Home ›› 20 Sep 2021 ›› Front

The disposal of industrial loans rose 44.42 per cent in the second quarter (April-June) of this calendar year compared to the same period in the previous year.

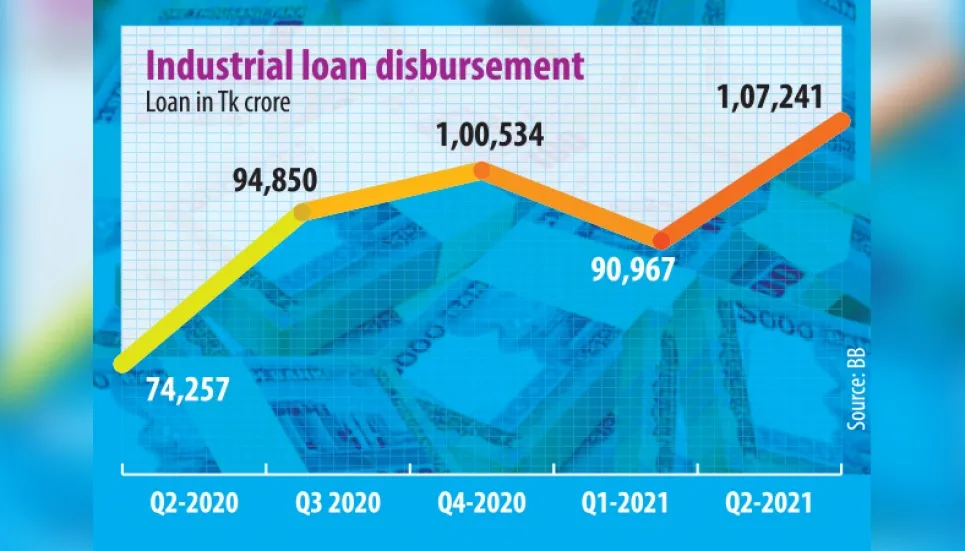

The reopening of the country’s economy after some intermittent shutdowns caused by the Covid-19 pandemic contributed to the surge. The disposal of industrial loans in April-June period in 2021 stood at Tk 1,07,241.36 crore, up from Tk 74,257.43 crore in the corresponding period of last year, according to the latest data from the Bangladesh Bank.

However, the industrial loan disbursal soared by 17.89 per cent to Tk 1,07,241.36 crore during this quarter (Q2).

Businesses and corporations take industrial loans to meet their short- and long-term financial needs such as funding capital expenditure and for business expansion.

Most banks suspended their loan disposal in June quarter last year when the government announced countrywide lockdown to contain the coronavirus infection.

Besides, industrial expansion also came to a halt due to the pandemic-induced shutdown in 2020, which is why this year’s Q2 sees an increasing demand for industrial loans.

As the Covid-19 cases had continued to rise alarmingly since mid-March last year, the government imposed a nationwide lockdown for a week from April 5 to contain the surge.

Later, a ‘strict’ lockdown was declared from April 14 to 21, which was later extended till June 16 this year.

The country’s banks generally disburse two types of loans to the industrial sector -- industrial term loans and industrial working capital loans.

The disbursement of industrial term loans rose by 60.16 per cent to Tk 19,430.74 crore while working capital loans 41.34 per cent to Tk 87,810.63 crore in the second quarter of this year, as per the BB data.

This is not an actual growth of industrial loan disbursement because loan disbursement came to a stop in April-June period last year, said Brac Bank Managing Director and CEO Selim RF Hussain.

He observed that the country’s economy has returned to normalcy to some extent, but it will take more time to come back to a full revival.

“If the present vaccination programme continues, the economy will be normal within four or five months, but the upcoming days are very uncertain,” he explained.

Echoing Selim, Mutual Trust Bank Managing Director and CEO Syed Mahbubur Rahman said the demand for credit has increased slightly, but the upcoming months are full of uncertainties should the third wave of the virus hit the country.

The recovery of industrial loans also rose by 28.20 per cent to Tk 82221.23 crore in June of this year, reads the BB data.

The recovery of industrial term loans rose by 44.63 per cent to Tk 14,734.86 crore while that of working capital loans 25.10 per cent to Tk 67486.37 crore in the same period of this year.

Bankers said the rise in the recovery of industrial loans in June quarter this year is because borrowers enjoyed loan moratorium facility throughout 2020, and they are also enjoying the same facility now due to banker-customer relationship.

The total outstanding industrial loans stood at Tk 6,18,164.12 crore in June quarter this year which is 8.67 per cent higher than the same period last year.