Home ›› 17 Oct 2021 ›› Corporate

Debit card use has increased amid the pandemic as more people are avoiding cash transactions and public gatherings to protect themselves from coronavirus infection, Bangladesh Bank data show.

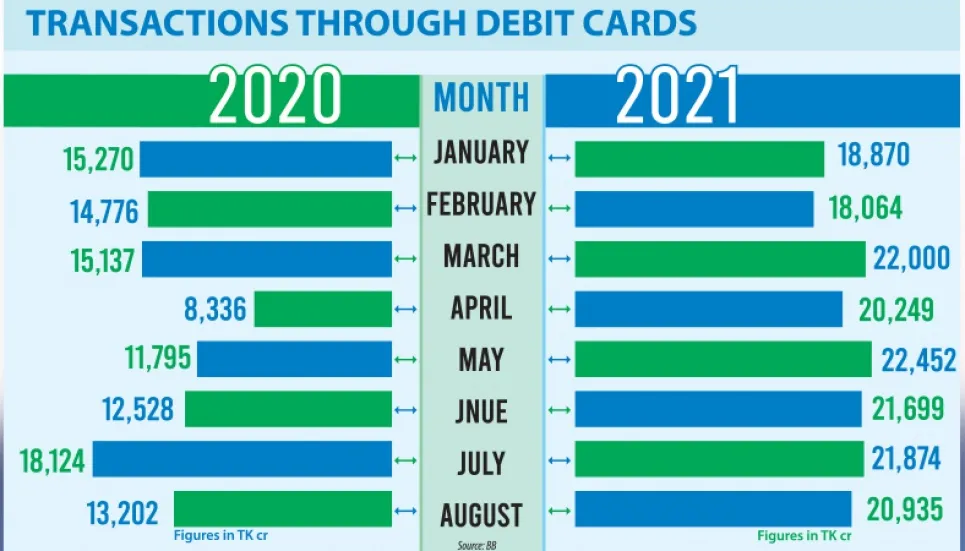

In August this year, debit card transactions stood at Tk 20,934.8 crore, up from at Tk 13,202 crore in the same month a year ago, according to BB.

Besides, the number of debit cards has also increased amid the pandemic. Until August, banks issued 2.39 crore debit cards, which was around 2 crore in the same month last year.

A senior central bank official said that clients used their debit cards only to withdraw cash from ATM booths but amid the pandemic, they used debit cards for online shopping and making other payments. However, ATM transactions through cards are still higher than other transactions, he added.

BB data showed that ATM transactions through cards stood at Tk 17,580 crore in August this year compared to the point of sale transactions of Tk 1,590 crore. Industry insiders said an increasing number of clients avoided cash on delivery when the pandemic hit the country last year.

MasterCard Bangladesh country manager Syed Mohammad Kamal told The Business Post that digital transaction was increasing day by day despite the withdrawal of lockdown as people were gradually getting used to the digital payment mode. He said that offline transactions through cards increased with normalcy returning and businesses, shops and restaurants reopening.

Kamal said that people got a taste of the convenience of digital payments amid the pandemic. “Now is the right time for the government to incentivise card transactions if it is serious about making a cashless society,” he said.

He recommended providing a 5 per cent incentive for using digital payments to reduce the use of cash. Of it, 3 per cent should be for consumers and 2 per cent for merchants.

“We have already proposed the government and the central bank take initiatives in this regard,” he noted. Cash transactions would go down further when digital payment channels such as Whatsapp banking, e-wallet, mobile financial services (MFS) and cards would increase, said Ahsan Ullah Chowdhury, Head of Digital Financial Services of Eastern Bank Ltd (EBL).

“Cash use will fall drastically if small businessmen like street hawkers and grocery stores are included in the digital payment channels,” he added.

BB rolled out an interoperable QR code to boost cashless transactions, especially in rural areas, in January this year. The digital payment method named ‘Bangla QR’ will help clients pay their bills for purchased goods and services through any mobile banking application, MFS or payment service provider.