Home ›› 23 Oct 2021 ›› Stock

The Dhaka Stock Exchange (DSE) experienced sharp correction in the past week as the investors opted for profit-booking taking cue from trimming GDP forecast by the IMF and rumours about the regulatory action against the manipulators.

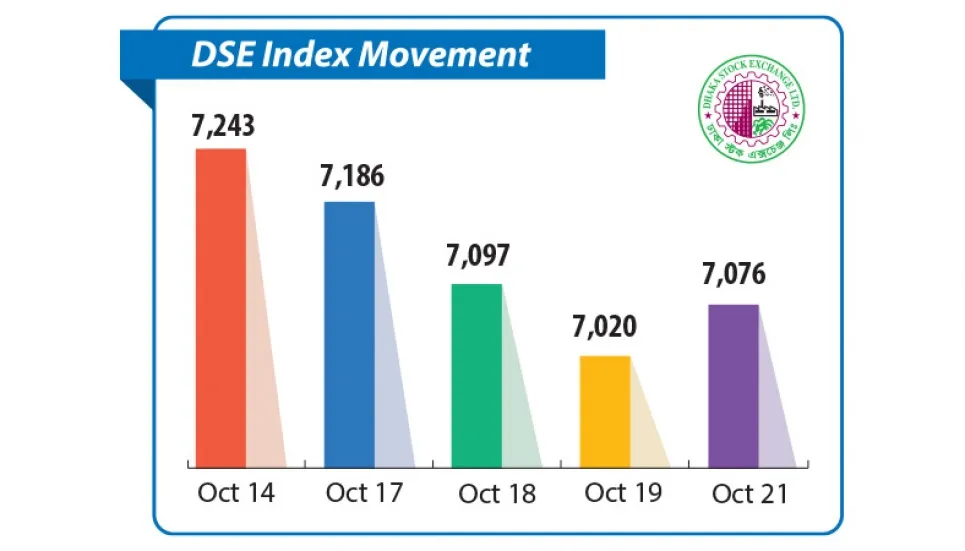

The benchmark DSEX index extended its previous week’s losing streak and dropped 167 points or 2.31 per cent to settle at 7,076.

The index fell 221 points in the first three trading sessions, but recovered 55 points in the closing session.

The blue chip comprising DS30 shed around 20 points to 2,600 and the Shariah DSES index was down 49 points to 1,518.

Keeping similar pace with the indices, the daily transactions and market capitalization of the premier bourse also declined to a great extent. The market capitalization fell Tk 10,261 crore or 1.77 per cent to finish the week at Tk 5.69 lakh crore. Meanwhile, the average daily turnover lost 17 per cent to Tk 1,511 crore last week, when the figure was Tk 1,812 in the previous week.

“The year-end dividend and quarter-end earnings declarations may have failed to meet the investors’ expectations which have prompted them for selling of shares,” said International Leasing in its weekly market review.

The investors booked profit in large cap sectors especially like cement, ceramics, travel and leisure and textile sector. However, the bargain hunters showed their buying appetite especially on the stocks of bank, pharmaceutical and chemical, miscellaneous and life insurance sector, observed the stock brokerage firm.

The review also mentioned that investors were in selling mode riding on the news that the International Monetary Fund cut the economic growth forecast for Bangladesh to 6.5 per cent for the current fiscal year.

Besides, a decision made by Bangladesh Securities and Exchange Commission (BSEC) paved the way for reinvestment of the market- stabilization fund worth Tk 9.0 billion, formed after the 2010-11 stock- market crash which has influenced the investors to limit profit booking sell offs and enhance their buying spree, it added.

Among the sectors cement (-7.7 per cent), ceramic (-7.4 per cent) and textile (-6.6 per cent) sectors achieved price correction while miscellaneous (8.1 per cent), life insurance (1.8 per cent) and tannery (1.7 per cent) sectors witnessed price appreciation last week.

The investors’ activity was mostly focused on bank (15.2 per cent), pharma and chemicals (12.6 per cent) and miscellaneous (9.1 per cent) sectors while SBAC Bank (16.2 per cent), Goldeson (14.9 per cent) and Beximco (11.7 per cent) were on top of the weekly scrip-wise turnover board.

EBL Securities said in its weekly market review that the continuous corrections and declining turnovers have compelled investors to engage in sell-off across sectoral issues with a view to reducing losses.