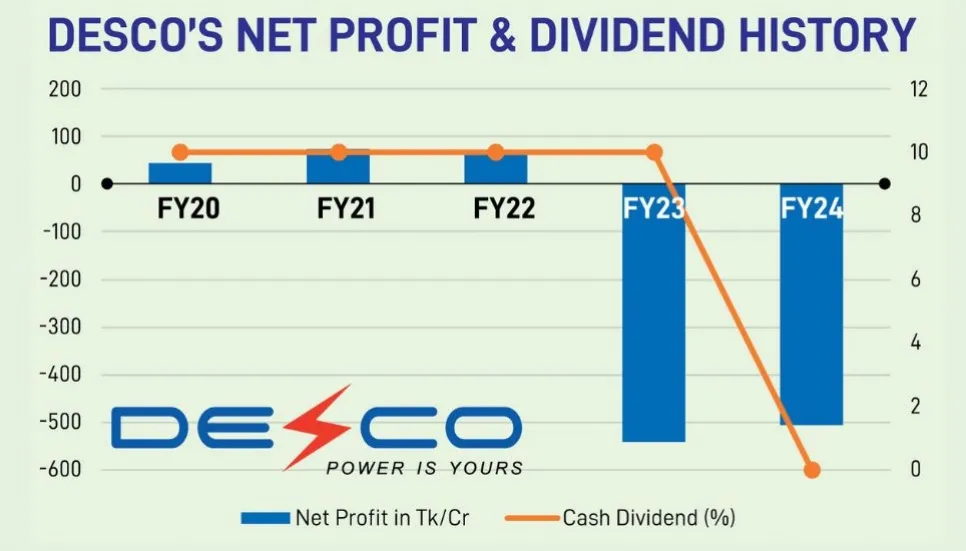

State-run power supplier Dhaka Electric Supply Company Ltd (DESCO) posted a loss of Tk 505.7 crore for FY24, marking a second consecutive year of losses. Its losses per share were Tk 12.7 during the financial year, an improvement from losses Tk 13.61 a year ago.

The publicly traded company did not recommend any dividend for the fiscal year to its shareholders for the first time in its history since it was listed with stock exchanges.

According to a disclosure on the Dhaka Stock Exchange (DSE) website, DESCO recorded a loss of Tk 541 crore in FY23. It should be noted that the company recorded its first ever loss in FY2001-02.

The company has also informed that it incurred losses in the current year and retained earnings are negative, so the board of directors was not able to recommend any dividend this year. EPS however improved marginally as distribution revenue grew slightly and foreign exchange fluctuation losses decreased.

As a result DESCO did not recommend a dividend for the last fiscal year to its shareholders for the first time in its history since it was listed on the Dhaka Stock Exchange. In FY23, the company paid 10 per cent cash dividend to its shareholders.

The company’s annual general meeting (AGM) will be held on January 25. It has also reported NAV per share of Tk 37.92 and NOCFPS of Tk 15.49 for the year ending in June 30, 2024, against Tk 50.62 and Tk 8.72 respectively for the year ending on June 30, 2023.

Due to the no dividend declaration, the company’s share price dropped by 5.91 per cent to settle at Tk 22.50 on Tuesday.

In June this year, the Bangladesh Securities and Exchange Commission (BSEC) had allowed DESCO to issue 60.76 crore preference shares at Tk 10 each to the government against a share money deposit.

DESCO officials said after the increase in the bulk power price, the company plunged into losses, as the retail price was not increased at the pace of the bulk price.

They believe that if this situation continues, the company’s losses will mount in the upcoming quarters. The last power tariffs, both at retail and bulk levels, were raised on March 1, 2020.

DESCO’s net profit witnessed a 14.50 per cent decline in FY22. The power supplier reported earnings per share of Tk 1.59 for 2021-22, down from Tk 1.86 recorded during the previous financial year of 2020-21.

The company paid a 10 per cent cash dividend to its shareholders for the last financial year.

In FY21, this company made a profit of Tk 73.91 crore, and its EPS was Tk 1.86, compared to the profit of Tk 45.56 crore and the EPS of Tk 1.15 in FY20.

Starting commercial operation in 1998, the company got listed on the stock exchanges in 2006. The power sector company belongs to category “A” of the country’s prime bourse Dhaka Stock Exchange (DSE).

The company’s paid-up capital is Tk 397 crore. DESCO distributes electricity to the northern parts of Dhaka City.

The government owns a 67.66 per cent stake in the company, while institutional investors own 23.83 per cent of the company’s shares, foreigners represent 0.5 per cent, and the general public 8.46 per cent.