Home ›› 27 Sep 2021 ›› Back

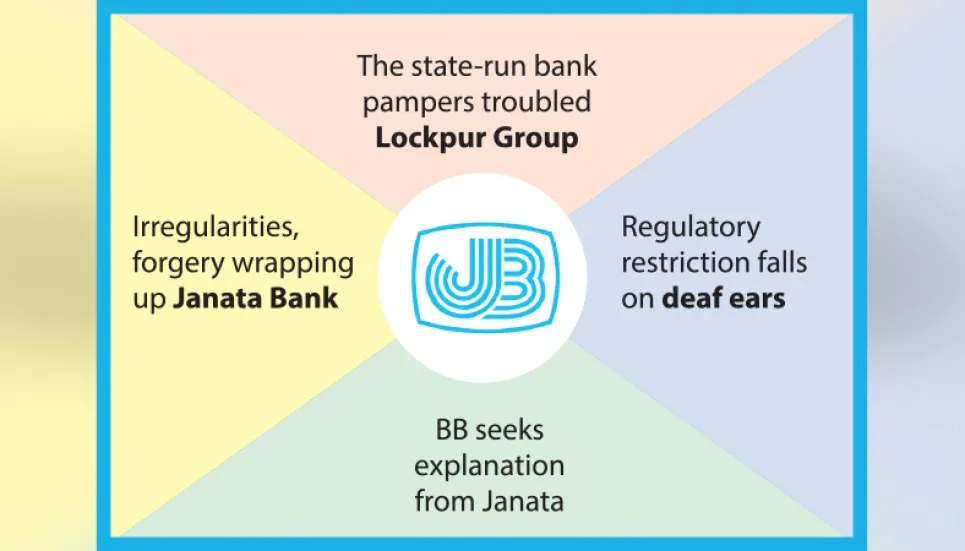

There is no end to irregularities in once good performer Janata Bank as the state-run lender is repeating its litany of scams fighting shy of banking regulations.

Even the central bank’s warning and restrictions fall on deaf ears when the state-run lender provided a lifeline to troubled Lockpur Group.

A hotbed of financial irregularities, Janata, has approved reschedule of Lockpur Group’s loan worth Tk 110 crore in the bank’s 668th board of directors meeting this year.

The Bangladesh Bank has unearthed irregularity and forgery galore in the state-run bank.

The extensive flaws surrounding the bank came out in a special probe report of the Bangladesh Bank. The Business Post obtained a copy of the report.

As per the investigation report, the production and export activities of Moon Star Polymer Export Ltd and Eastern Polymer Ltd of Lockpur Group remain shut since October last year while the two sister companies declared massive layoffs from February this year.

But hiding the actual information, Janata Bank provided loan rescheduling facility to the two enterprises – a brazen violation of the Bangladesh Bank regulation, a high official of the central bank said, seeking anonymity.

The bank board in its 642th meeting in December last year approved rescheduling of Tk 58.43 crore liabilities against the Letter of Credit (LC) of Moon Star Polymer Export Ltd and Eastern Polymer Ltd for 10 years.

The central bank did not provide No Objection Certificate (NOC) for Janata to go for rescheduling as the banking regulator found huge irregularities and forgeries in the Khulna-based business group.

According to the probe repot, since the central bank did not give NOC to reschedule the liabilities, they are adversely classifiable but the lender showed them in its Credit Information Bureau (CIB) report without proper classification, which is another violation of the Banking Companies Act.

The board of directors of Janata Bank asked its management to submit a memo immediately on what action has been taken against the bank officials who were responsible for those irregularities, but the management is yet to submit the memo to the board, the probe finds, adding that the present managing director of the bank is responsible for that.

Irregularities in Lockpur Group

The Bangladesh Bank on January 27 last year had given No Objection Certificate (NOC) to Janata Bank to reschedule a Tk 9.94 crore LTR (Loan against Trust Receipt) loan of Moon Star Polymer Export Ltd on condition.

However, the BB said the reschedule will be effective after getting 5.30 per cent of the total loan as down payment but the central bank inspection team finds that the company did not provide any down payment as per the condition.

Even no evidence was found as initial security against the loans or any payment of liabilities during the inspection.

The Moon Star Polymer Export Ltd and Eastern Polymer Ltd of used to import goods by taking bonded warehouse facility and sold them to local market instead of using those imported goods for making exportable products, which is a serious irregularity and forgery, as per the probe report of BB.

A bonded warehouse is a building or other secured area in which dutiable goods may be stored, or they may undergo manufacturing operations without payment of duty.

The Anti-Corruption Commission (ACC) has started a probe against the allegations of financial irregularities against Lockpur Group Chairman and CEO SM Amzad Hossain.

Mr Amzad had also been the chairman of South Bengal Agriculture and Commerce Bank Limited since 2013 who has tendered resignation from his post on September 07 on health grounds.

The Business Post correspondent tried to reach Amzad over phone but his phone was found switched off.

BB asks Janata to give explanation

The Bangladesh Bank on August 31 this year sent a letter to Janata Bank asking it to explain the series of irregularities within seven working days.

The central bank also asked Janata Bank Managing Director and CEO Md Abdus Salam Azad why no action would be taken against him for violating the BB’s instruction.

The state-run lender has also been instructed to refrain from issuing any Letter of Credit, approving, extending or disbursing any new loans in favour of the companies belonging to Lockpur Group.

The explanation from the bank is not satisfactory to the BB and the BB is going to take legal action against the Bank, said another high official of the central bank.

The Business Post correspondent tried to reach Janata Bank Managing Director Abdus Salam Azad over phone but he did not respond.

Even the correspondent paid a visit to the bank head office in Motijheel commercial area to meet the MD of the bank but he was not found in the office.

Later asked about the issue, Janata Bank Deputy Managing Director Abdul Jabber told The Business Post that the companies of Lockpur Group were open when the loans were rescheduled.

“We made the rescheduling of loans after taking down payment from them as per the policy,” claimed a confident Jabber.

Asked why then the central bank seeks explanation, the banker said: “May be there is some misunderstanding.”

Janata Bank’s financial health

Now Janata Bank has the highest defaulted loans in the country’s banking sector, with its NPLs standing at Tk 13,692.68 crore till June this year, which was 23.52 per cent of the total outstanding loans of the bank.

However, the amount was Tk 5,818 crore at the end of 2017.

The sharp increase in bad loans has largely been attributed to the failure of loan repayments by the bank’s clients -- Crescent Group and AnonTex.

The bank lent over Tk 10,000 crore to Anon Tex and Crescent Group by violating the BB’s single borrower exposure limit criteria, according to the BB’s inspection report.

The state-run bank faced a Tk 345 crore capital shortfall as of June this year.