is considerable evidence that (workplace) reform is most effective where unions are involved – forcing management to devote more resources to the management of employees”.

Walsh and Brosnan (1999) in their research observed in their workplace survey that 56 per cent of employers in responding unionized workplaces reported that unions were ignored or merely informed of change decisions.

In the United Kingdom, Haynes and Allen (2001) showed the inconsistent and ambivalent attitude of management towards unions.

Lehto and Böckerman (2006) analyze the employment effects of Mergers and acquisitions ’s concluded that a prominent explanation for employment losses is that the change in control through Mergers and acquisitions offers an opportunity for new management teams to neglect implicit labour contracts that have previously constituted obstacles to layoffs.

In the Merger & Acquisition literature, it is not only ignores the possibilities of union involvement, but also ignores the impact of incompatible or mismatched approaches to employment relations in merging organizations.

The merger literatures often consider cultural fit of organizations (Appelbaum et al., 2000) but seldom the employment relations policy choices which embed those cultures.

It is argued that this issue would benefit from an extended use of Guest’s (1995) taxonomy of employment relations policy choices dependent on the priority placed on HR and industrial relations.

Conclusion

Sometime prior or some time in-processes of M&A; target organization trigger takeover defense tactics and bidder face hindrances and sometime make it hard to integrate. In human resource perspective it become a nightmare.

As an anti-dose: “Restoration human resource management”- a combination of interrelated HR related action to mitigate the implemented anti-takeover tactic, restore Human Capital as before used as anti-takeover tactic.

“Restoration HRM” is a reactive strategy which covers the re-recruitment of key position by returning back the left employee who has left due to adverse environment.

So, involving human resource management people from very initial stage of mergers and acquisitions could insure insignificant employee retention and enhance process success.

Moinul Hoque, the author of this article, is a management consultant at AH Management. He can be reached at [email protected]