Home ›› 22 Oct 2021 ›› Stock

Square Pharmaceuticals, Beximco Pharmaceuticals, and Beximco Limited have declared highest ever cash dividends as the companies raked in crores in additional profits during the pandemic.

Square Pharmaceuticals, the country’s leading drug makers, has declared 60 per cent cash dividends for the fiscal 2020-21, which was a record in the dividend payout history of the company.

The company’s latest dividend payout broke the record it made in FY 20 when it was 47 per cent.

The directors recommended the dividends in the company’s board meeting on Thursday.

The company’s annual general meeting (AGM) is scheduled for December 15 to approve the dividend. The record date for the entitlement of the dividend is November 22.

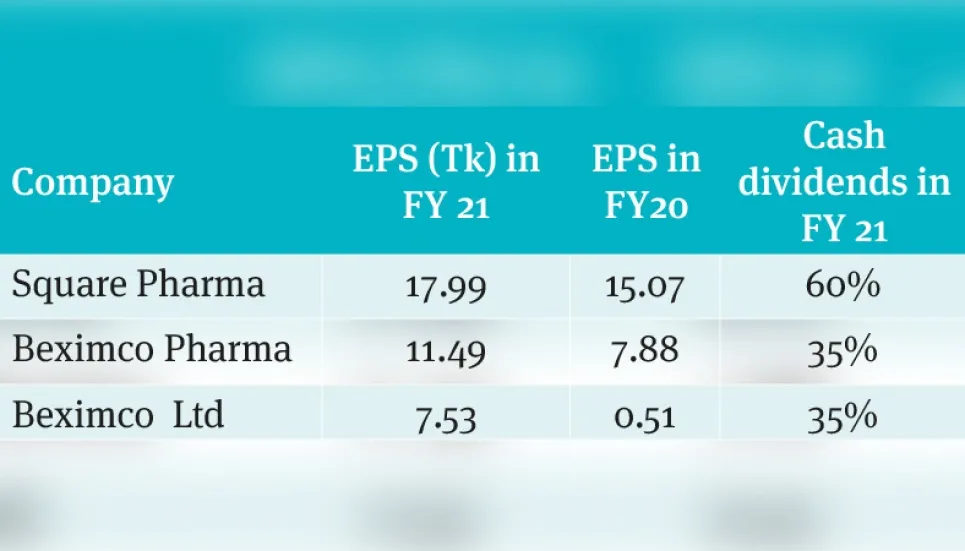

According to the company sources, it reported earnings per share (EPS) for the last financial year was Tk 17.99, an increase of 20 per cent in the same period a year earlier. And the consolidated EPS stood at Tk 15.07 during the period.

And on June 30, 2021, the company’s net asset value per share (NAV) stood at Tk 102.54.

On Thursday, the company’s share rose 1.12 per cent to Tk 233.80 on the Dhaka Stock Exchange.

Beximco Pharmaceuticals—another leading drug makers in the country—has declared 35 per cent cash dividends for FY21, which was the highest-ever in its history, thanks to increase in sales of the products demanded during the pandemic.

The directors recommended the dividends in the company’s board meeting on Thursday. The latest dividend payout broke the record made in FY 20 when it was 15 per cent.

The company’s AGM is scheduled for December 23. The record date is November 22.

Its consolidated profit increased around 46 per cent to stand at Tk 517 crore in the last financial year compared to the previous fiscal year.

On Thursday, the company’s share rose 3.38 per cent to Tk 229.60 on the Dhaka Stock Exchange.

The company made an agreement with the government to supply 30 million doses of the Oxford University-AstraZeneca coronavirus vaccine manufactured by Serum Institute of India.

According to the company’s latest annual report, the pharmaceuticals sector experienced positive growth despite the coronavirus pandemic that damaged the many sectors.

According to IMS Plus (July 2019 to June 2020) study, the domestic market size of pharmaceuticals reached Tk 23,310 crore with 4.28 per cent growth over last year which was the lowest growth rate in the recent past.

Compound Annual Growth Rate for the last five years (2016-2020), National Market Growth Rate and Square Pharma’s Growth Rate were 10.49 per cent, 4.28 per cent and 1.62 per cent respectively.

The pharmaceuticals industry is providing about 98 per cent of the total demand for medicine of the domestic market and exports spread over to more than 147 countries. The local companies are holding 90 per cent of the market shares with only 10 per cent supplied by multinationals (MNCs)

Of the total pharmaceutical market share, Square Pharmaceuticals holds 17.73 per cent, Incepta 10.21 per cent, Beximco 8.39 per cent, Opsonin 5.54 per cent, Renata 4.97 per cent, Healthcare Pharma 4.57 per cent, ACI 4.43 per cent, Aristo pharma 4.38 per cent, Eskayef 4.36 per ent, and Acme 3.91 per cent.

On the other hand, Bangladesh Export Import Company Limited or Beximco Ltd recommended a 35 per cent cash dividend for the FY21 fiscal as it had passed good year despite the Covid-19 pandemic.

The cash dividend is the highest in the history of the company after FY 20 when it paid 5 per cent.

According to audited financial statement, the EPS of Beximco was Tk 7.5 in FY21, a significant jump from Tk 0.51 recorded in the same period a year ago.

The company’s NAV per share was Tk 78.28 for the year ended on June 30, 2021.