Home ›› 17 Oct 2021 ›› Corporate

With increasingly accessible online payment platforms and digitization of services, transactions through the credit card increased sharply, turning the credit card into a lifestyle product.

The ongoing Covid-19 pandemic fuelled the transaction growth as people preferred contactless payment to avert infection.

The growing habit of online shopping and dependency on e-commerce during the lockdown caused by the pandemic was another push factor for the rise in credit card use.

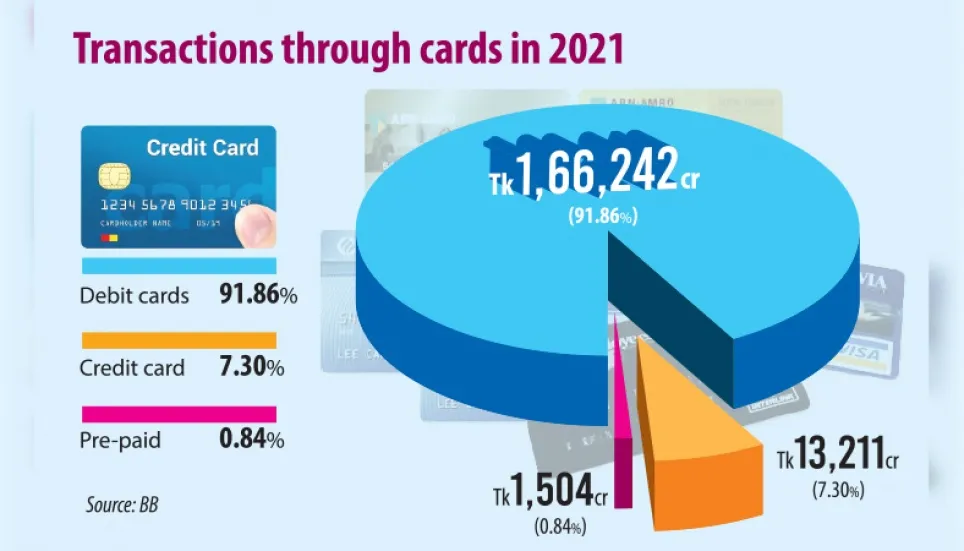

From January through August of 2021, transactions through credit cards stood at Tk 13,209 crore, up 52.73 per cent from Tk 8,650 crore in the same period a year ago, according to Bangladesh Bank (BB).

On the other hand, the number of credit card users was 27.70 lakh as of August this year, which was 18.82 lakh in August last year.

In August 2021, credit card transaction was Tk 1, 674.4 crore, which was Tk1,51.9 crore in the same period a year earlier.

Catalyst for sharp growth

Coupled with people’s increased income, the Covid-19 pandemic, booming e-commerce business have acted as catalysts for the sharp rise in credit cards transactions.

In addition, different types of discounts and facilities offered by the banks and financial institutions also attracted customers to spend more.

“After the outbreak of the Covid-19 pandemic, people became panicked and they preferred contactless transactions to avoid infection. As the outbreak starts to peter out, they still stick to credit cards as they became habituated to the card-based transactions,” Md Minhaz Uddin, head of cards at LankaBangla Finance told The Business Post.

On the other hand, with the developed infrastructure, banks and other financial institutions offering credit cards made the pause machines available, which also have encourages customers, he said.

In addition, a range of discounts on purchasing several goods and services made people more interested to use credit cards, he added.

“The alternatives to cash have been there, though on a limited scale, for quite some time now in various forms. It’s Covid-19 that opened our eyes and minds. Covid compelled us to stay home and restricted our movements to a bare minimum to avoid probable contraction of the virus,” M Sabbir Hossain, Deputy Managing Director and Chief Operating Officer at BRAC Bank told the Business Post.

“Sitting at home, we had to find out alternative ways for the day-to-day essential transactions such as paying bills, purchasing essentials, furnishing periodic payments of loans and deposit accounts as well as helping many individuals in need,” said Sabbir.

“We had used a combination of internet banking, mobile app, mobile financial services, e-commerce, as well as cash.”

Interestingly, the transaction volume at the bank branches and ATMs gradually decreased while internet banking, e-commerce and MFS transactions grew significantly. More importantly, this trend continues even today in a post-pandemic situation, according to him.

Right now, some of the Mobile Financial Service (MFS) account holders can add money through credit cards, which is another reason for the rise in the transaction.

“To facilitate the digital transaction and integrate banks with the mobile financial services, we have introduced add money option for our customers. With this option, a customer can add money in his or her bKash account from Visa and Mastercard issued in Bangladesh by any banks,” Shamsuddin Haider Dalim, head of corporate communications at bKash told the Business Post.

The option makes an account holder meet the emergency need for money without visiting a branch of a bank or ATM booth. Similarly, a credit cardholder also can make payment through MFS on an urgent basis, said Dalim.

As a result, both banks and MFS are gaining from the facilities, which is contributing to the cashless and contactless transaction, he added.

Credit card now a lifestyle products

Consumer’s lifestyles and habits have changed and they are using credit cards to meet the needs of everyday demands related to urban living.

“Credit card is a lifestyle product, not a loan product. As people’s income is increasing, we have noticed dramatic changes in the user segment. Covid-19 forced to changes the payment behaviour,” Md Abed ur Rahman, head of cards at Midland Bank told the Business Post.

“The payment landscape shaped so many new users. Coming back to the point, we found middle class and upper-middle-class people are still on the rock, said Rahman.

The head of cards at LankaBangla Finance said, “With the changing in living and taste, people need different types of products. To this end, credit card providers are offering different types of services for their clients.”

Now, a consumer can buy home appliance products like washing machines, refrigerators on credit with zero interest rate through credit cards, he said.

“In addition, we are offering traveling credit facilities to cardholders as well as discounts on air tickets, hotel bookings to enjoy holidays,” he said.

Challenges people face

Despite having significant advantages and growth in the sector, there are challenges.

“The sector is facing many challenges. One of the big challenges is the infrastructure that is not in good shape yet. The growth rate is increasing approximately by 10 per cent but the Point of Sale (PoS) is not increasing in line with this,” said the head of cards at Midland Bank.

“If you look at Bangladesh Bank’s figure, credit card use increased by 8.80% compared to 2020. Currently, we have 75,000 PoSs nationwide. The majority of those are in urban areas. Another challenge is card acceptance not available everywhere,” he said.

“For creating a cashless society, we need a combined policy and awareness where people will feel card use instead of cash,” he added.

“As the credit is an unsecured product in terms of collateral, in case of delinquency, it is very difficult to recover the card dues and legal procedures are also very limited in such types of recoveries,” Mohammad Shafiul Azam, head of cards at South Bangla Agriculture and Commerce Bank told the Business Post.

Due to lifestyle and time demand, credit cards are very popular with young aged service holders, businessmen, and entrepreneurs but due to lack of Tax Identification Number (TIN), we cannot issue credit cards to these segment customers, said Azam.

“As the government wants to move towards a cashless society, so I think we need some waiver on such types of regulatory limitations,” he said.

What next to grow further

“The rise in credit card transaction is a good sign for the economy. To boost the economic growth, cashless payment systems can be a tool as it offers easier and convenient payment system. As a result, people’s consumption and participation in economic activities would increase further,” Khondaker Golam Moazzem, the research director at the Centre for Policy Dialogue (CPD) told the Business Post.

However, the card provider should not be aggressive as it may encourage customers to use excessively, which may put them at risk of defaulting, he said.

The services offered by the credit cards providers should be reasonable and the Bangladesh Bank as the regulator must be vigilant for sustaining the growth, said Moazzem.

He suggested the customers be aware of the terms and conditions of the credit card and the sector also needs to focus to instill trust in customers and guarantee the security of the systems.